-

Product Validation

Product Validation

Moments of Truth

Launch Validation Methods

Simulated Test Markets

BASES

Controlled Store Test

Product Launch Evaluation

Parfitt-Collins Model

TRB Model

Bass Diffusion Model

- New Product Development

- Product Design

- Product Validation

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

-

MarketingMind

Product Validation

Product Validation

Moments of Truth

Launch Validation Methods

Simulated Test Markets

BASES

Controlled Store Test

Product Launch Evaluation

Parfitt-Collins Model

TRB Model

Bass Diffusion Model

- New Product Development

- Product Design

- Product Validation

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

Simulated Test Markets

Simulated test markets (STMs) provide sales estimates of new products prior to launch. They are used by management to make the “go/no-go” decision prior to the launch of the new product.

Pioneering work in STMs began in the 1960s, and most of the commercially available STM systems were marketed initially in the mid to late ’70s. Amongst these the best known are Assessor, BASES, Designor and MicroTest. Mostly similar in nature these tools decompose sales into trial volume and repeat volume, and estimate each of these components to predict the new product’s sales volume for the first and second year of launch.

Assessor was developed at the Sloan School in 1973 by Alvin J. Silk and Glen L. Urban and is currently marketed by M/A/R/C Research.

Julian Bond is credited with developing MicroTest at the MR agency Research International in the 1980s. Research International was acquired by the Kantar Group (WPP) in 1989 and was merged with TNS in 2009.

The research agency Novaction developed Perceptor, a concept testing system that was based on Assessor in 1979, and later in 1986 introduced Designor. The firm was bought over by Ipsos in 2001.

BASES, currently marketed by Nielsen, was developed by Lynn Y.S. Lin at Burke Marketing Research in 1977. Details about BASES, which is currently the leading STM in the market research industry, are provided in the next section.

STMs typically adopt one of two approaches to forecast sales: purchase intent and/or preference. Purchase intent gauges respondents’ likelihood of purchase on a 5-point rating scale, and adjusts these claims for overstatement. In the preference approach, participants purchase a product from a competitive set that includes the new product. BASES and MicroTest are designed on purchase intent, whereas Designor and Assessor were originally based on preference share. Over time, some of the above models have evolved to incorporate elements of both these approaches.

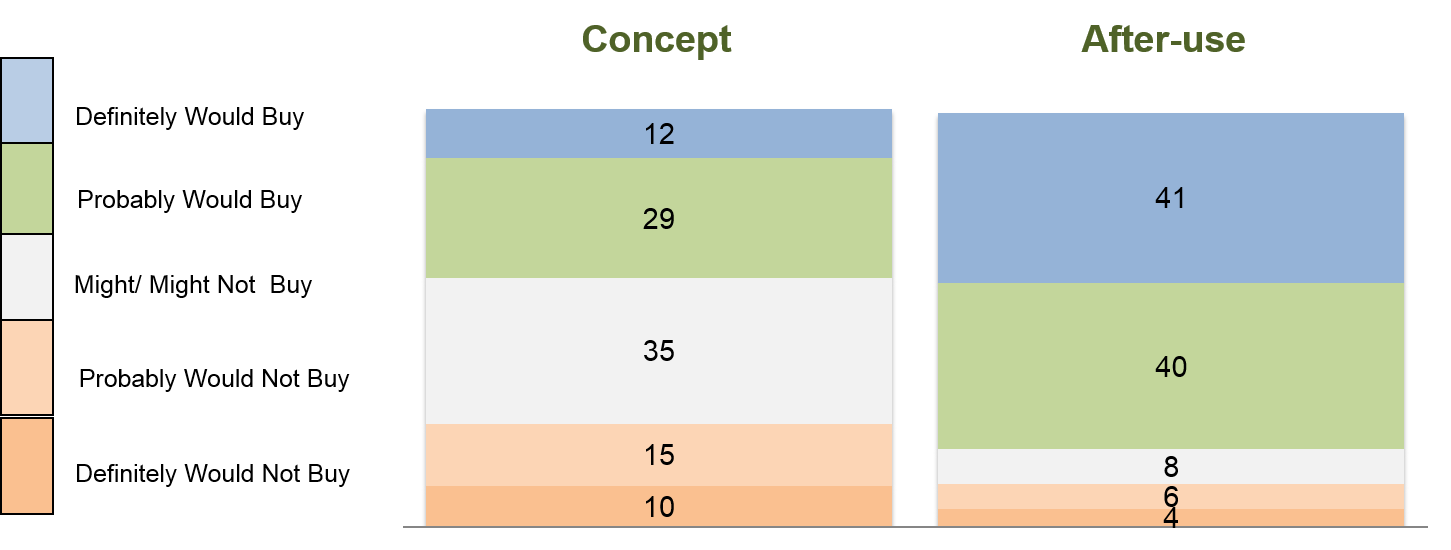

STM interviews are conducted in two stages: concept and after-use. The concept stage yields information on the product’s appeal and trial rate. Subsequently, after allowing respondents time to use product samples, the post-usage interview yields information on respondents’ likelihood to repurchase the product.

The following information is obtained at both the concept and after-use stages, for forecasting trial and repeat volume:

- Purchase intention: This is gauged through statements that describe how respondents feel about buying the product (See example in Exhibit 11.8).

- Share of preference: Respondents select one or more products from a competitive set displayed on a simulated shelf.

- Claimed units: Respondents are asked how much of the product, if any, they will buy.

- Claimed frequency: Respondents are asked how often, if ever, they would buy the product if it became available.

Besides volume forecasting, STMs provide diagnostic insights on how to improve the marketing mix and optimize performance. They evaluate the strength of the mix on underlying factors that make new products appealing to consumers, such as the following:

- Novelty: Rating product on uniqueness.

- Likeability (and Relevance): Overall liking of the product.

- Credibility: Believability of the statements made about the product.

- Affordability: Price/Value perception.

STM studies also seek to obtain information on product usage, perception on key image and performance attributes, suggested improvement, drivers and inhibiters, and the source of volume (i.e., what product would it replace).

To reliably forecast sales, STMs should test the final mix, or a mix that is close to final. If product development has not reached this stage, a concept product test (CPT) or a concept screener may be the appropriate tool to use.

The insights gleaned from a CPT are a sub-set of those from a STM. Moreover, since there are no product prototypes for respondents to use, there is no after-use survey. Hence only ballpark volume estimates based on assumed repeat performance can be generated in a CPT.

Concept screening systems are useful at an earlier stage in the product development process when marketers are reviewing a broad range of ideas or concepts for further development. Concept screeners help prioritize and select the most promising among these concepts.

Typically, STM service providers maintain a suite of products that cater for various stages of development of concept and marketing mix. The BASES suite for instance includes Concept Constructor and BASES SnapShot which are concept screeners, BASES I, a CPT where only concepts, not prototypes, are tested, and BASES II, the full blown STM.

The success of STM systems like BASES is largely because of their intuitive appeal and reputation for accuracy. By and large STM systems claim average deviation within ± 10% of actual sales. Changes in market dynamics (the internet, faster speed-to-market) have driven numerous incremental improvements in STM systems. They have become more modular in design and take less time to run. The fundamentals, however, of simulated test markets have not changed since their inception over 40 years back.

Previous Next

Use the Search Bar to find content on MarketingMind.

Contact | Privacy Statement | Disclaimer: Opinions and views expressed on www.ashokcharan.com are the author’s personal views, and do not represent the official views of the National University of Singapore (NUS) or the NUS Business School | © Copyright 2013-2026 www.ashokcharan.com. All Rights Reserved.