-

Sales & Distribution

Sales and Distribution

Interdependence of Demand and Supply

Components of Sales — Width & Depth

Measures of Distribution (Width)

Sales and Distribution Priorities

Distribution Network — Basics

Relationship between Sales and Distribution

Right Channels, Right Chains

Right Assortment

Managing Assortment

Battle of Shelf Space

Measures of Assortment and Sales Velocity

Number of Items Stocked

Assortment Analysis

Sales per Point of Weighted Distribution

Share in Handlers

Average Sales per Store

Rate of Sales

Rate of Sales/Gross Profit

Portfolio Analysis

Fragmentation Analysis

Securing Retailer Support

Managing Stock in Trade

Allocation of Shelf Space

Cost of Stockouts

- Retail Tracking

- Sales and Distribution

- Retail Analytics

- Category Management

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

-

MarketingMind

Sales & Distribution

Sales and Distribution

Interdependence of Demand and Supply

Components of Sales — Width & Depth

Measures of Distribution (Width)

Sales and Distribution Priorities

Distribution Network — Basics

Relationship between Sales and Distribution

Right Channels, Right Chains

Right Assortment

Managing Assortment

Battle of Shelf Space

Measures of Assortment and Sales Velocity

Number of Items Stocked

Assortment Analysis

Sales per Point of Weighted Distribution

Share in Handlers

Average Sales per Store

Rate of Sales

Rate of Sales/Gross Profit

Portfolio Analysis

Fragmentation Analysis

Securing Retailer Support

Managing Stock in Trade

Allocation of Shelf Space

Cost of Stockouts

- Retail Tracking

- Sales and Distribution

- Retail Analytics

- Category Management

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

Cost of Stockouts

Short-term

In the short term, stockouts can have a significant impact on a brand’s business. Consider for instance, a scenario for a brand with a numeric distribution of 80% and sales of 100,000 units:

- Numeric distribution: 80%

- Universe of stores: 500

- Number of stores handling: 400

- Period sales: 100,000

- Average sales per store: 250

If this brand experiences an out-of-stock (OOS) rate of 10%, we can estimate the loss in sales due to stockouts by projecting the losses in the retail sample to the universe of store.

- OOS distribution: 10%

- Note: OOS ratio is calculated in proportion to the universe of stores, and not the number of handlers. This is industry reporting practice.

- Number of stores OOS: 50

- Average sales lost per store: 250

- Total lost sales: 12,500

Note that the OOS distribution is reported as a proportion of the universe of stores, not the number of handlers. This is an industry reporting practice.

The above calculation assumes two things:

- The probability of a stockout at any store, at any point in time during the period under investigation, is 10%, which seems reasonable.

- OOS is considered equal to lost sales. However, this assumption may be questionable, as there are alternative options available to shoppers when they encounter a stockout. In instances where brand loyalty is high, a stockout may not necessarily result in the loss of brand sales.

While the projected loss in sales provides insight into the potential impact of stockouts, it is important to consider additional factors such as customer behaviour, the availability of substitute products, and, importantly, long term implications, when assessing the true cost of stockouts.

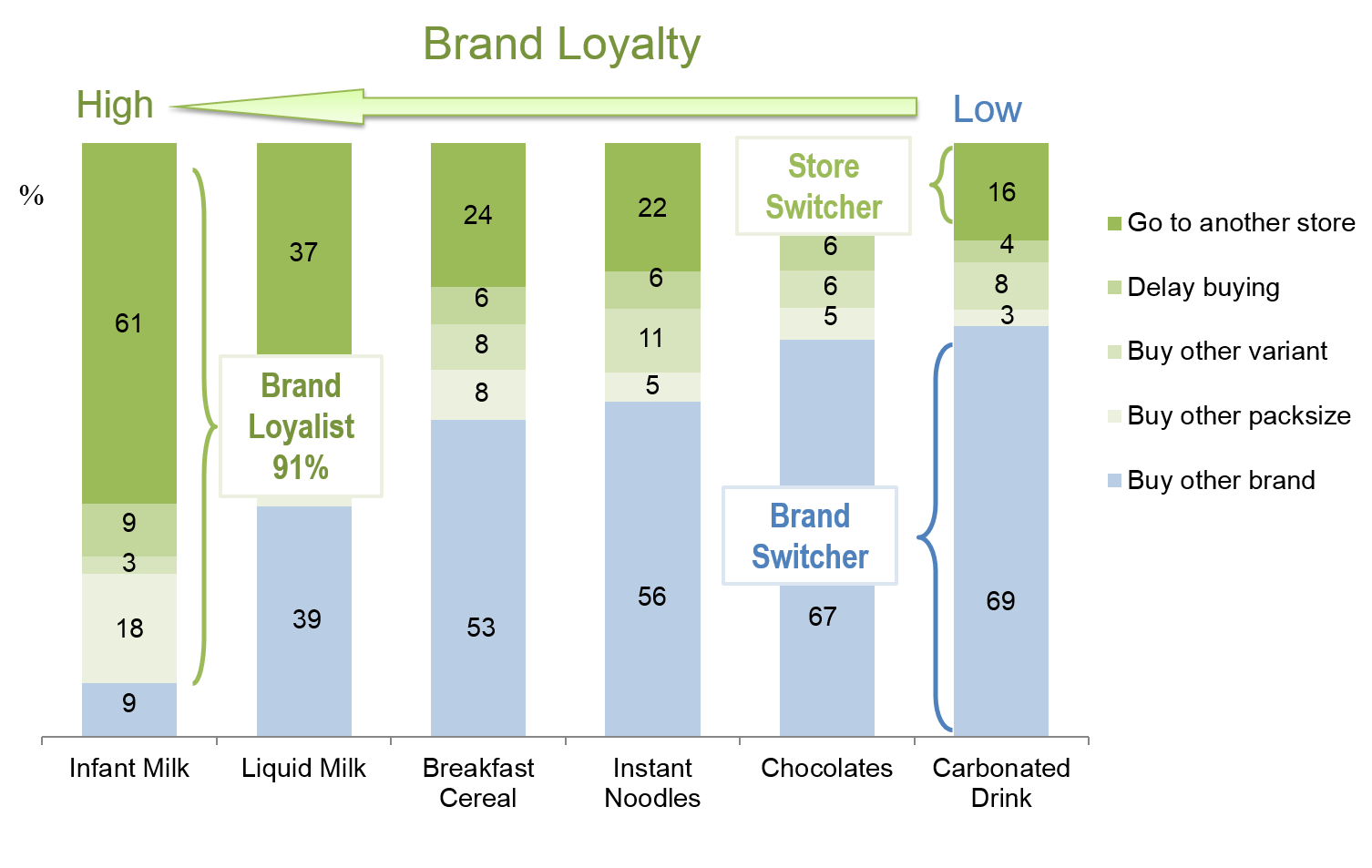

How Consumers Respond to Stockouts

How a consumer responds when she is unable to find the item she wants in store, depends on factors such as:

- Pack or variant loyalty,

- Brand loyalty,

- Product loyalty,

- Store loyalty,

- Urgency to use.

Her response is determined by the influences that are of greater importance at the time of purchase. The possible outcomes include:

- She buys an alternative size/variant of the same brand.

- She buys a different brand — supplier loses.

- She buys from a different store — retailer loses.

- She delays purchase — both supplier and retailer could lose if this leads to a drop in consumption or a change of brand/store.

- She buys a different category — supplier loses.

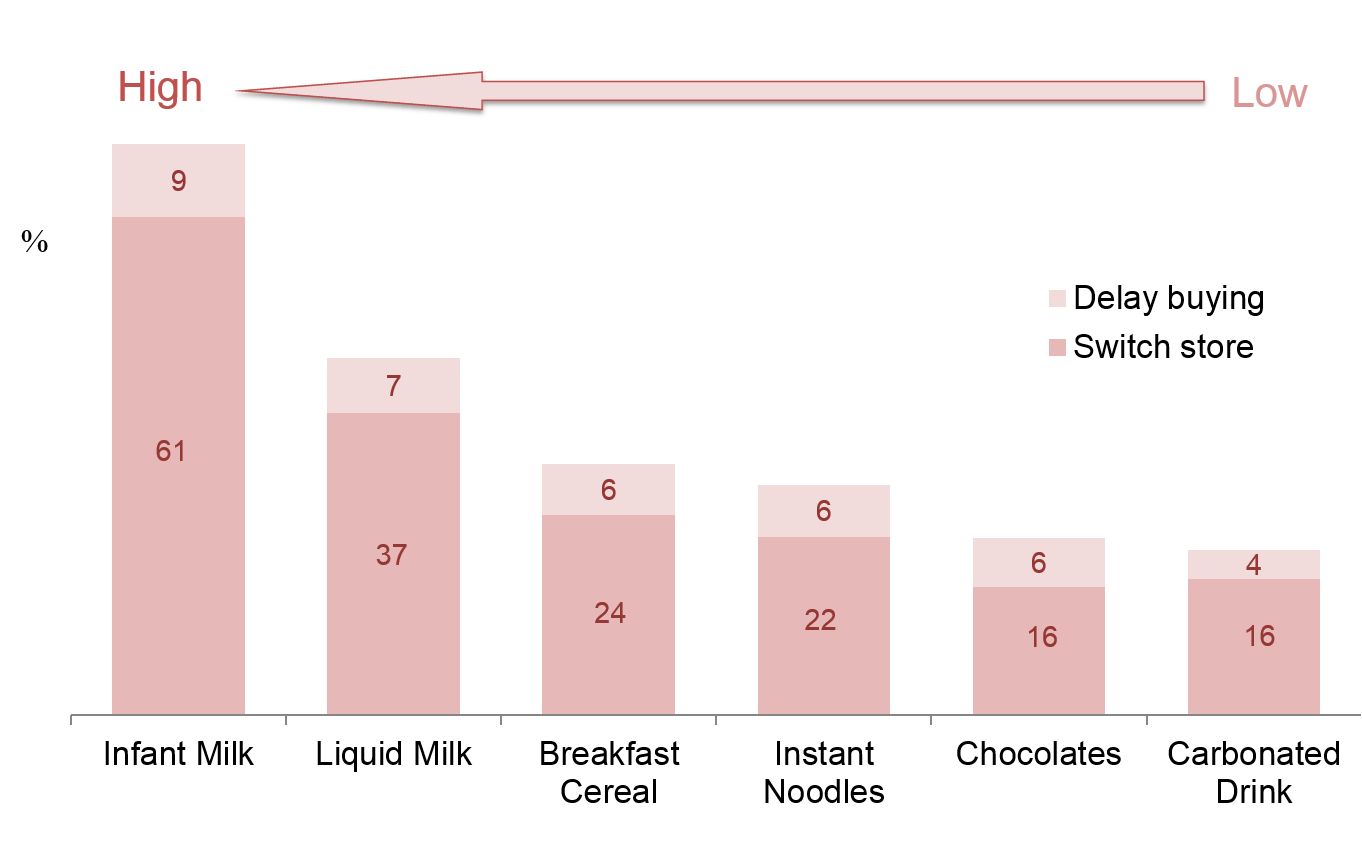

Exhibit 31.15 Claimed response to out-of-stock situations for different categories of FMCG goods (Source: based on a Nielsen survey in Singapore).

Exhibit 31.16 Based on Exhibit 31.16, the cost of OOS to retailers is higher for categories like infant milk and liquid milk, and lower for categories like carbonated drinks and chocolate.

According to shopper claims and data presented in Exhibits 31.15 and 31.16, the response to stockouts can vary significantly across different product categories. For example, in categories like infant milk with high brand loyalty, the cost of a stockout to retailers is high because parents are often unwilling to try a new brand of infant formula and will actively search for their preferred brand in other stores. On the other hand, in categories like carbonated drinks and chocolate, where shoppers are more open to switching brands, the cost of stockouts to retailers is lower as consumers are willing to choose an alternative brand when their preferred one is unavailable.

Understanding how consumers respond to stockouts in different categories is essential for both suppliers and retailers to effectively manage inventory and mitigate potential losses.

True Cost of Poor Distribution

Manufacturers are keen to avoid giving their loyal consumers any reason to try out competitors’ products, as it may result in a shift in loyalty towards the competing brand. This not only leads to the loss of immediate sales but also affects future sales. Once consumers experience something new and find it appealing, their loyalty may be compromised, leading to a potential loss of future sales for the manufacturer.

For retailers, their top 10% of shoppers usually account for as much as 30% to 50% of the total store sales. These core shoppers, who buy more and shop more frequently, are most impacted by stockouts. If they decide to switch their allegiance to other stores due to stockouts, the cost incurred will extend beyond a single category and affect their overall spending across various product categories.

In the earlier example, we estimated the loss in units sold during the period of OOS, to be limited to 12,500. While this estimate may capture the short-term impact, taking into account the long-term consequences on brand loyalty and store loyalty reveals that the true cost of stockouts, both for manufacturers and retailers, is likely to be much higher. This highlights the critical importance of maintaining distribution channels and ensuring adequate stock levels in trade to avoid detrimental effects on customer loyalty and sales in the long run.

Previous

Use the Search Bar to find content on MarketingMind.

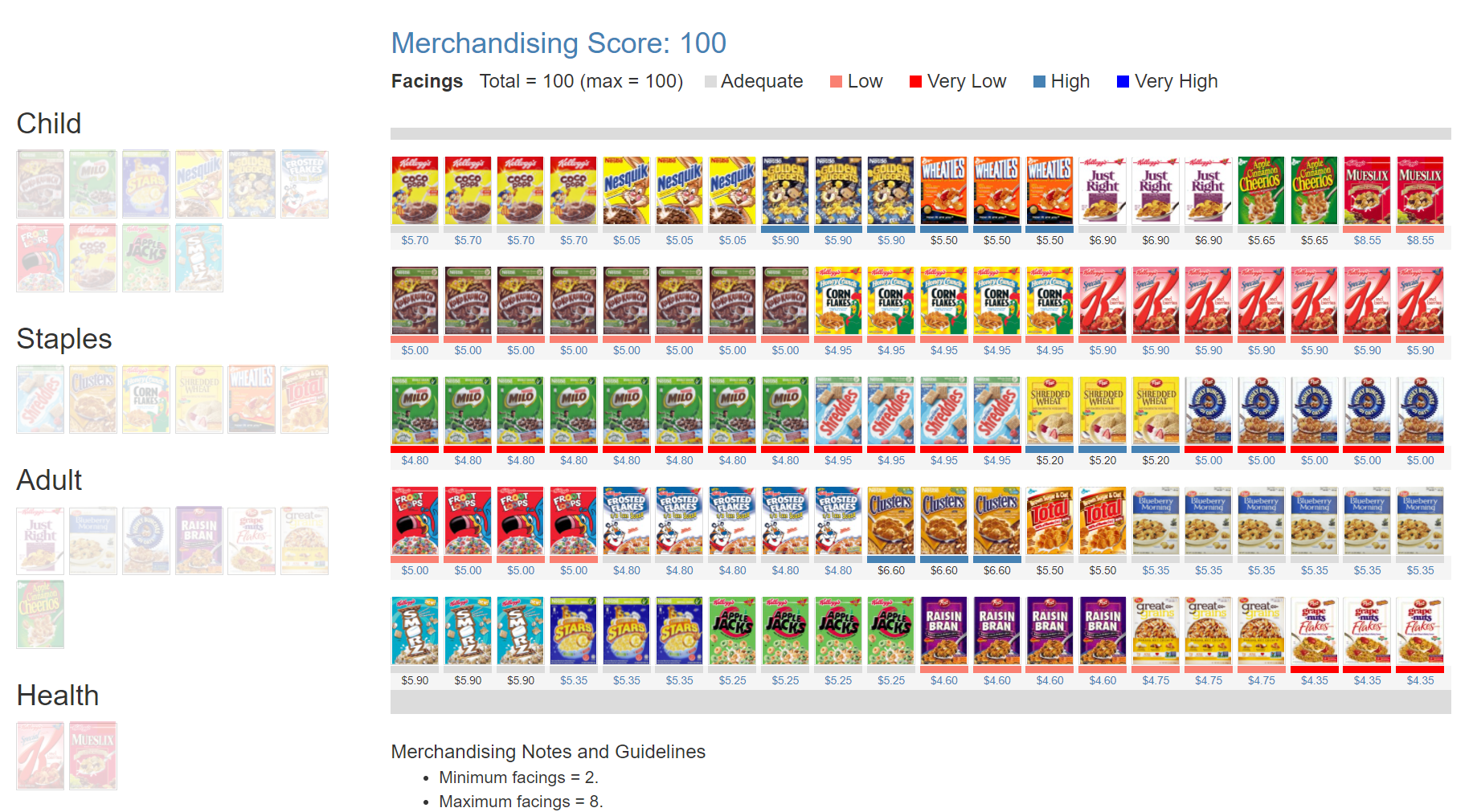

Online Apps to train Category Managers

The Plannogrammer is an experiential learning facility for category managers, trade marketers, and retailers in consumer markets. Ideally suited for hybrid learning programmes, Plannogrammer imparts hands-on training in the planning and evaluation of promotions and merchandising.

It supports a collection of simulation and analysis platforms such as Promotions and Space Planner for optimizing space and promotions, Plannogram for populating shelves and merchandising, a Due To Analysis dashboard that decomposes brand sales into the factors driving sales, and a Promotion Evaluator to evaluate the volume, value and profit impact of promotion plans.

Contact | Privacy Statement | Disclaimer: Opinions and views expressed on www.ashokcharan.com are the author’s personal views, and do not represent the official views of the National University of Singapore (NUS) or the NUS Business School | © Copyright 2013-2026 www.ashokcharan.com. All Rights Reserved.