Exhibit 7.21 An advertisement of Johnson’s Body Wash and

Johnson’s H&B lotion.

Johnson’s, a brand that

cuts across multiple categories, is a leading brand in hand & body (H&B)

lotion and body wash — two categories where market dynamics differs greatly.

H&B lotion is a small relatively quiet market where Johnson’s often

maintains a dominant leadership position. Body wash on the other hand is a cutthroat

business with thin margins, as big global brands jostle for market share.

Some years back Johnson’s regional leadership was

exploring ways to exploit the synergy of the brand across the two categories.

They had a few questions on their minds — Could Johnson’s equity transcend

categories? Could they leverage the brand’s equity from one category to

another? If so, that would open opportunities to strengthen the brand as well

as optimize costs in brand building.

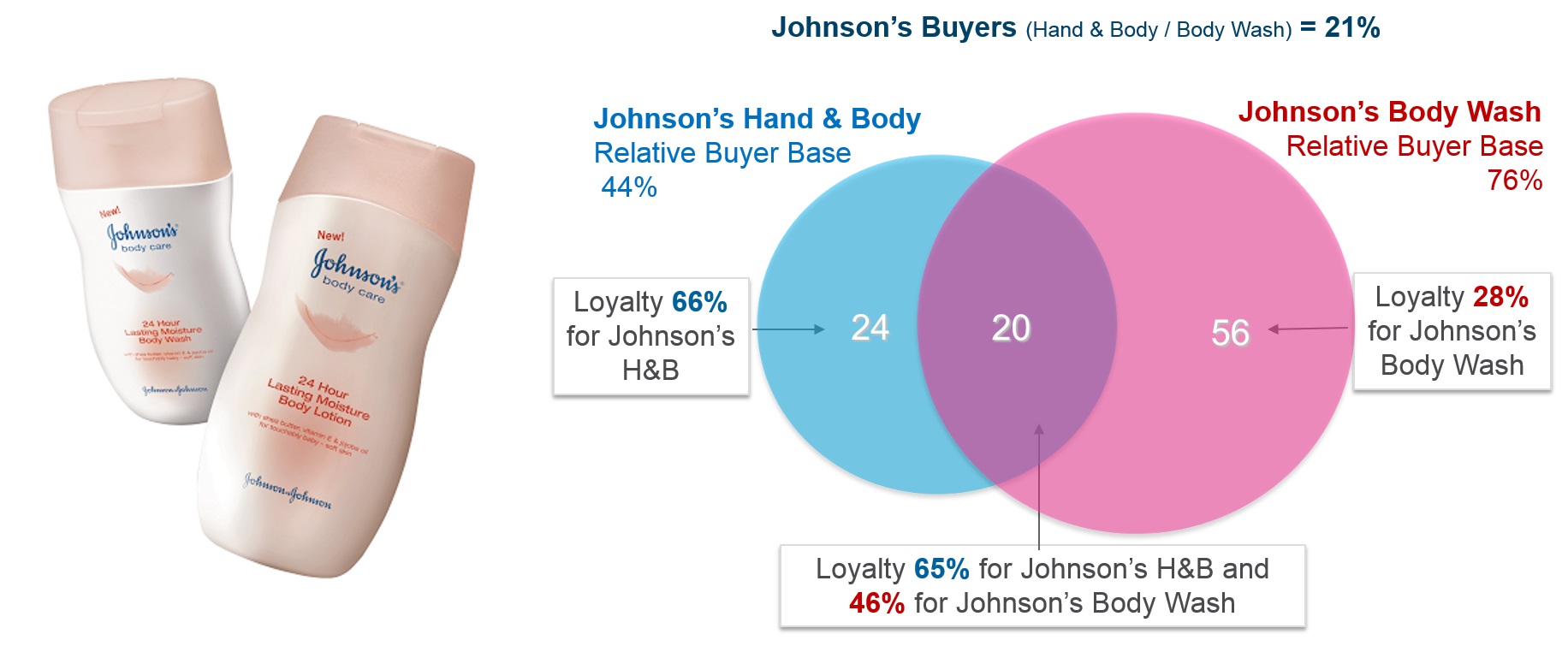

Exhibit 7.22 Cross-category overlap analysis: Johnson’s Hand

& Body and Body Wash.

At Nielsen, we picked the Singapore market for

in-depth study of the Johnson’s brand. One analysis, depicted in Exhibit

7.22, provides a break-up of the 21% Johnson’s buyers into three buyers groups

— those who bought Johnson’s H&B only (H&B only — 24% of

buyers), those who bought Johnson’s Body Wash only (BW only — 56% of

buyers) and those who bought both Johnson’s H&B and Johnson’s Body Wash (H&B

+ BW — 20% of buyers). For each of the three buyer groups,

we examined their behavioural loyalty to the Johnson’s brand within H&B and

body wash.

Considering Johnson’s dominant position in H&B,

it did not come as a surprise that loyalty for Johnson’s H&B was high (65-66%)

for both H&B only and H&B + BW buyer

groups. What caught our attention, however, was the much higher loyalty of 46%

for Johnson’s Body Wash, among H&B + BW buyers, compared to

the 28% loyalty, among BW only buyers.

Also revealing was the cross-basket analysis

of Johnson’s H&B buyers. Exhibit 7.23 depicts the body wash basket

of purchases by the Johnson’s H&B buyers’ buyer group. Within this

group, Johnson’s Body Wash had a commanding share of 27.5% — which is

exceptionally high when compared with the 9.5% market share of Johnson’s Body

Wash, within the panel population as a whole.

In the context of buyer groups, the share of

Johnson’s Body Wash in total market (9.5%) is called the “fair share” — i.e.,

the share we would expect if there was nothing extraordinary about the buyer

group. The index 27.5/9.5 (= 290 re-based to 100), called the fair share

index, is extraordinarily high. It tells us that the propensity of a

Johnson’s H&B buyer to buy (in terms of value) Johnson’s Body Wash, is 2.9

times greater than that for the average brand buyer.

The cross-category overlap analysis,

and the cross-basket analysis suggested that Johnson’s brand equity transcended

the categories; that there existed a strong synergistic relationship. Consumers

buying both Johnson’s product were much more loyal to Johnson’s Body Wash. This

synergy was leveraged via subsequent marketing efforts such as the joint Johnson’s

body care ad in Exhibit 7.21, which jointly advertised

Johnson’s Body Wash and Johnson’s H&B lotion.