Marketing Analytics Workshop

Advanced training program for Consumer Analysts and Marketing Professionals

Testimonials

“I have been working for a global FMCG company as a design manager for the past 10 years. In my mind, I always had an unclear picture—why am I doing this, and what is it all for? After a 12-week journey with Professor Ashok Charan, I am now able to see that picture much more clearly. It helps me understand the purpose of my work and also find a better way of working with my colleagues in different departments.”

Senior Design Manager, Kimberly Clark

“Thank you for what was likely the most challenging, yet undoubtedly the most enriching marketing module I have taken thus far. I have learned a great deal and am deeply grateful for how you shared your experiences and insights with us. I wish I had a copy of your text when I was interning at a global analytics consultancy two years ago; it should be mandatory reading for all new hires. Once again, thank you for a wonderful semester.”

Strategy Manager at Accenture

“It was an intellectually stimulating and exciting experience being in your classroom. Beyond the module content, there were always insightful takeaways. One that I cherish the most is ‘follow the journey of the customer,’ and the stories from Unilever and Nielsen were something I always looked forward to the most in class.”

Strategy and Consumer Insights Manager at M&C Saatchi Performance

“I have thoroughly enjoyed the class and benefited greatly from your lectures, the case studies, and the Destiny simulator. As someone without a marketing background, the material presented posed a challenge, yet it remained within reach due to your carefully designed case studies and examples that effectively illustrated the tools and tricks of the trade. I appreciate you sharing your extensive experience with us, addressing questions no matter how basic, and providing us the opportunity to explore the latest developments and overarching theoretical concepts in the field. This has been a valuable learning experience, significantly enhancing both my depth and breadth of knowledge, and offering a fresh perspective on the world of business. Thank you!”

Subject Head, School of the Arts Singapore

“Every day brings new challenges in my role as a consultant, with clients making diverse demands. Whenever I encounter difficulties with a concept, I refer back to your text, eGuide and notes. Many people across various teams have provided positive feedback on my knowledge and learning skills. Every time, I proudly attribute it to my professor. Your teachings have significantly streamlined my growth process.”

Consultant Advanced Analytics, APAC and Europe, NielsenIQ

“Your passionate class facilitated my transition to a new career. I still vividly recall the time spent in your class, particularly the clear and coherent logic that shattered my preconceived notions about marketing. This newfound perspective greatly aided me in impressing interviewers.”

Manager, Retail Service

“Throughout the 13 sessions and on Destiny, I received a comprehensive introduction to the various stakeholders in the FMCG sphere, delving into the utilization of data and establishing a foundation in strategy. Your real-life experiences and stories of actual brands were insightful, making the concepts memorable. I thoroughly enjoyed working on Destiny. Thank you for creating such an engaging ‘war game’.”

Digital Marketer, Elevandi

Overview

In an analytics-driven business environment, this analytics-centred consumer marketing course is tailored to the needs of consumer analysts, marketing researchers, brand managers, category managers and seasoned marketing and retailing professionals.

Participants study the art and science of brand management and category management. They learn to use consumer analytics to effectively market consumer (FMCG/CPG) products. They learn the use of retail analytics to refine the retailing mix. They gain expertise in the use of marketing/business analytics, market research, and financial statements for taking analytics-driven business decisions. They acquire an appreciation of supplier-retailer relationships in the development of marketplace equity.

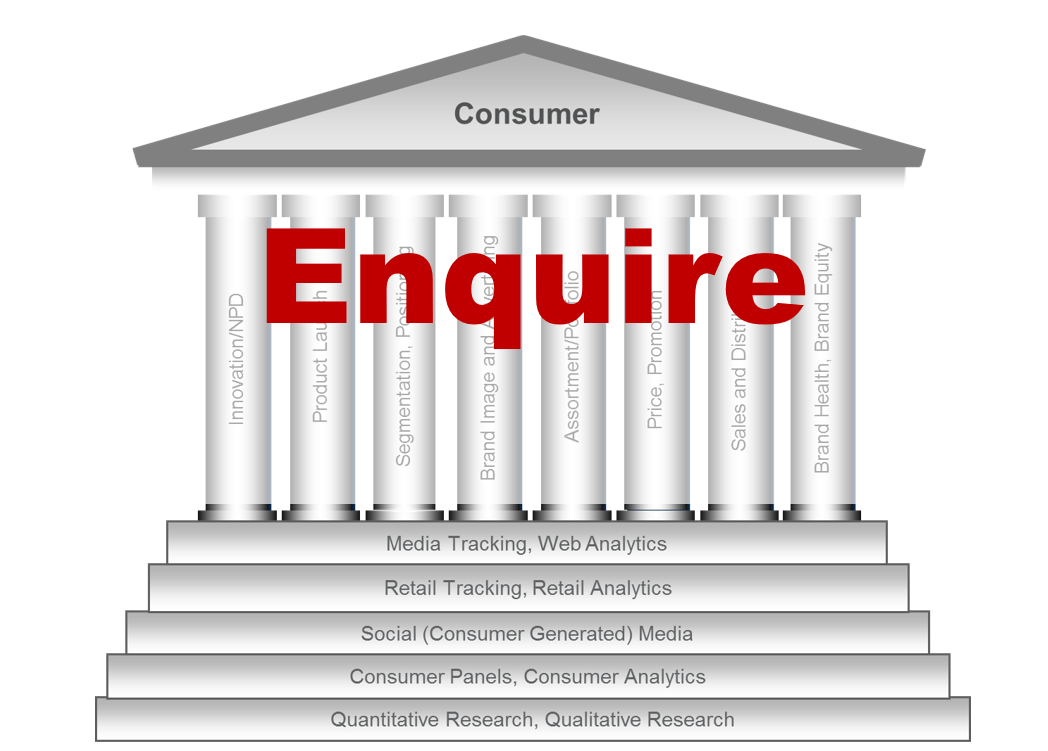

Participants learn how to apply a wide range analytical techniques for applications such as developing and launching new products, evaluating price, promotion and advertising, tracking brand image, monitoring brand health, and optimizing sales and distribution. They learn about the platforms that form the foundation of marketing analytics, including disciplines like consumer analytics, quantitative and qualitative research, media analytics, retail analytics, web analytics and social media. And they learn advanced analytics techniques for measuring brand equity, emotional and behavioural loyalty, for examining brand buying and switching behaviours, and for validating new product launches.

The scope, summarized in the content outline, comprehensively covers an assortment of topics which may be customized to meet participants’ specific needs.

Participants

Given its focus on the practice of marketing analytics, this programme is tailored to the needs of

- consumer analysts,

- marketing researchers,

- brand managers,

- category managers

- and seasoned marketing and retailing professionals.

Learning Outcomes

The course is designed to train practitioners in the application of analytic techniques and research methods that leading consumer marketing companies use, for taking day-to-day marketing decisions, and developing and executing marketing strategies. It combines theory with practice, imparting a holistic, multi-faceted learning experience that encompasses:

- Analytics-centred Consumer Marketing: The art and science of Brand Management and Category Management.

- Marketing Mix: Marketing a consumer (FMCG/CPG) product in the age of analytics.

- Retailing Mix: Application of retail analytics to run retail chains.

- Marketing Intelligence: Use of marketing and business analytics and market research for decision-making.

- Trade Marketing/Business Marketing: Category management, supplier-retailer relationships and marketplace equity.

- Marketing and Business Strategy.

Content Outline

- Brand, brand image and positioning.

- Tracking brand image

- Image profiling

- Perceptual maps

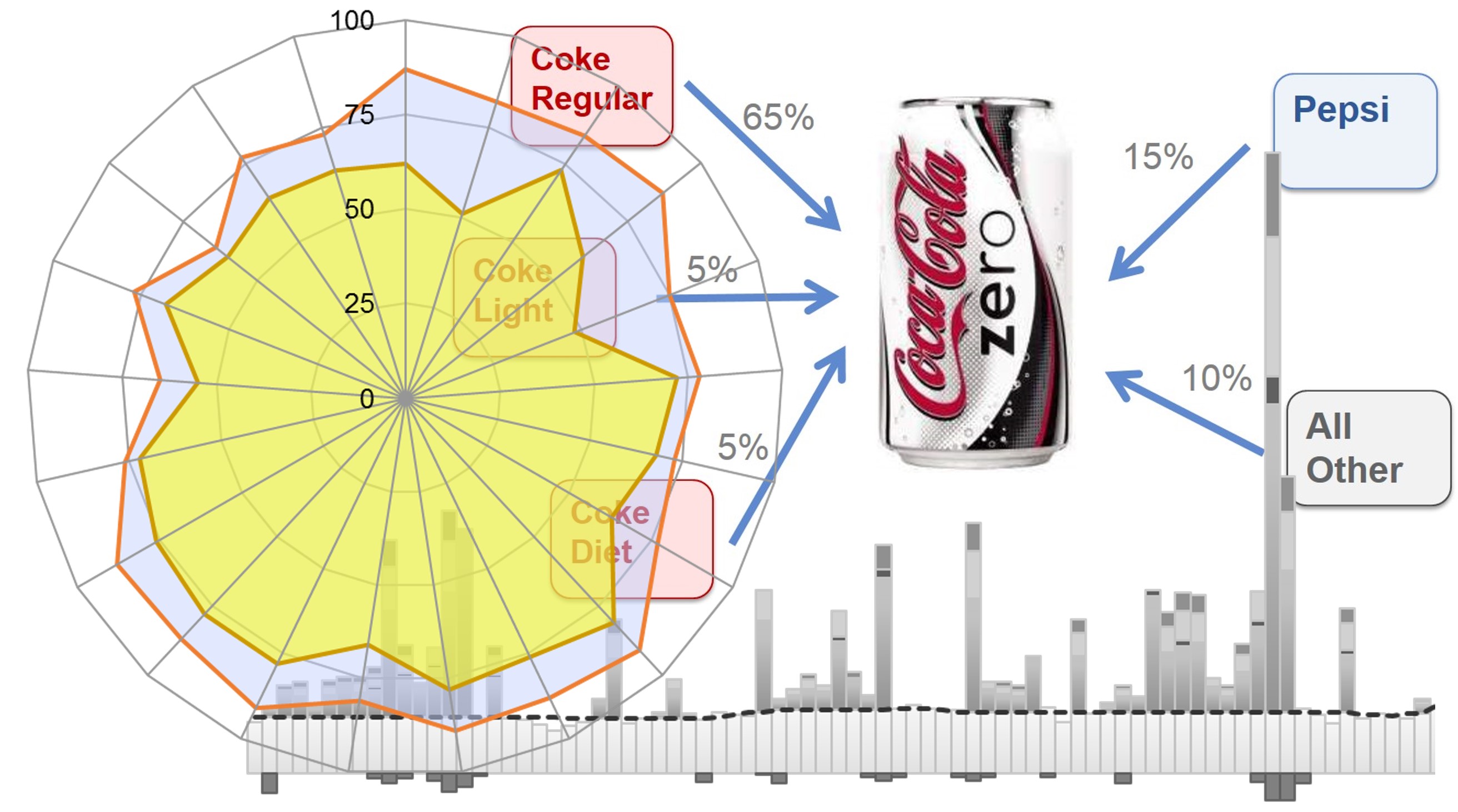

What distinguishes a brand from the tangible product are the thoughts and feelings that it evokes. The manner in which these thoughts and feelings are tracked, measured and presented, by means of techniques such as image profiling and perceptual mapping, is the prime focus of this session. It introduces the subject of brands and highlights their importance, and reviews the concepts of brand image, positioning, the segmentation and targeting of consumers, and the differentiation of products.

Through examples, this session illustrates that the essence of a brand, and the source of its power, lies in its image. You learn the techniques to assess and track imagery, and the application of these techniques for the development of a brand.

- Brand Health Pyramid.

- Measurement of brand equity.

- Drivers of brand equity.

Prior to its launch in 1985, 190,000 taste tests undisputedly confirmed that consumers preferred the New Coke formulation. What mattered, however, was the extraordinary affinity for Coca-Cola, the brand. This state of mind that aroused the outpouring of affection for the brand is its source of equity.

This session dwells on what constitutes brand equity, how it is measured, and what drives it. The topics covered include loyalty pyramid, net promoter index, net advocacy index, brand equity models and the drivers of brand equity.

The session will equip you with a framework to measure and understand your brand’s equity, and with the tools to pursue its growth. This is of particular relevance at a time when the stakeholders are demanding greater accountability of marketing.

- How advertising works

- Advertising models and theories — salience, persuasion, likeability, symbolism, relationship, emotion

- Advertising execution

Great advertising is characterized by its ability to produce excellent results. It demonstrates a deep understanding of the target audience. This session seeks to offer a comprehensive insight into the dynamics of advertising, encompassing the mechanisms and fundamental principles that underscore its effectiveness. It delves into an exploration of advertising mechanisms and provides an elucidation of the six pivotal themes—salience, persuasion, likeability, symbolism, relationship, and emotion—that serve as the foundation for numerous advertising theories.

From a learning standpoint, the session aims strives to impart an appreciation for the elements that render advertising potent and influential, within the context of diverse communication objectives.

- Digital influences and Media Fragmentation

- Concerns — Inbound and Outbound

- Media Analytics — Audience Measurement, Engagement Measurement, Market Response Modelling

- GRP, active and passive people meters — Audience Measurement

- Viewer Analytics, Facial Coding — Audience Measurement

- Digital Audience Measurement

- Total Audience Measurement

- Copy testing — Engagement Measurement)

- Advertising tracking — Engagement Measurement

- Eye tracking and Heat Maps — Engagement Measurement)

- Advertising evaluation, ad evaluation exercise — Engagement Measurement

- Web Analytics — Engagement Measurement

- Measuring emotions: biometrics, EEG, Emoti*Scape — Engagement Measurement

- Awareness Index model — Market Response Modelling

In the 19th century, John Wanamaker lamented, “Half the money I spend on advertising is wasted; the trouble is I don’t know which half”. Since his time, and especially during the latter half of the 20th century, many theories and models emerged that have enhanced our understanding of advertising and its impact. Yet uncertainty still clouds advertising as the complexity of evaluating it has increased with media fragmentation and the proliferation of online and conventional platforms.

The session primarily focuses on audience measurement and engagement measurement, two critical aspects of modern advertising. It discusses how these areas have evolved beyond traditional media silos into the digital landscape, requiring multiplatform metrics to measure the total audience accurately.

Furthermore, it underscores that advertising effectiveness can manifest in various ways, driven by diverse objectives influenced by nature of product, brand history, competition, and other factors. These factors need careful consideration when evaluating advertising performance.

The training also provides an overview of advertising analytics in the context of pre-testing (copy testing) and post-testing (tracking) advertising campaigns. It highlights how major global advertising analytics and research firms, such as Millward Brown (Kantar) and Ipsos ASI, track and measure the imperatives mentioned above.

In essence, this training session offers a comprehensive exploration of advertising analytics, addressing the challenges and complexities brought by the digital age while emphasizing the critical role of research in understanding and optimizing advertising strategies.

- New Media

- Digital Marketing tools and techniques

- Case study to illustrate the strengths and limitations of social campaigns, and the complexity of managing a brand public relations crisis

- Social Media — an overview highlighting best marketing practices on key platforms

In the evolving landscape of new media, ordinary people empowered with social media are interacting and collaborating with increased speed, reach and effectiveness. This has had a profound impact on society, changing the political, economic and cultural landscapes across the globe.

As marketers embrace the new media and practice digital marketing, they find themselves navigating a multifaceted terrain. To succeed, they must craft a comprehensive multi-pronged strategy aimed at attracting, converting, and retaining customers in the digital realm. This involves not only drawing customers to the web through the dissemination of useful, relevant, and compelling content but also maintaining a foothold in conventional media channels to promote their products.

This session serves as a guide through this dynamic digital landscape, delving into a myriad of contemporary concepts and developments. From the art of “social listening” to the formation of intricate online communities or “social cloisters”, from tackling the proliferation of misinformation and fake news to exploring the collaborative world of co-creation and permission marketing, attendees will gain valuable insights. The discussion extends to understanding the “long tail” of niche markets and the intricate dance between inbound and outbound marketing strategies.

Thriving in the digital age demands a nuanced understanding of digital tools, techniques, and processes, as well as a keen awareness of the opportunities and challenges presented by this ever-evolving terrain. Special emphasis is placed on the creation of content that fully harnesses the internet’s vast potential, employing techniques like personalization and the strategic utilization of influencers and buzz marketing. Moreover, the session provides an in-depth exploration of the intricacies of online advertising, shedding light on the pivotal challenges confronting marketers in this dynamic digital ecosystem.

Search Engine Optimization and Search Analytics

- On-page/off-page optimization

- Digital marketing funnel

- Consumer purchase journey

- Google Search Console — hands on training

- Web Analytics

- Google Analytics — hands on training

Securing a high rank on search platforms is of such enormous interest that a completely new industry emerged in the early 1990s. Referred to as search engine optimization (SEO), it helps marketers optimize their websites for search engines like Google.

This session imparts a comprehensive understanding of the SEO processes — strategize, optimize and review. It covers on-page and off-page optimization techniques, as well as strategies for increasing inbound traffic and improving site retention.

Participants learn the tools and functions of analytics platforms such as Google Search Console and Google Analytics, to monitor and improve site search performance.

Search Advertising and Google Ads

- Search Advertising

- Google Ads Auction

- Google Ads Architecture

- Keywords

- Google Ads Assets

- Google Ads — hands on training

Search marketing is more effective than any other form of marketing because you target interested customers, often with intent to transact. This makes search marketing far more effective than marketing on social media channels.

Accountability is another key advantage of search advertising. It is possible to track increases in leads and sales resulting from search advertising by tracing users as they navigate through the website. Additionally, search ads are non-disruptive, which can be a major advantage for users.

This session encompassed the paid processes of attracting search traffic, the Google auction, keyword strategies, and practices to improve the effectiveness of search advertising. Through a demo of the platform, participants learn how to use Google Ads to research keywords, forecast campaign performance, and to create, launch and monitor search campaigns.

- Trade marketing

- Category roles and strategies

- Retail mix

- Assortment, price, promotion and in-store media

- Space management

“There is only one boss. The customer. And he can fire everybody in the company from the chairman on down, simply by spending his money somewhere else.” — Sam Walton.

As pointed out by Sam Walton, the customer is the boss, the only boss. To attract and retain her, retailers must align their retailing mix to cater to her needs and preferences. To achieve this, they need to develop strategies and processes to manage their business in a customer-centric manner. These strategies and processes fall under the realm of category management.

The objective of this session is to provide retailers with a framework on how to manage their business, and for suppliers to understand the dynamics of trade marketing.

The topics covered include an overview of category management, its processes, trade marketing, the partnership between retailers and manufacturers, category roles, category strategies, retail mix and space management.

Consumer Analytics and Consumer Panels:

- Consumer analytics/loyalty card analytics — consumer and loyalty panels

- Consumer panel — research methodology

- Techniques: width/depth of purchase, buyer groups, profile analysis, brand loyalty, trial and repeat, overlap, basket, gain-loss

- Case examples

Since their inception in 1932, developments in the use and application of consumer panels have greatly contributed to the science of consumer analytics. More recently, the explosion of data has expanded the role and application of consumer analytics, such that it cuts across virtually every sector of economic and social activity.

This session delves into the realm of consumer analytics powered by the insights derived from consumer panels. It explores a toolkit of analytical instruments designed to unearth valuable knowledge from consumer transactions. The approach is designed to be accessible, unravelling a wide array of metrics and techniques, including width and depth of purchase, buyer group analysis, profile scrutiny, behavioural brand loyalty assessment, trial and repeat purchase analysis, overlap investigation, basket analysis, and gain-loss evaluation. The primary focus is on the practical applications of these methodologies, with an emphasis on diagnosing brand health and tackling pertinent business challenges.

- Market measurement services (retail tracking)

- Retail universe

- Retail census, sample design

- Data collection, data processing, data projection

- Analysis and interpretation

- Numeric, weighted, in-stock, OOS distribution

- Coverage analysis

Metrics such as market share, sales, and distribution, estimated by the retail tracking service (also known as retail index and retail measurement service), are fundamental to formulating marketing strategies and sales plans. These are the key statistics that yield insights into market structure, channel performance, brand health, competition and sales performance. For this reason, practitioners rely heavily on retail tracking.

While these metrics themselves may be easy to grasp, it is vital to understand the scope of the service and its strengths and limitations in order to interpret the data and derive meaningful insights. The purpose of this session is to provide a comprehensive study of the methodology, imparting this understanding to the reader.

The session delves into the six processes that constitute a retail tracking service: universe definition, retail census, sample design and recruitment, data collection, data processing, and analysis and interpretation. It explains the metrics supported by the service, highlights the key benefits it offers, and demonstrates how the data is interpreted.

By exploring these topics, readers will gain a thorough understanding of the methodology behind retail tracking, enabling them to leverage the service effectively for strategic decision-making.

- Sales and distribution strategies

- Metrics/analysis — sales/distribution

- Range and assortment, fragmentation analysis

- Sales per store, SPPD, share in handlers

- Rate of sales, cash rate of sales, rate of gross profits

- Share of shelf space

- Optimum stocks, short/long term cost of OOS

To state the obvious, sales generate money, which serves as the lifeblood that sustains a business. This is precisely why companies continually strive to enhance their sales.

As sales is the outcome of supply and demand, it should be tracked and analysed through metrics that relate to supply and demand. These metrics are covered in this session in the context of the analysis of sales and distribution.

The primary focus of this session revolves around five key managerial objectives — building distribution network, targeting the right channels and chains, optimizing assortment, securing retailer support, and managing stocks in trade.

You will be introduced to a wide range of metrics that can be employed to measure supply, such as stock and distribution, as well as metrics to assess demand, share in handlers, rate of sales, cash rate of sale and rate of gross profits.

Furthermore, the session explores various techniques for evaluating product assortment, conducting portfolio analysis, and performing fragmentation analysis, all of which contribute to effectively managing the supply side of the business.

- Outlet group analysis — handlers, assortment, brand overlap, shelf space, pricing, promotion and rate of sales

- Pricing analysis

- Disaggregate data analysis

- Shopper profile analysis

- Loyalty and propensity

- Assortment and fragmentation analysis

- Case example — Analysis of launch of new outlet

Data sourced from point-of-sale (POS) scan terminals and retail audits, generates continuous transaction data that feeds into retail analytics. Fundamental to the analysis of this data is the filtering of retail outlets to form outlet groups. For instance, an analyst might be interested in examining outlets that stocked a particular brand compared with outlets that did not stock that brand. Or outlets that offered a promotion versus outlets that did not do so.

This session describes a wide array of outlet group analysis addressing aspects such as brand handlers’ analysis, brand overlap, assortment, shelf space, pricing, promotion and rate of sales.

In addition, customer transaction data (e.g., shopper transactions data, consumer panel data, loyalty panel data) also feed into retail analytics. These databases have the customer dimension in addition to the outlet dimension, thus adding an additional layer of diagnostic capabilities. The data can be used to compute chain or outlet penetration, spend per customer, chain loyalty, cannibalization among outlets and so on, using similar concepts, tools and techniques that are applicable for the analysis of consumer panels.

The analysis outlined in this session include customer profile, loyalty and propensity, assortment analysis, overlap, outlet group, outlet repertoire, gain–loss, trial and repeat visit, penetration and repeat rate, and sales forecasting.

- Types of pricing research methods: Econometrics, simulated test markets and adhoc

- Van Westendorp’s Price Sensitivity Meter

- Brand/Price trade-off analysis

- Conjoint analysis for pricing

- Discrete choice models

Pricing decisions come with numerous intricacies and associated risks. Within the marketing mix, price stands as the pivotal variable responsible for revenue generation. Consequently, achieving the right pricing strategy demands meticulous consideration of both marketing and financial factors.

This session focuses on the various methods used in pricing research, such as brand price trade-off, conjoint analysis, and discrete choice models. It also emphasizes the importance of price elasticity of demand and the multiple factors that can influence it, as well as the need for realism in pricing research.

- Promotion–Commotion–Demotion

- Trade promotion, consumer promotion

- Promotions evaluation — basics

- Promotions evaluation — econometric modelling

- Discount price elasticity, price-promotion response curve

- Cannibalization and cross-elasticity

- Decomposition of sales

- Goodness-of-fit

- “What if” Analysis

Promotions are a crucial element of the marketing mix. They contribute to a large proportion of total sales for most product categories, and help to build brand awareness, engage with customers, and foster brand loyalty.

But how effective are promotions? Considering that the proportion of on-promotion sales is so high, one would imagine that manufacturers can barely afford not to evaluate their impact.

This session provides an overview of the various types of trade and consumer promotions, emphasizes the importance of evaluating and rationalizing them, and discusses the metrics and techniques used to evaluate their effectiveness. It presents an elementary approach for assessing promotions in terms of volume, value, and profit gains. It also explores the concept of market modelling for promotion evaluation and outlines the essential structure of such models.

- New Product Development Process

- Ideation

- Concept development, concept screening

- Product development

- Product design — conjoint analysis

- Product validation — simulated test markets, BASES

- Product launch — launch evaluation, sales forecasting — trial rate, RBR and buying index

- Case examples

In a fast-changing world, companies must innovate or face extinction. While introducing new products is crucial for survival, it entails substantial investments and poses great risks, with uncertainties permeating every stage of development and product launch. Extensive research reveals alarming failure rates in new endeavours, especially within the fast-moving consumer goods (FMCG) sector, where failure rates can range from a staggering 75% to an astonishing 95%. The business-to-business (B2B) market is also not immune to risk, with estimates indicating that approximately one-third of B2B products do not achieve success.

Marketers find themselves at a crossroads, navigating the delicate balance between investment risk and opportunity in product development. On one side, there looms the spectre of financial loss stemming from product failures, while on the other side, the risk of forgoing potential revenue and profits from unexplored product opportunities is equally daunting. Some innovative firms tend to prioritize the allure of opportunity, while others are more risk-averse, focusing on mitigating investment risk. Irrespective of their strategic orientation, marketers can minimize these risks by grounding their decisions in data-driven insights and comprehensive research.

This session encompasses a wide range of topics on new product development (NPD), covering innovation, ideation, knowledge immersion, consumer immersion, generation of insights, generation of ideas, concept development, product development and product launch. It imparts an understanding of the conception of new products, along with the tools, methodologies, and processes essential for refining and assessing product concepts.

Furthermore, the session delves deep into the realm of product design techniques and processes, including sensory research, the Kano model, conjoint analysis, and the house of quality. By delving into these subjects, participants will gain profound insights into the journey of transforming ideas from abstract concepts into tangible, market-ready products.

The session also imparts knowledge about the processes and methodologies for validating new products, recognizing the elevated risk of product failure. It underscores the significance of these validation techniques in averting potential failures. Covered within the session are pre-launch strategies, such as simulated test markets like BASES, and post-launch approaches, including the TRB Share Prediction model, which finds particular relevance in the FMCG sector.

In essence, this session equips participants with the tools and knowledge needed to navigate the treacherous waters of new product development, from ideation to market validation, fostering a culture of innovation while minimizing the perils associated with it.

- Problem definition

- Research design

- Questionnaire design

- Information needs

- Sampling

- Data collection

- Online research — advantages and limitations

- Self-service surveys

- Analysis process

- Interpretation and recommendations

Steve Jobs once famously remarked, “it isn’t the consumers’ job to know what they want”, highlighting a perspective on innovation that challenges conventional thinking.

The associates at Cupertino, the epicentre of Apple’s innovation, possess unparalleled expertise in iPhones and iPads, understanding their intricacies and foreseeing their future evolution. Similarly, brand owners are intimately acquainted with their products and brands, surpassing the familiarity of the average consumer.

This prompts the question: Why, then, do these companies invest in consumer research?

Among several compelling reasons, one stands out: despite their deep knowledge, these organizations recognize the necessity of understanding the thoughts, feelings, beliefs, and desires of ordinary people.

The paradox lies in the fact that, armed with extensive knowledge, marketers may view their products and brands through a lens that significantly diverges from the perspective of real consumers. This skewed perspective can obscure critical insights. Moreover, marketers are susceptible to selective perception, where they may inadvertently filter or interpret research findings in a manner that aligns with their preconceived notions.

In essence, consumer research serves as a vital corrective lens, helping companies bridge the gap between their internal expertise and the external perceptions of their target audience. It allows them to see their products and brands as consumers see them, ultimately leading to more informed decisions and innovative developments.

Quantitative research (quant) is widely used in marketing to methodically investigate markets via theoretical models and statistical techniques. As a marketer, you will find the practical, diverse applications of quant useful for formulating strategies and refining the marketing mix of your brand. Applications such as brand image tracking, market segmentation and measurement of brand equity, discussed in earlier sessions are a few among the multitude of examples of quant in practice.

This session covers the basic processes and practices in quant, including topics such as problem definition, research design, questionnaire design, information needs, sampling, data collection, online research, and the analysis process.

- What is qualitative (qual) research

- Differences Between qual and quant

- Applications of qualitative research — when to use it

- Qual advantages and watchouts

- Qual methods — focus groups, depth interviews

- Qual research process — discussion guide, setting, structure, sequence and script

- Projective and enabling techniques to unlocking people’s minds

- Body language

- Guidelines for interviewing/moderating

- Interpretation and analysis — descriptive and interpretative analysis

Qualitative research (qual) reveals what people think and feel, and explores issues by understanding how people’s attitudes and motivations influence their behaviour. It relies on implicit models of analysis of the participants’ verbal and non-verbal communication, their actions and reactions to interpret why people feel the way they do.

The distinguishing characteristic of qual is that it is primarily concerned with “how” and “why”; while it serves to explore and investigate, qual does not attempt to measure.

Group discussions and depth interviews, the two commonly used modes of qual are moderated by trained qual researchers. The researchers make use of open-ended interviewing techniques to explore participants’ feelings and bring forth emotions into the open in a way that they feel comfortable with.

This session highlights the difference between qual and quant research, discusses the use of user-generated content, and clarifies what type of marketing problem each of these methods is best suited to resolve.

It covers various aspects of qual including group discussions, interviews, observation, online qual, the design and preparation of a qual study, projective and enabling techniques, and body language. For the practitioner, the session chalks out guidelines for moderating groups. It serves as a guide to the use of qualitative research and imparts an understanding of how to conduct qual studies.

Customer Satisfaction and Customer Value:

- Retention and attrition

- Evolution of customer satisfaction

- Customer value management

- Service profit chain

- Kano model — categorizing product features

- Customer satisfaction research

- Transaction satisfaction surveys

- Relationship satisfaction surveys

- Key driver analysis

- customer satisfaction incentive schemes

This session imparts an understanding of how to manage customer satisfaction. It covers a wide array of topics on the subject including the evolution of customer satisfaction, the interplay between employee satisfaction and customer satisfaction, customer loyalty, customer satisfaction measurement, transaction and relationship surveys, drivers of customer loyalty and satisfaction, and the Kano model.

The session also provides an overview of customer value management, i.e., the process of creating superior value for target customers and securing an equitable return on the value delivered. Concepts such as customers’ value-in-use and customers’ purchasing philosophy are reviewed here.

Case Studies: A selection of data rich analytics cases to impart an understanding of how marketers apply market research to respond to the challenges confronting them in the marketplace.

Instructor

Professor Ashok Charan, a distinguished expert in the field, boasts a remarkable 25 years of invaluable professional experience in marketing and marketing analytics. His journey has encompassed pivotal roles at esteemed organizations such as Unilever and Nielsen.

A seasoned author, Professor Charan has contributed extensively to the realm of marketing analytics and digital marketing through his published books. His literary accomplishments stand as a testament to his deep insights and comprehensive understanding of the subject.

Notably, he stands as the visionary behind the Destiny marketing simulator, a pioneering experiential learning platform for consumer marketing and retailing professionals. Moreover, his dedication to innovation is evident through his role as a developer, where he has engineered analytic tools and solutions tailored to the needs of practitioners. Among these, the illustrious MarketingMind takes the lead as the premier analytics platform designed for marketing professionals and consumer analysts.

Since 2002, Professor Ashok Charan has taught at some of the leading global business schools, including the NUS Business School where he has served since 2006. Throughout this tenure, he has exhibited his commitment to cultivating the next generation of marketing minds. With an impressive track record spanning two decades, he has actively imparted his wealth of knowledge to marketing practitioners hailing from leading consumer-centric organizations. This dedication underscores his role as both a mentor and a catalyst for excellence in the marketing sphere.