-

Sales & Distribution

Sales and Distribution

Interdependence of Demand and Supply

Components of Sales — Width & Depth

Measures of Distribution (Width)

Sales and Distribution Priorities

Distribution Network — Basics

Relationship between Sales and Distribution

Right Channels, Right Chains

Right Assortment

Managing Assortment

Battle of Shelf Space

Measures of Assortment and Sales Velocity

Number of Items Stocked

Assortment Analysis

Sales per Point of Weighted Distribution

Share in Handlers

Average Sales per Store

Rate of Sales

Rate of Sales/Gross Profit

Portfolio Analysis

Fragmentation Analysis

Securing Retailer Support

Managing Stock in Trade

Allocation of Shelf Space

Cost of Stockouts

- Retail Tracking

- Sales and Distribution

- Retail Analytics

- Category Management

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

-

MarketingMind

Sales & Distribution

Sales and Distribution

Interdependence of Demand and Supply

Components of Sales — Width & Depth

Measures of Distribution (Width)

Sales and Distribution Priorities

Distribution Network — Basics

Relationship between Sales and Distribution

Right Channels, Right Chains

Right Assortment

Managing Assortment

Battle of Shelf Space

Measures of Assortment and Sales Velocity

Number of Items Stocked

Assortment Analysis

Sales per Point of Weighted Distribution

Share in Handlers

Average Sales per Store

Rate of Sales

Rate of Sales/Gross Profit

Portfolio Analysis

Fragmentation Analysis

Securing Retailer Support

Managing Stock in Trade

Allocation of Shelf Space

Cost of Stockouts

- Retail Tracking

- Sales and Distribution

- Retail Analytics

- Category Management

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

Sales and Distribution — Managing Assortment

Items available for sale in retail stores are typically identified by a barcode, which is scanned at the checkout. Each book, for instance, possesses a unique International Standard Book Number (ISBN). In the Fast-Moving Consumer Goods (FMCG) industry, an item’s barcode is denoted by various abbreviations such as Stock Keeping Unit (SKU), Universal Product Code (UPC) in the U.S., European Article Number (EAN), Global Trade Item Number (GTIN), Japanese Article Number (JAN), and so on.

The average supermarket typically carries approximately 10,000 to 20,000 items in its inventory. While this may seem like a considerable number, it pales in comparison to the extensive range of products that suppliers have available to offer.

To provide a sense of scale, I previously inquired about the number of active items on Nielsen’s item master in Singapore. I was told that there were 4,714 facial products, 3,441 biscuits, 2,376 chocolates, 2,137 shampoos, and 2,110 soft drinks. Aside from pondering what you can do to your face these days, one cannot help but wonder how retailers manage to cope with such an overwhelming abundance of options.

Brick and mortar stores can stock only a small fraction of the items that manufacturers have to offer. They need to manage this carefully because assortment is a key driver of store choice. It impacts consumers’ perception of their chain, their store loyalty, and the amount they spend in store. The limited shelf space that is available in a store must be optimized so that consumers may benefit from a wide range of choices, with minimum incidence of stockouts.

From the manufacturer’s perspective, the brand’s range and its distribution should be aligned to its marketing strategy. In trade channels however their brand is faced with a battle for shelf space. Ultimately how much of the brand’s range is stocked by a retailer is a function of several size factors:

- Size of the store.

- Size of the category. Importance of the category. Destination categories, for instance, would get higher priority on space.

- Size of the brand. Importance of the brand. In addition to size in terms of sales, brands that are better aligned with the chain's identity should get higher priority.

- Size of item.

Bigger stores accommodate more categories and offer more space for each category. For instance, supermarkets stock over 30 SKUs of Campbell’s soup, whereas provision stores on average stock less than 5. Campbell’s marketing and sales management teams need to take a decision on which items to sell through which store in these channels and ensure that these items remain in stock.

Previous Next

Use the Search Bar to find content on MarketingMind.

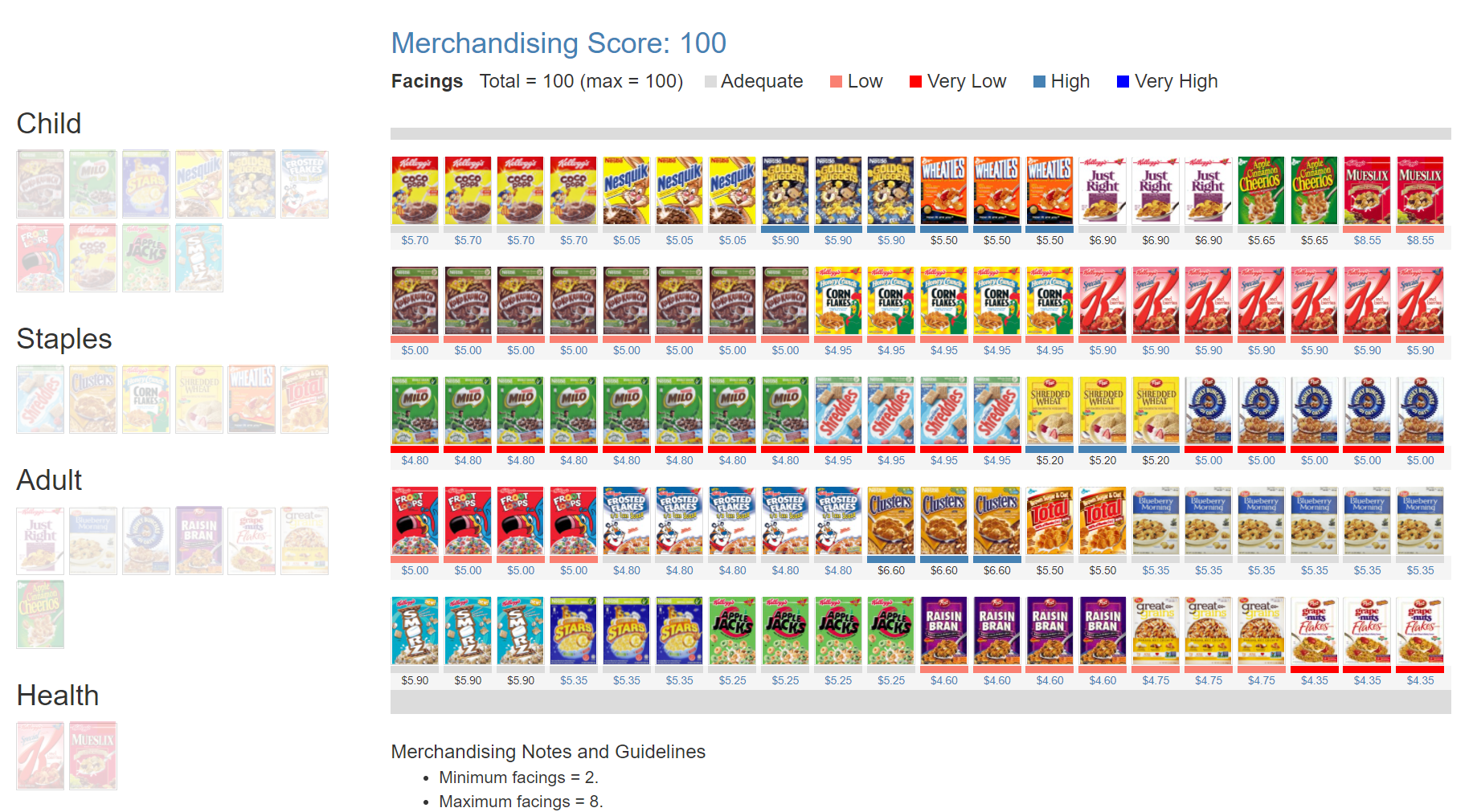

Online Apps to train Category Managers

The Plannogrammer is an experiential learning facility for category managers, trade marketers, and retailers in consumer markets. Ideally suited for hybrid learning programmes, Plannogrammer imparts hands-on training in the planning and evaluation of promotions and merchandising.

It supports a collection of simulation and analysis platforms such as Promotions and Space Planner for optimizing space and promotions, Plannogram for populating shelves and merchandising, a Due To Analysis dashboard that decomposes brand sales into the factors driving sales, and a Promotion Evaluator to evaluate the volume, value and profit impact of promotion plans.

Contact | Privacy Statement | Disclaimer: Opinions and views expressed on www.ashokcharan.com are the author’s personal views, and do not represent the official views of the National University of Singapore (NUS) or the NUS Business School | © Copyright 2013-2026 www.ashokcharan.com. All Rights Reserved.