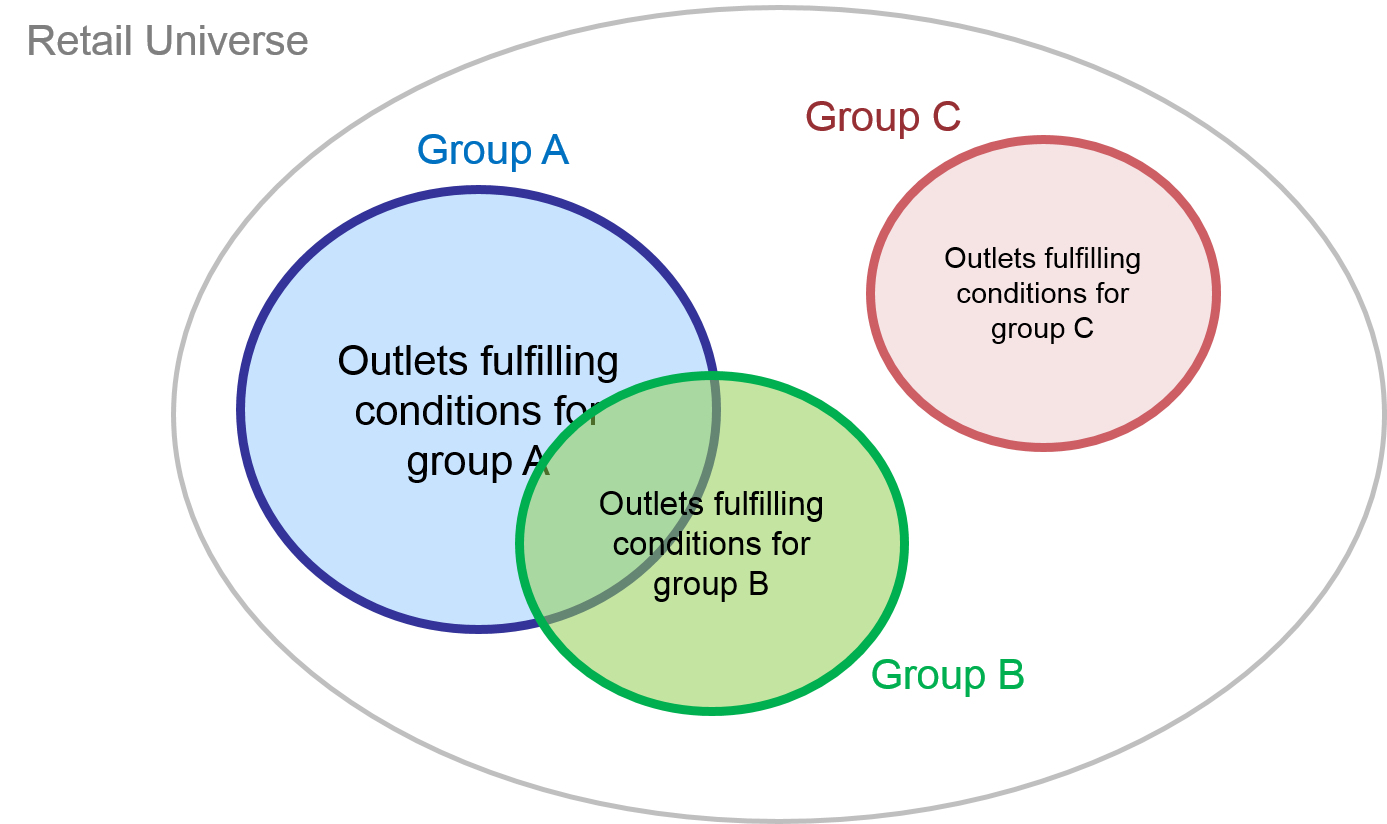

Exhibit 32.1 Forming outlet groups.

Continuous data on shoppers and their transactions

is a data mine that can help diagnose business issues.

Whereas chapters Retail Tracking and Sales and Distribution focussed on

aggregate data analytics (i.e., aggregated to market breakdowns such as chain, channel,

region and country), this chapter covers analyses of disaggregate or outlet level data

which tends to be more diagnostic in nature.

The term “retail analytics” is commonly in use in

ways that tend to overlap with related areas such as “consumer analytics” and “retail

tracking”. Since each of these topics is covered in separate chapters, let me clarify that

in context of this chapter, retail analytics relates to the analysis of continuous

outlet level data pertaining to shoppers and their transactions.

Retail Tracking Databases

Data sourced from point-of-sale (POS) scan terminals

and retail audits, generates continuous transaction data that feeds into retail analytics.

Whereas the retail tracking service aggregates the data to capture market size, share and

distribution for market breakdowns, retail analytics analyses the data at the disaggregate

or outlet level.

Fundamental to retail analytics is the filtering

of retail outlets to form outlet groups (Exhibit 32.1). For instance, an analyst

might be interested in examining outlets that stocked a particular brand

compared with outlets that did not stock that brand. Or outlets that offered a

promotion versus outlets that did not do so.

This chapter describes a wide array of outlet group

analysis addressing aspects such as brand handlers’ analysis, brand overlap, assortment, shelf space,

pricing, promotion and rate of sales.

Customer Transaction Databases

Customer transaction data (e.g.,

shopper transactions data, consumer panel data, loyalty panel data)

also feed into retail analytics. These databases have the customer dimension in

addition to the outlet dimension, thus adding an additional layer of diagnostic

capabilities. The data can be used to compute chain or outlet penetration,

spend per customer, chain loyalty, cannibalization among outlets and so on,

using similar concepts, tools and techniques that are applicable for the

analysis of consumer panels.

The analysis outlined in this chapter include

customer profile, loyalty and propensity, assortment analysis, overlap, outlet

group, outlet repertoire, gain–loss, trial and repeat visit, penetration and

repeat rate, and sales forecasting. A case example pertaining to the opening of

a new petrol station illustrates a number of these analyses.