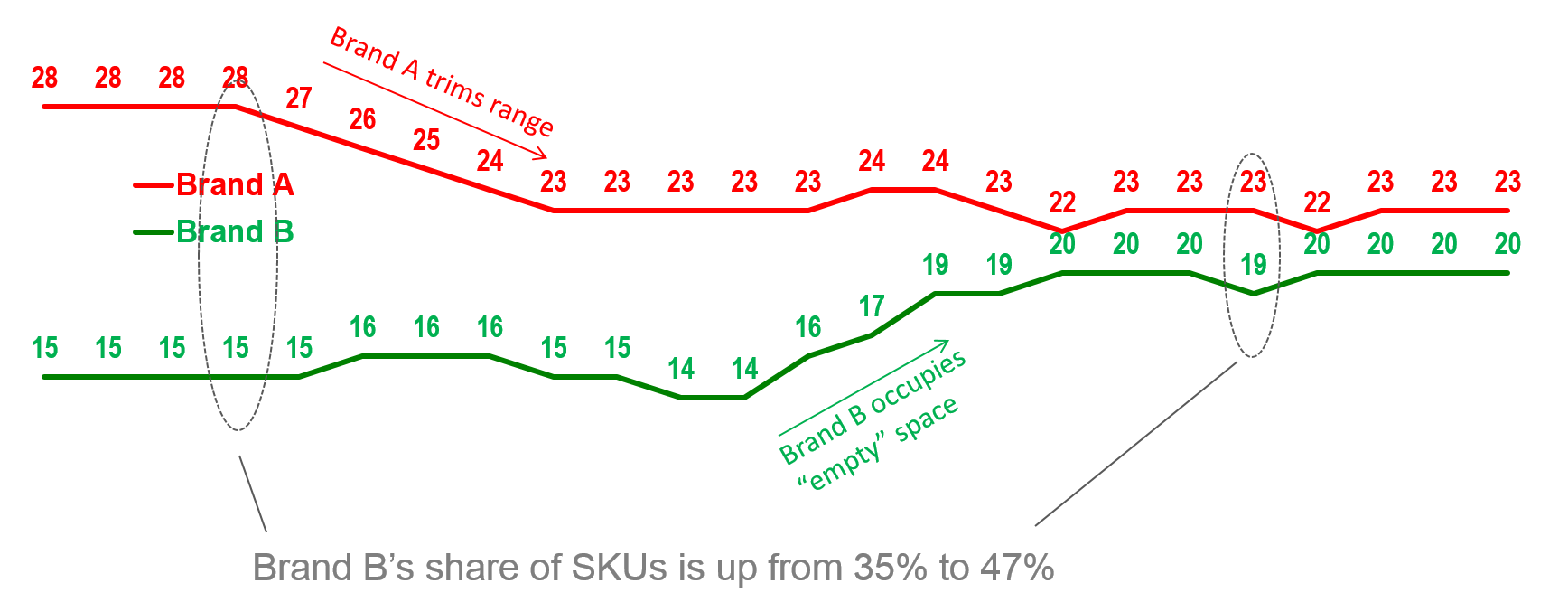

Exhibit 31.3 Average number of items (SKUs) of cat food in

supermarket over a period of two years (monthly data).

While delivering a presentation to a cat food

manufacturer, I observed the interesting trend depicted in

Exhibit 31.3. As part of

a cost-cutting initiative, the client’s brand A reduced the number of Stock Keeping

Units (SKUs) from 28 to 22. In response, the retailer began sourcing additional items from a

competitor, resulting in an expansion of brand B’s range from 15 to 20 variants.

This shift led to very substantial sales gains for brand B. A year-by-year

comparison revealed a 30% growth for brand B, whereas brand A’s volume dipped by about 2%,

and its market share fell from 42% to 38%.

Cat food is one among a number of categories where a brand’s share of space has a

strong bearing on market share. The marketing team of brand A informed me that

cats, unlike dogs, are notoriously finicky eaters. Given the decline in volume and significant

loss in market share, it becomes difficult to envision any positive outcomes for brand A.

Furthermore, by trimming its range, brand A inadvertently yielded considerable competitive

advantage to brand B.

The battle for shelf space stems from the relationship between share of space, share

of mind, and share of sales. By expanding its range on the shelf, a brand is able to offer

consumers greater choice. The increase in facings to accommodate the additional items leads to

increased visibility i.e., greater mind space. Moreover, the incremental shelf space must be

relinquished by other brands. As a result of these factors the brand usually gains market share.

In this battle, while the temptation to grab more space may exist, it is important to

note that each item within a brand’s range must earn its place on the shelf. Failure to do so can

erode both the retailer’s and the manufacturer’s margins, and negatively impact the brand’s

reputation. Ultimately, underperforming items face the risk of being delisted.