-

Price

At What Price?

Basics of Pricing Research

Importance of Realism

Price Elasticity of Demand

Factors Affecting Consumers’ Sensitivity to Price

Shrinkflation

Pricing Research Methods

Gabor Granger

Van Westendorp Price Sensitivity Meter

Brand Price Trade-Off

Conjoint Analysis

Discrete Choice Modelling

Hierarchical Bayes

Interaction Effects

DCM vs Conventional Conjoint Analysis

Example — Rationalizing Brand Range

How to Price a Product Feature

New Product Pricing

Statistical Structure — Discrete Choice Model

- Price

- Promotion

Infant Milk — Real Reasons why Prices Soared

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

-

MarketingMind

Price

At What Price?

Basics of Pricing Research

Importance of Realism

Price Elasticity of Demand

Factors Affecting Consumers’ Sensitivity to Price

Shrinkflation

Pricing Research Methods

Gabor Granger

Van Westendorp Price Sensitivity Meter

Brand Price Trade-Off

Conjoint Analysis

Discrete Choice Modelling

Hierarchical Bayes

Interaction Effects

DCM vs Conventional Conjoint Analysis

Example — Rationalizing Brand Range

How to Price a Product Feature

New Product Pricing

Statistical Structure — Discrete Choice Model

- Price

- Promotion

Infant Milk — Real Reasons why Prices Soared

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

At What Price Should We Sell Our Product?

The answer to this question invariably depends on business goals and objectives. Pricing decisions are not made in isolation but rather in the context of the broader business strategy.

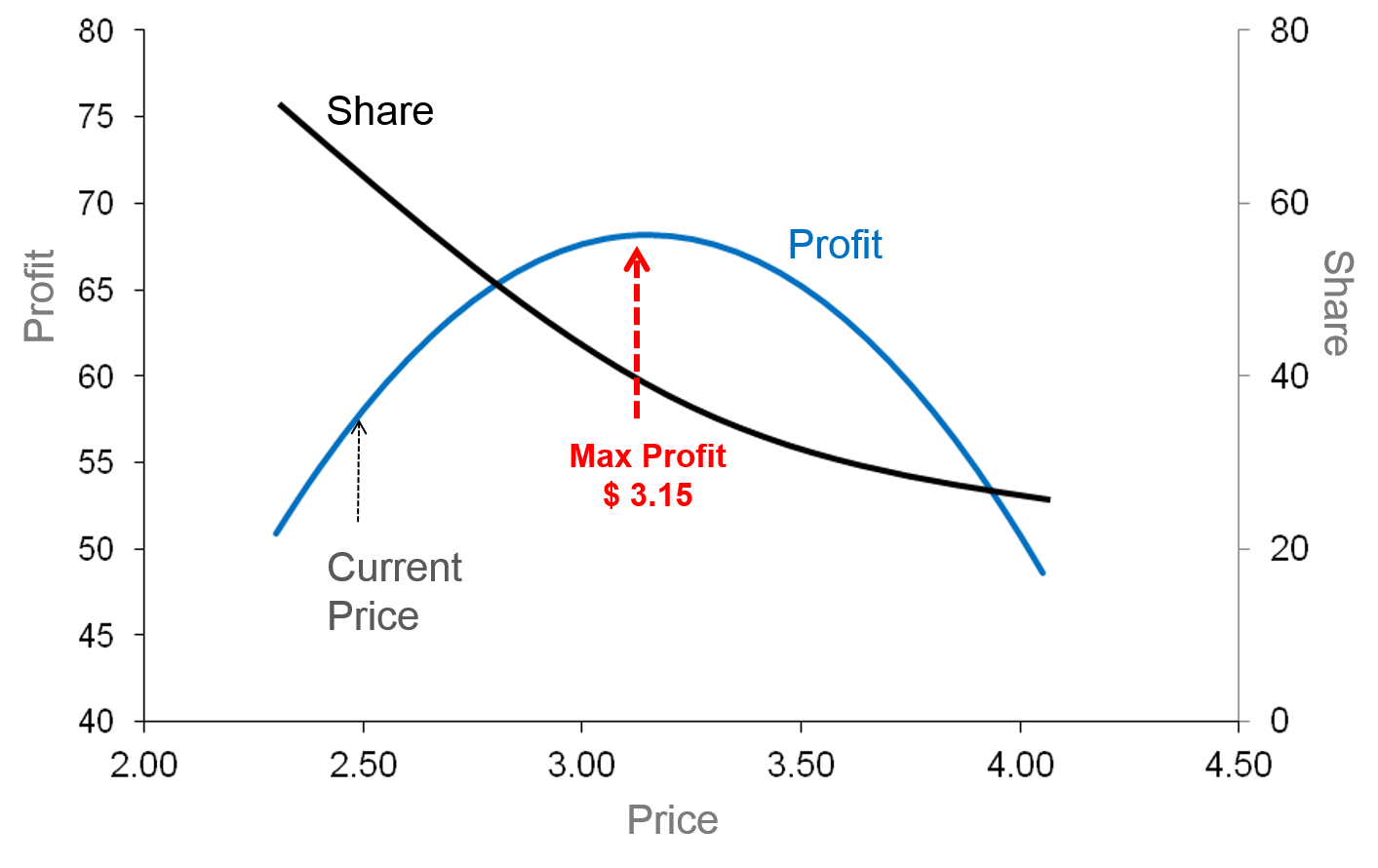

Consider, for instance, the typical scenario portrayed in Exhibit 16.1, where profits increase up to a point, as prices go up. What price adjustment would you recommend?

If the objective is to maximize profit, you might consider raising price all the way up to $3.15. However, if you do this, your market share will plummet from about 60% to 40%, and your competitors’ collective share will soar to 60%. If the market size does not change and if competitors’ variable costs per unit remains the same, they gain 50% growth in volume, value and profit. You, on the other hand, will gain about 19% in profit, and lose considerably in volume and value. Therefore, by maximizing your profit, you will be conceding competitive advantage to your competitors.

If the objective is to grow market share, you might consider reducing price. But if you do this, your profits will plunge, and you might trigger a price war.

While low-cost leaders may engage in price wars to squeeze out competitors, this may not always result in a favourable outcome.

For instance, in 2005, when IBM, under competitive price pressures from Dell, sold off its PC business to Lenovo, the change in market dynamics did not favour Dell. Lenovo, which already possessed a low-cost manufacturing base, gained competitive advantage by acquiring IBM’s customers and brands like ThinkPad, along with talented associates who came with the business takeover. According to Gartner, with a share of 16.9% in 2013, Lenovo displaced Dell as the leader in the global PC market.

Though it is illegal in most countries, the temptation to engage in price-fixing may still be alluring for some oligopolies. For example, the conglomerates that monopolize the cigarette market in several countries, may be tempted to raise prices to the levels that the government is targeting so that they get to “keep the money” rather than let it go to the government in the form of increases in excise duty.

However, unless there are sustainable competitive advantages, high-price, high-margin tactics lower the barriers of entry for competitors. When cigarette prices were fixed upwards in a particular country, the market was soon flooded with cheaper imports from a Chinese manufacturer. The commotion that followed led ultimately to sharp and penalizing increases in excise duties in that market, as the government became aware of the unscrupulous pricing tactics.

As can be seen from some of the above examples, pricing decisions are fraught with hidden risks. The tendency quite often is to take a blinkered view to the problem, not foreseeing the impact on competitors and other industry players, and not anticipating the sequence of events that might follow a pricing decision.

The answer to the question posed above, hinges on several factors. You need to take into consideration company objective, price positioning, cannibalization, profit, revenue, market share, competitive scenario, competitive response, and where applicable, government’s response. You also need to make a clear distinction between pricing strategy and pricing tactics.

The above discussion emphasizes the intricacies and risks involved with pricing decisions. As is often highlighted, price is the variable in the marketing mix that generates revenue. Getting it right therefore warrants careful attention to marketing and financial considerations.

This chapter focuses on the various methods used in pricing research, such as Gabor-Granger, Van Westendorp’s price sensitivity meter, brand price trade-off, conjoint analysis, and discrete choice models. It also emphasizes the importance of price elasticity of demand and the multiple factors that can influence it, as well as the need for realism in pricing research.

Furthermore, the chapter provides insights into the complex dynamics of price and volume and the potential risks and challenges in making pricing decisions. By studying this chapter, readers can gain a better understanding of pricing research and be better equipped to make informed pricing decisions.

To facilitate a deeper understanding of pricing research and its practical applications, this volume includes a case study on Yakult at the end of Part V. The case offers valuable insights into the complexities of pricing decisions and the role that pricing research can play in helping companies make informed decisions.

Next

Use the Search Bar to find content on MarketingMind.

Contact | Privacy Statement | Disclaimer: Opinions and views expressed on www.ashokcharan.com are the author’s personal views, and do not represent the official views of the National University of Singapore (NUS) or the NUS Business School | © Copyright 2013-2026 www.ashokcharan.com. All Rights Reserved.