-

Sales & Distribution

Sales and Distribution

Interdependence of Demand and Supply

Components of Sales — Width & Depth

Measures of Distribution (Width)

Sales and Distribution Priorities

Distribution Network — Basics

Relationship between Sales and Distribution

Right Channels, Right Chains

Right Assortment

Managing Assortment

Battle of Shelf Space

Measures of Assortment and Sales Velocity

Number of Items Stocked

Assortment Analysis

Sales per Point of Weighted Distribution

Share in Handlers

Average Sales per Store

Rate of Sales

Rate of Sales/Gross Profit

Portfolio Analysis

Fragmentation Analysis

Securing Retailer Support

Managing Stock in Trade

Allocation of Shelf Space

Cost of Stockouts

- Retail Tracking

- Sales and Distribution

- Retail Analytics

- Category Management

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

-

MarketingMind

Sales & Distribution

Sales and Distribution

Interdependence of Demand and Supply

Components of Sales — Width & Depth

Measures of Distribution (Width)

Sales and Distribution Priorities

Distribution Network — Basics

Relationship between Sales and Distribution

Right Channels, Right Chains

Right Assortment

Managing Assortment

Battle of Shelf Space

Measures of Assortment and Sales Velocity

Number of Items Stocked

Assortment Analysis

Sales per Point of Weighted Distribution

Share in Handlers

Average Sales per Store

Rate of Sales

Rate of Sales/Gross Profit

Portfolio Analysis

Fragmentation Analysis

Securing Retailer Support

Managing Stock in Trade

Allocation of Shelf Space

Cost of Stockouts

- Retail Tracking

- Sales and Distribution

- Retail Analytics

- Category Management

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

Securing Retailer Support

To gain trade support, suppliers must demonstrate why their product deserves a place on the retailer’s shelves. Does the product outperform competing brands in term of return on inventory (turn × earn)? Can it contribute to the retailer’s overall business goals?

By highlighting the product’s ability to generate a favourable return on inventory investment, suppliers can illustrate its potential to contribute to the retailer’s profitability. This metric combines the speed at which the product sells (inventory turnover) with the margin or profit earned per unit sold. A higher return on inventory indicates a more efficient use of shelf space and resources, resulting in increased sales and profitability for the retailer.

For example, consider a brand that is seeking to expand its distribution to a major supermarket chain. Currently, the brand is available in a few supermarkets, its value share in the supermarket channel is 2.5%, and its distribution weighted on value in the channel is 20%.

Simply presenting these metrics may not be sufficient to secure retailer support. Consider why should the retailer be interested in stocking the brand? Is there a more compelling rationale to persuade the retailer?

Based on the data, the brand’s share in handlers is 12.5% (calculated as value share, 2.5%, divided by distribution, 20%), indicating that its value share in the stores carrying the brand is 12.5%. This is impressive; it places the brand among the market leaders in the category within the outlets where it is distributed.

Highlighting the brand’s strong share among handlers demonstrates its performance and appeal to customers in the outlets where it is currently available. This information showcases the brand’s potential to attract customers and drive sales within the retailer’s stores. By emphasizing this aspect, the trade marketer can present a more convincing case to the category manager and secure the retailer’s support for listing the brand.

Metrics used for Securing Retailer Support

In the above example, because it is conceptually meaningful, share in handlers is an apt measure to demonstrate the brand’s potential, where the strength of the brand lies in its market share. Like share in handlers, comparisons based on SPPD and rate of sales, can help to justify the distribution of a product based on sales velocity, and the ability to attract and retain shoppers (build traffic).

Additionally, metrics based on the rate of gross profit can be effective for brands that command higher retail margins. These metrics highlight the brand’s potential as a profit generator, making a strong case for its inclusion in the retailer’s assortment.

Beyond these metrics, the alignment between the brand’s image and the retailer’s role and positioning is crucial. Retailers carefully consider the synergy between the brand and their own target market. For example, an upmarket retailer may not be inclined to list a low-end brand, regardless of its market size or success elsewhere.

By leveraging these metrics and considering the brand’s image in relation to the retailer’s positioning, suppliers can effectively demonstrate the value and fit of their product within the retailer’s portfolio, increasing the likelihood of securing retailer support.

New Products

Securing retailer support for new or less established brands can be a challenging task, especially in a market flooded with new products. In such cases, manufacturers often face the hurdle of convincing retailers to stock their unfamiliar or less-known products. In addition to covering listing fees, manufacturers often employ various discounts and incentives to encourage retailers to take a chance on these new offerings.

Partnership

Building a strong partnership based on trust is crucial in facilitating alliances between trade partners. When relationships are well-developed and based on trust, the process of gaining retailer support becomes smoother. However, in situations where manufacturers have limited resources or are unable to establish direct relationships with retailers, they may opt to collaborate with well-established distributors who have established networks and expertise in marketing products to retailers. This allows manufacturers to leverage the distributor’s resources and industry connections to effectively promote their products and secure retailer support.

Previous Next

Use the Search Bar to find content on MarketingMind.

Online Apps to train Category Managers

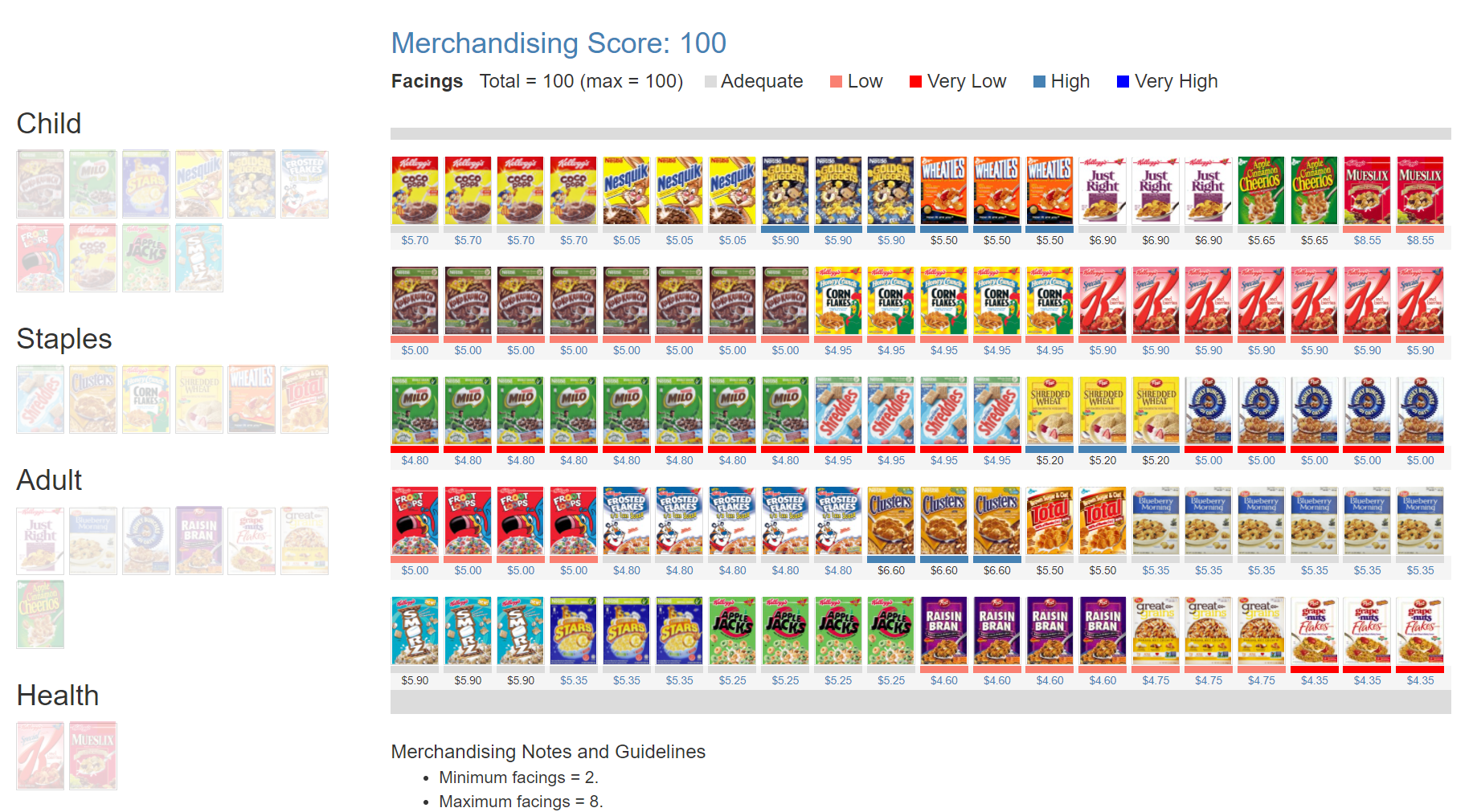

The Plannogrammer is an experiential learning facility for category managers, trade marketers, and retailers in consumer markets. Ideally suited for hybrid learning programmes, Plannogrammer imparts hands-on training in the planning and evaluation of promotions and merchandising.

It supports a collection of simulation and analysis platforms such as Promotions and Space Planner for optimizing space and promotions, Plannogram for populating shelves and merchandising, a Due To Analysis dashboard that decomposes brand sales into the factors driving sales, and a Promotion Evaluator to evaluate the volume, value and profit impact of promotion plans.

Contact | Privacy Statement | Disclaimer: Opinions and views expressed on www.ashokcharan.com are the author’s personal views, and do not represent the official views of the National University of Singapore (NUS) or the NUS Business School | © Copyright 2013-2026 www.ashokcharan.com. All Rights Reserved.