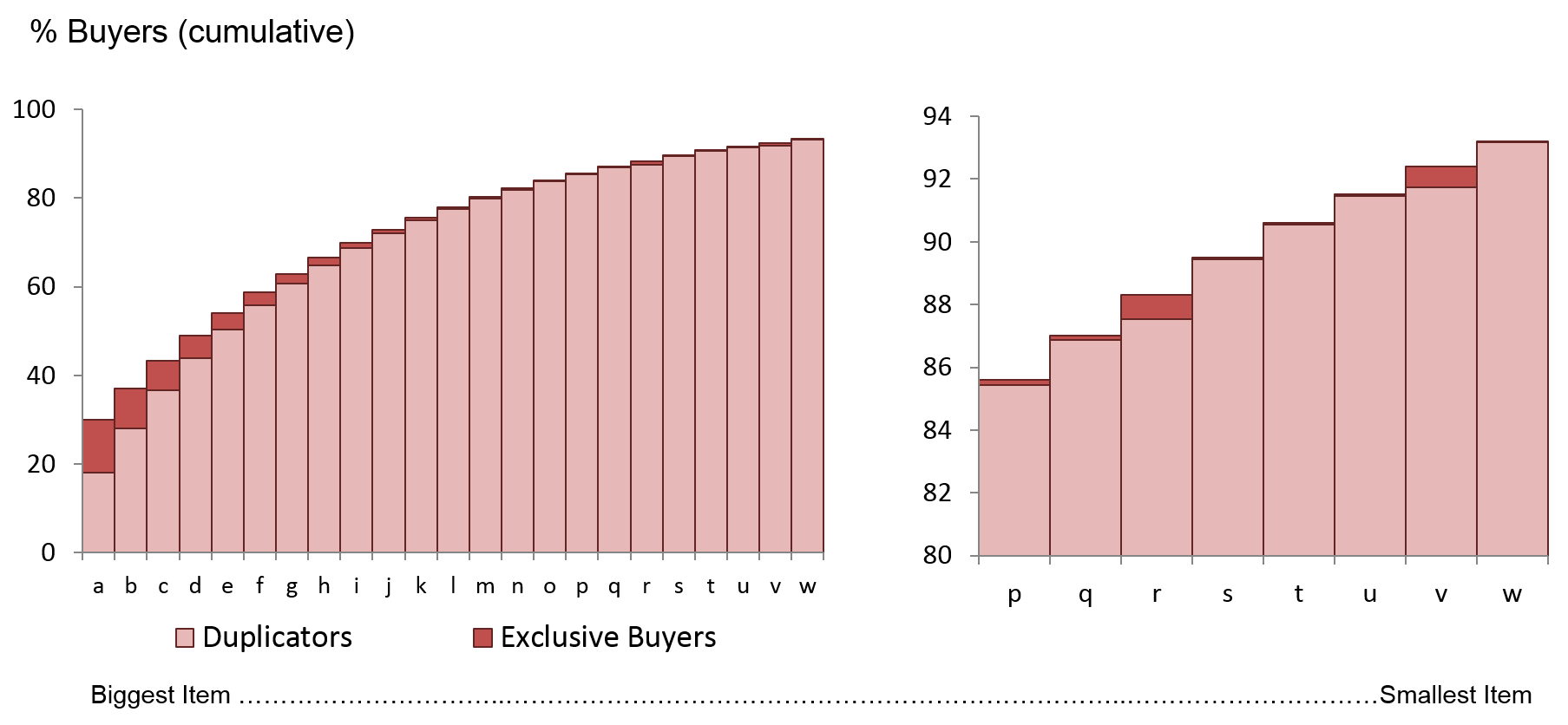

Exhibit 32.5 Assortment optimization.

Retailers are constantly grappling with

requests to list an ever-increasing parade of new products. Their space is finite

— as new items get listed, some items on the shelf need to be de-listed.

One approach to optimizing assortment is on the basis of sales volume,

sales value and profitability. This is covered in detail in Chapter

Sales and Distribution. It is important

also for the retailer to examine measures such as the proportion of shoppers who

buy an item (% buyers), and particularly those who exclusively buy.

A low selling item might have relatively high base of shoppers who

exclusively buy it. Such an item exhibits high brand loyalty. So, if it is de-listed,

the likelihood that some shoppers may switch to other stores, is greater, and the retailer

stands to lose their total spend in store when shoppers switch.

Exhibit 32.5 depicts an analysis of exclusive buyers and cumulative

duplicate buyers of items for some category. The items are listed in order starting from

the item with the biggest buyer base.

Observe, at the tail end, items r and v have a high proportion

of exclusive buyers. Since their shoppers exhibit high loyalty, the retailer should refrain

from de-listing items r and v; or do so only after careful consideration.