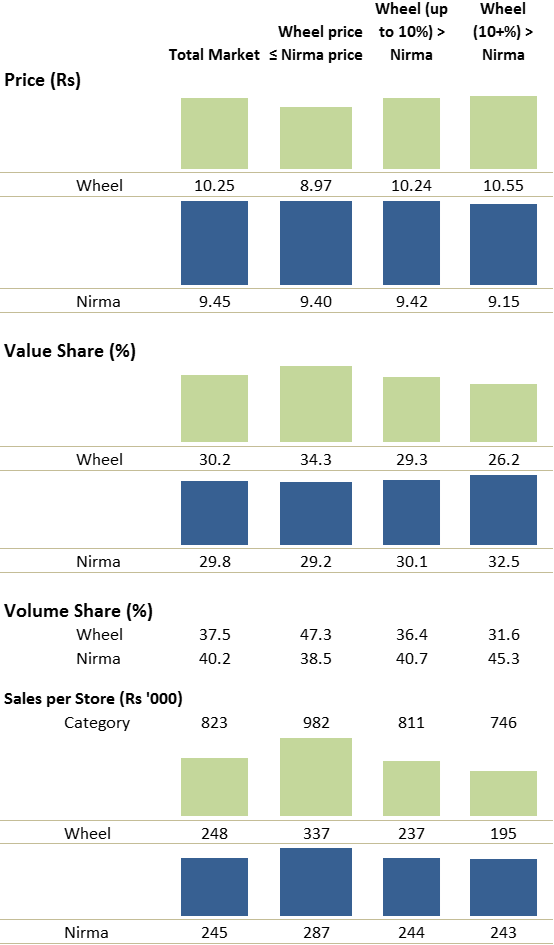

Exhibit 32.2 Price analysis for Wheel and Nirma (fictitious

data).

Wheel and Nirma are direct competitors

in the low-price segment of the Indian detergent bar market. The fictitious analysis

for these brands, shown in Exhibit 32.2 uses comparative price groups to assess

the impact of different comparative prices on volume and value share.

In this illustration, both brands have close to 30% value share in the

total market. However, in stores where Wheel’s price is cheaper or same as Nirma, the

brand’s value share is 34%, i.e., +4 points.

In volume terms the dissimilarities between the buyer groups is even more

pronounced — Wheel’s share varies from 31.6% in outlets where it is priced more than

10% higher than Nirma, to 37.5% where it is priced up to 10% more, and 47.3% in outlets

where it is priced the same or cheaper than Nirma.