Exhibit 7.1 Panellist with handheld scanner. (Photo courtesy of NielsenIQ).

Since their inception in 1932,

developments in the use and application of consumer panels have greatly

contributed to the science of consumer analytics.

More recently, the explosion of data has

expanded the role and application of consumer analytics, such that it

cuts across virtually every sector of economic and social activity.

This chapter imparts an understanding of

consumer analytics through consumer panels. It covers the analytic tools

used to extract insights from consumer transactions.

The book takes an easy-to-understand approach

to explain a repertoire of metrics and techniques such as width and depth

of purchase, buyer groups, profile analysis, behavioural brand loyalty,

trial and repeat purchase, overlap analysis, basket analysis and gain–loss.

It focusses on the applications of these techniques to diagnose brand

health and address business issues.

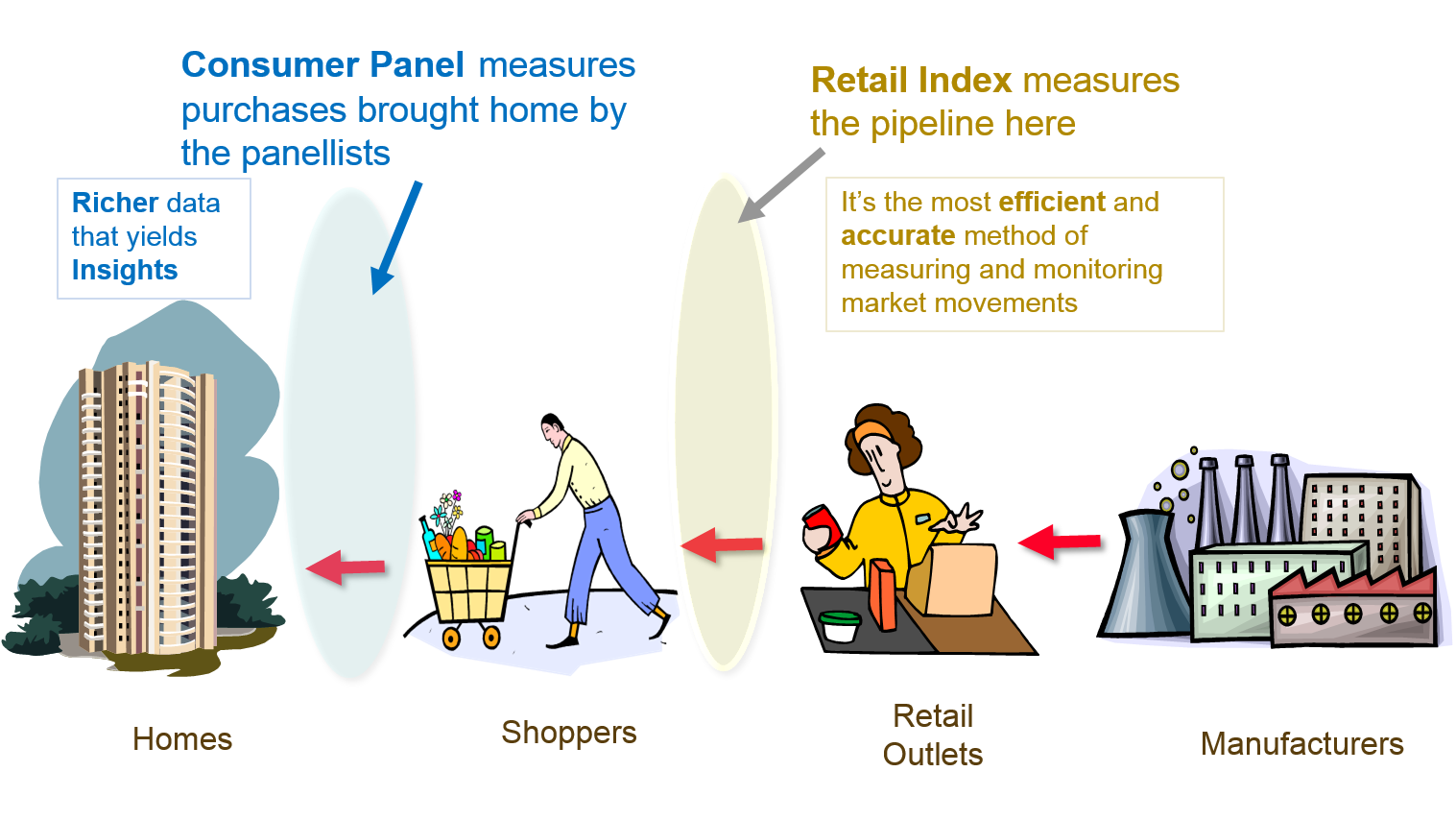

Exhibit 7.2 Different approaches to tracking sales as goods flow

along the path from manufacturer to retailer and shopper.

A Consumer Panel is a panel

of households or individuals whose purchases are monitored on a continuous

or ongoing basis. In some ways it is similar to a loyalty panel, which

comprises loyalty card holders. They both are powerful research platforms that

produce streams of continuous customer transaction data, which are ideal for

diagnosing the buying behaviour of products and services, where repeat

purchasing is the norm.

Though the scope does vary, the research methods

described in this chapter apply across the different forms of disaggregate

consumers’ purchasing data. Unlike consumer panels though, loyalty panels and

customer transaction data present only a blinkered view, confined to customers’

transactions within the organization. However, because they represent a larger

customer base, their data is more tactical/actionable in nature — it allows for

the execution of tactics, targeting segments or even individuals, at specific

locations, e.g., store, bank, etc.

Consumer panel data is broader in scope as it is not

confined to an organization’s customers. Yet because it is a platform that is

specifically created and maintained for research purposes, the data acquisition

cost for consumer panels is far greater than that for live sources like

customer transaction and loyalty data.

Exhibit 7.2 depicts the

different approaches to tracking sales as goods flow along the path from

manufacturer to retailer and from retailer to shopper. The data sourced at

retail checkouts offers the most efficient and accurate means of tracking

sales. Called the retail index, this is the industry standard for market

measurement.

The accuracy of consumer panel data is limited by

the panel size, yet it is richer and better suited for diagnosing buying

behaviour. In research lingo, data of this nature is called disaggregate.

Key brand health measures like brand loyalty, %buyers, volume

per buyer and so on rely on disaggregate data. Other diagnostic analysis

like brand switching, repeat buying rate, share forecasting rely on data that

must be both continuous and disaggregate.

Typically, consumer panels are composed of

households/individuals who are representative of the market in terms of relevant

characteristics such as household size, life stage, income, dwelling type, ethnic

group, geographical location, etc.

The panels in existence today are almost entirely

anchored in the fast moving consumer goods (FMCG) sector. There is a

considerable, as yet largely unexplored potential for panels in sectors such as

finance, telecom and petroleum. Behaviour of usage/consumption of credit cards,

mobile phones and petroleum, can provide valuable information that could help

shape marketing and business decisions in these sectors.

Nielsen, the largest service provider operates FMCG

panels in 28 countries covering about 300,000 households. The first panel was set

up by Nielsen in 1932, in the U.S. The first scan panel, BrandScan

was launched in 1986 in Australia by AGB McNair, which subsequently was

acquired in 1994 by Nielsen. Today the majority of FMCG consumer panels are

scan-based, and the two major service providers are Nielsen and Kantar (TNS).

In addition to home panels there are a few

out-of-home panels for impulse foods like chocolate, ice cream and soft drink

that are consumed out of home.