-

Price

At What Price?

Basics of Pricing Research

Importance of Realism

Price Elasticity of Demand

Factors Affecting Consumers’ Sensitivity to Price

Shrinkflation

Pricing Research Methods

Gabor Granger

Van Westendorp Price Sensitivity Meter

Brand Price Trade-Off

Conjoint Analysis

Discrete Choice Modelling

Hierarchical Bayes

Interaction Effects

DCM vs Conventional Conjoint Analysis

Example — Rationalizing Brand Range

How to Price a Product Feature

New Product Pricing

Statistical Structure — Discrete Choice Model

- Price

- Promotion

Infant Milk — Real Reasons why Prices Soared

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

-

MarketingMind

Price

At What Price?

Basics of Pricing Research

Importance of Realism

Price Elasticity of Demand

Factors Affecting Consumers’ Sensitivity to Price

Shrinkflation

Pricing Research Methods

Gabor Granger

Van Westendorp Price Sensitivity Meter

Brand Price Trade-Off

Conjoint Analysis

Discrete Choice Modelling

Hierarchical Bayes

Interaction Effects

DCM vs Conventional Conjoint Analysis

Example — Rationalizing Brand Range

How to Price a Product Feature

New Product Pricing

Statistical Structure — Discrete Choice Model

- Price

- Promotion

Infant Milk — Real Reasons why Prices Soared

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

New Product Pricing

The pricing of a new product is crucial to its success and should be approached with careful consideration of both marketing and financial factors.

From the marketing standpoint, the decision relates to the brand’s positioning and marketing strategy. In crafting that strategy, the brand manager must have a good understanding of the trade-off between price and sales volume, and how that impacts on profits.

Techniques discussed so far are not suitable for revealing the relationship between price and volume for new products. Van Westendorp’s Price Sensitivity Meter, which works for new products where no obvious benchmarks or competitor equivalents exist, provides a framework for determining the acceptable price range for such products. It does not, however, reveal the price-volume relationship.

Importantly, for FMCG products where repeat purchase is the norm, we need assessment not only for the trial purchases, but also the repeat purchases.

For consumer durables, we need to account for the perceived risk in buying an unknown product. (Since FMCG products cost less, the fear of buyer remorse is less pronounced. Moreover,it can be alleviated by launching smaller packs or by offering free samples).

Some of the abovementioned complexities can be addressed through simulated test markets (STM). These techniques described in Chapter Product Validation, can be suitably adapted to study the relationship between price and volume for new FMCG products.

BASES Price Advisor

In a typical STM, the price is set prior to the study and included in the concept board. This is not of much use for price testing where we need responses over a price range.

One adaptation, adopted by BASES Price Advisor, exposes consumers to the new concept without the selling price, and asks them to suggest the price at which the product would be “very good value”, “average value”, and “somewhat poor value”.

Consumers are then interviewed on the BASES measures for each of these volunteered price points. Their response at each price point is modelled into a single volume-based measure at the respondent level and aggregated across all price points to yield the relationship between price and volume.

This is expensive because a major portion of the STM exercise is repeated over three price points, and a larger sample would be required to ensure accuracy.

In addition, from a pricing research perspective, the approach is relatively weak as it does not take into account the context of competing products.

STM-DCM Approach

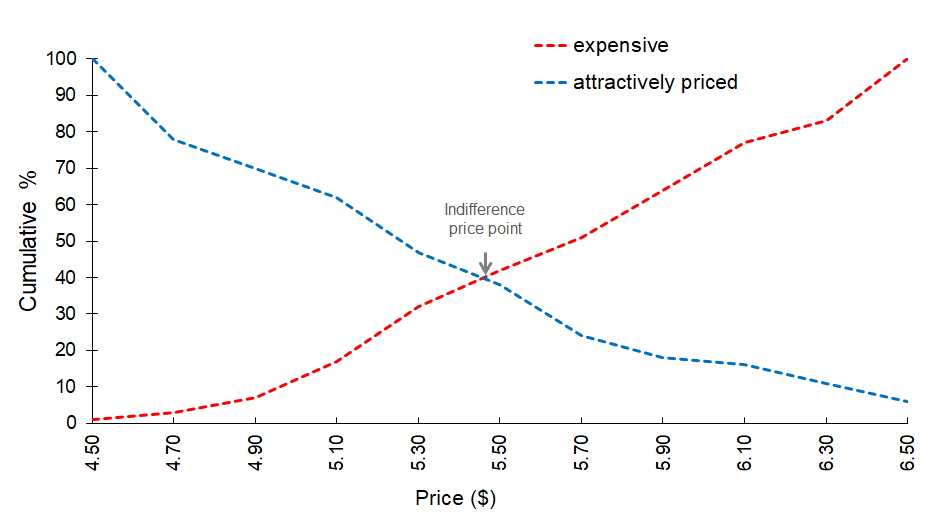

Exhibit 16.14 Indifference price point is the price where the number of respondents who regard the price as attractive is equal to the respondents who regard the price as expensive.

An alternative approach to consider is a combination of STM (Simulated Test Market) and DCM (Discrete Choice Modelling). Specifically:

- STM concept phase to exclude price from the concept board, and to amend the question on purchase intent to include the phrase “… if priced within your budget”.

- Gauge price perceptions over fixed price points: “Select the closest price at which you would consider

the product to be:

- attractively priced (moving from maximum to minimum price),

- expensive (moving from minimum to maximum price).”

- All respondents, even those who indicates they will not try, are given the product for trial.

- After the new product has been tried, purchase intent is gauged at the indifference price point or at the preferred selling price, if this has been set by the brand’s management team.

- The indifference price (refer Exhibit 16.14) is the price where the number of respondents who regard the price as attractive is equal to the respondents who regard the price as expensive.

- The discrete choice modelling price test is conducted after respondents have tried the product, and their purchase intent has been gauged.

Note: This approach has yet to be tried and tested. The advantage is that DCM is a rigorous, proven pricing test. However, it is likely to be expensive because this is essentially a two-in-one study.

Previous Next

Use the Search Bar to find content on MarketingMind.

Contact | Privacy Statement | Disclaimer: Opinions and views expressed on www.ashokcharan.com are the author’s personal views, and do not represent the official views of the National University of Singapore (NUS) or the NUS Business School | © Copyright 2013-2026 www.ashokcharan.com. All Rights Reserved.