-

Sales & Distribution

Sales and Distribution

Interdependence of Demand and Supply

Components of Sales — Width & Depth

Measures of Distribution (Width)

Sales and Distribution Priorities

Distribution Network — Basics

Relationship between Sales and Distribution

Right Channels, Right Chains

Right Assortment

Managing Assortment

Battle of Shelf Space

Measures of Assortment and Sales Velocity

Number of Items Stocked

Assortment Analysis

Sales per Point of Weighted Distribution

Share in Handlers

Average Sales per Store

Rate of Sales

Rate of Sales/Gross Profit

Portfolio Analysis

Fragmentation Analysis

Securing Retailer Support

Managing Stock in Trade

Allocation of Shelf Space

Cost of Stockouts

- Retail Tracking

- Sales and Distribution

- Retail Analytics

- Category Management

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

-

MarketingMind

Sales & Distribution

Sales and Distribution

Interdependence of Demand and Supply

Components of Sales — Width & Depth

Measures of Distribution (Width)

Sales and Distribution Priorities

Distribution Network — Basics

Relationship between Sales and Distribution

Right Channels, Right Chains

Right Assortment

Managing Assortment

Battle of Shelf Space

Measures of Assortment and Sales Velocity

Number of Items Stocked

Assortment Analysis

Sales per Point of Weighted Distribution

Share in Handlers

Average Sales per Store

Rate of Sales

Rate of Sales/Gross Profit

Portfolio Analysis

Fragmentation Analysis

Securing Retailer Support

Managing Stock in Trade

Allocation of Shelf Space

Cost of Stockouts

- Retail Tracking

- Sales and Distribution

- Retail Analytics

- Category Management

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

Distribution Network — Basics

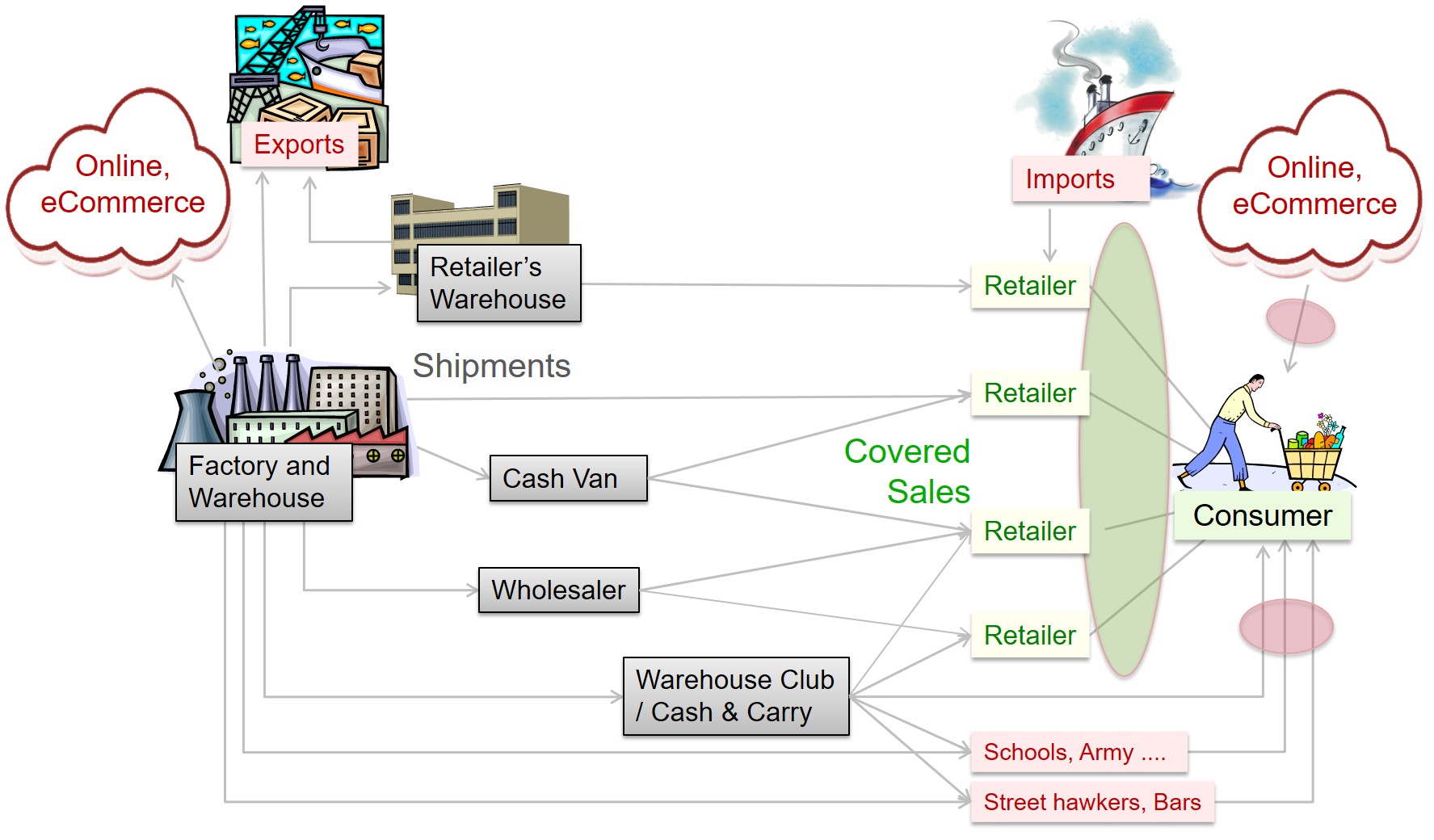

A distribution network is a set of interdependent organizations engaged in making goods and services available to customers. It includes primary channel partners such as wholesalers, distributors, retailers, agents and brokers who form the pipeline or link between manufacturers and customers. It also involves ancillary channel members who provide generic facilities such as transportation (logistics), financing, storage, promotion, and other such services. These primary and ancillary intermediaries make the flow of goods to target customers efficient and cost-effective.

Distribution channels vary from one class of goods to another, and channel strategies too can differ from manufacturer to manufacturer.

The FMCG (Fast Moving Consumer Goods) distribution network in particular is vast and intricate, often encompassing a conventional channel structure as illustrated in Exhibit 31.1. As explained in Chapter 29, Retail Tracking, the retail universe consists of both the upper (modern) and lower (traditional) trade segments. The trade formats span a wide spectrum, ranging from basic to advanced retailing concepts, including emerging trends like virtual shopping. Chapter 32, Category Management, provides detailed descriptions of the predominant FMCG trade formats found in the industry.

The pipeline characteristics vary depending on the nature of the product and the size of the market. Markets covering large geographies such as India, Indonesia and China have extensive and elaborate distribution networks.

Products like bread that have a short shelf life require distribution networks that can cater for daily deliveries to retail outlets. Other products like pasteurized milk and fresh foods require cool chain distribution, whereas ice creams and frozen foods require cold chain distribution.

A soft drink like Coca-Cola is distributed in a very large number of stores, including food and beverage outlets, as well as several indoor and outdoor locations, facilitated by vending machines. On the other hand, premium quality, niche and exclusive products like gourmet foods or luxury personal care brands are only distributed in select outlets.

Previous Next

Use the Search Bar to find content on MarketingMind.

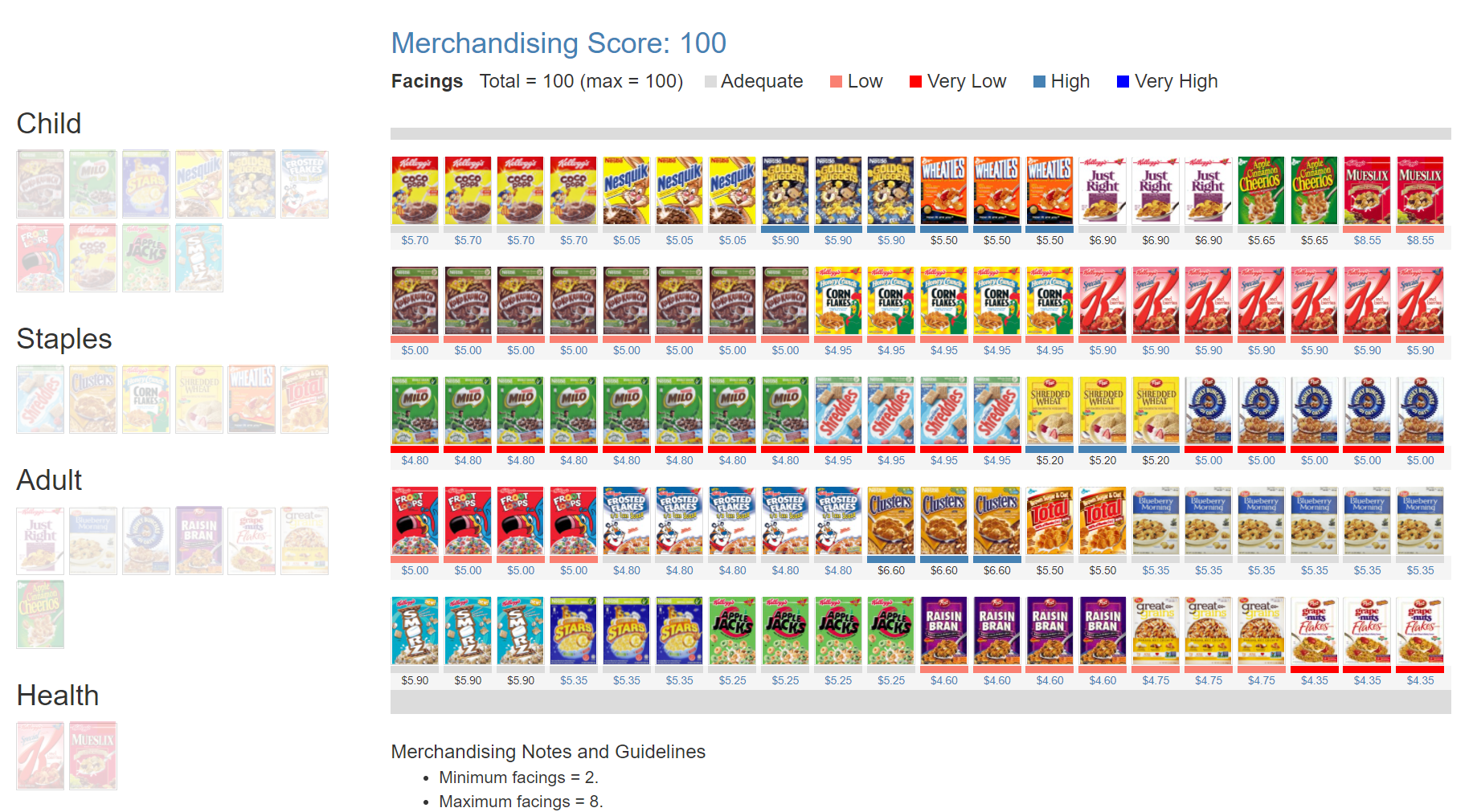

Online Apps to train Category Managers

The Plannogrammer is an experiential learning facility for category managers, trade marketers, and retailers in consumer markets. Ideally suited for hybrid learning programmes, Plannogrammer imparts hands-on training in the planning and evaluation of promotions and merchandising.

It supports a collection of simulation and analysis platforms such as Promotions and Space Planner for optimizing space and promotions, Plannogram for populating shelves and merchandising, a Due To Analysis dashboard that decomposes brand sales into the factors driving sales, and a Promotion Evaluator to evaluate the volume, value and profit impact of promotion plans.

Contact | Privacy Statement | Disclaimer: Opinions and views expressed on www.ashokcharan.com are the author’s personal views, and do not represent the official views of the National University of Singapore (NUS) or the NUS Business School | © Copyright 2013-2026 www.ashokcharan.com. All Rights Reserved.