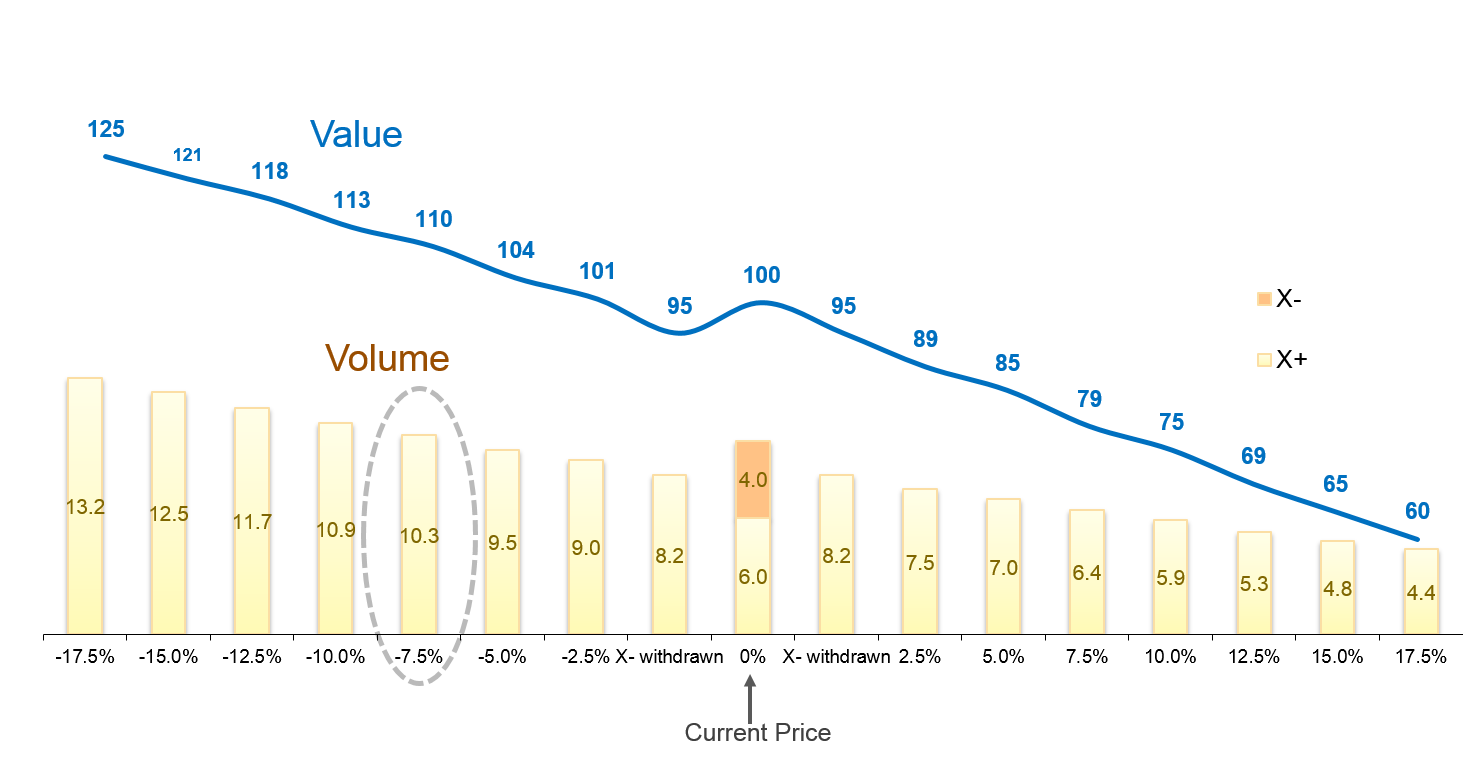

Exhibit 16.11 Trend in volume share and value as variant X−

is withdrawn, and the price of X+ is reduced.

The adulteration of milk by

Sanlu and a few other Chinese manufacturers in 2008, which resulted in the

death of 6 and the hospitalization of 54,000 infants,

left deep scars in the minds of Chinese mothers. In a market where premium

infant formula was already a fast-growing segment, its importance became even

more pronounced after the scandal.

At that time a major manufacturer that produced

both a low and a high-cost variant of infant milk under the same brand name,

considered the option of withdrawing the lower cost variant, in favour of

shifting resources to grow the premium variant. To gauge the impact on consumer

preferences that such an action might incur, the manufacturer undertook discrete

choice modelling to simulate the impact of the withdrawal of the lower cost

variant.

For illustration purposes, the two variants of

this follow-on infant formula are referred to as X+ and X−.

The cheaper variant, X−, targeted more

price conscious consumers, had leaner margins and was experiencing declining

sales. On the other hand, X+, the premium variant was experiencing strong growth in sales.

In general, if a brand is stretched in different

directions, as was the case with X, its positioning tends to get fuzzy.

It may confuse consumers and vitiate the brand’s equity.

These reasons — i.e., consumer preferences, poorer

margins, declining sales, fuzzy positioning — prompted the manufacturer to consider

withdrawing X−. But if X− was to be withdrawn, the overall

share of brand X was expected to drop substantially.

To offset the sales loss resulting from the discontinuation of X−,

one of the options under consideration was to lower the price of X+. To evaluate this

option and estimate the price-volume relationship for X+, discrete choice modelling pricing

studies were conducted in 4 towns in China. The output from one of these studies is presented

in Exhibit 16.11.

Based on the results depicted in the exhibit, it can be concluded that with

a 7.5% reduction in price, the premium variant could retain the entire share

that the brand was likely to lose if the lower priced variant was withdrawn.

To elaborate, variant X+ had 6% market

share and X− had 4% at the time of the analysis. Based on the study

results, if X− was withdrawn, brand X’s share would drop from 10%

to 8.2% (i.e., an 18% fall), and sales value would decrease by 5%. However, if

at the same time as the withdrawal of X−, the price of X+ is

reduced by 7.5%, the brand would retain volume share. While this would yield a

10% gain in value, without access to data on costs, it was not possible for the research agency

to estimate the erosion in profits. However, if the erosion was significant, the manufacturer

could consider an adjustment in pack size, or changes to product formulation, to restore margins.