-

Product Validation

Product Validation

Moments of Truth

Launch Validation Methods

Simulated Test Markets

BASES

Controlled Store Test

Product Launch Evaluation

Parfitt-Collins Model

TRB Model

Bass Diffusion Model

- New Product Development

- Product Design

- Product Validation

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

-

MarketingMind

Product Validation

Product Validation

Moments of Truth

Launch Validation Methods

Simulated Test Markets

BASES

Controlled Store Test

Product Launch Evaluation

Parfitt-Collins Model

TRB Model

Bass Diffusion Model

- New Product Development

- Product Design

- Product Validation

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

Launch Validation Methods

The success of a new product hinges on its moments of truth, which determine whether it can establish a loyal customer base that consistently purchases the brand. Only by building a significant group of regular consumers, who continue to buy the product after trying it, can the product truly thrive.

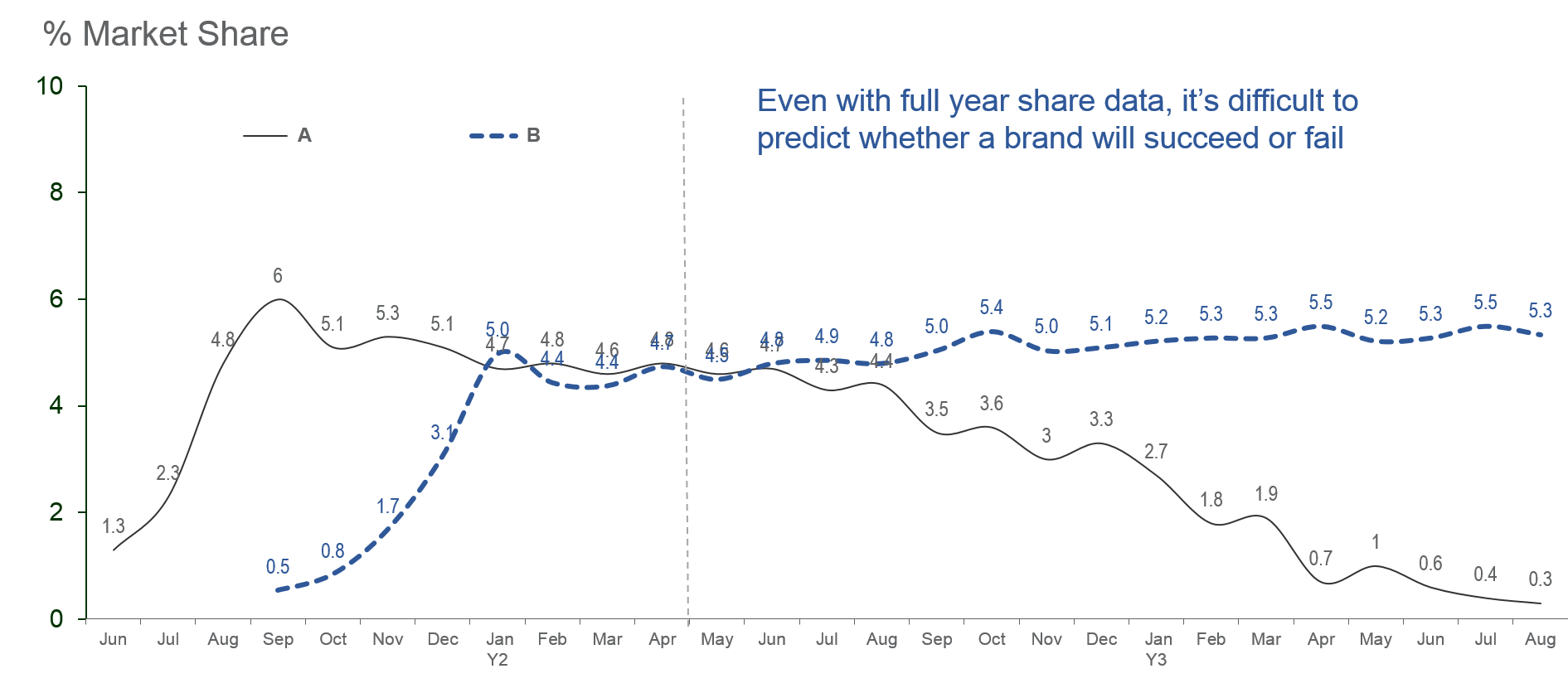

Brand ‘B’, as can be seen from exhibits 11.1, 11.2 and 11.4, experiences strong trial and repeat purchase, gains market share and sustains it over time. On the other hand, Brand ‘A’, which performed poorly in terms of repeat purchase (SMOT), loses market share.

The exhibits also highlight that the early sales and market share readings for a new product do not reveal the product’s future performance. Even by May Y2, one year after Brand ‘A’ is launched, it is hard to gauge from Exhibit 11.4 the direction that the brands’ share is heading. On the other hand, if the brand’s manager was aware of the brand’s RBR and trial rate, she would be able to predict its market share.

That the incidence of failure of new products is particularly high in FMCG, stresses the need for pre- and post-launch validation. This is conducted via techniques that are based primarily on measures of how well a new product is likely to perform at its FMOT and SMOT.

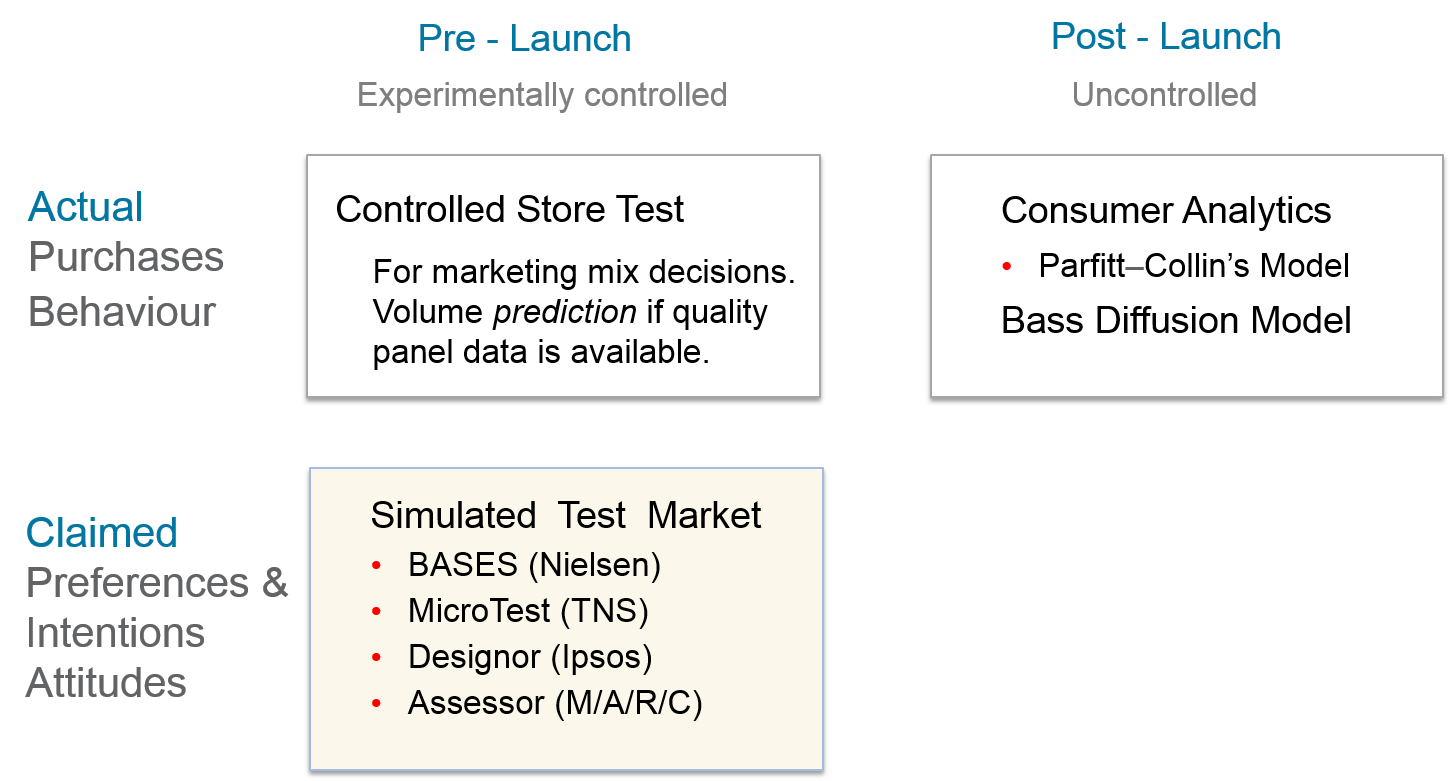

Exhibit 11.5 presents some well-known product validation methods. The tools most often used for pre-launch validation are simulated test markets (STM) and controlled test markets, such as controlled store tests. For post-launch validation, the TRB Share Prediction model, which relies on consumer panel data, works well of FMCG products.

Since STM systems adopt a standardized approach, and their results are accurate and comparable across categories and across markets, they are popular with many FMCG companies. Norms and benchmarks allow these companies to clearly spell out the go/no-go criteria, and many of them have explicit rules and guidelines on the use of STMs for the launch of any major NPD initiative.

Though they are better suited for FMCG products where adoption of products is reflected in consumers’ willingness to continue buying, STMs have also successfully been adapted for categories like over-the-counter (OTC) medicines, quick-serve restaurants, durable goods and services.

The Bass diffusion model is used for forecasting sales of goods in categories that are infrequently purchased. The model is versatile and is known to works well for a very wide range of categories and application fields within sectors like consumer durables, computers and technology products, medicine and medical services, agricultural innovations and services, prestige personal care, movies, books and so on. It has limitations, however, from the standpoint of product validation, because accurate estimation of the potential of an innovation usually requires a few years of sales data. By this time, for a newly launched product, key investments in product development, would already have been made. The Bass estimates do however serve as a useful guide for future NPD efforts.

Real world test markets, where a new product is launched into a small representative geographical area, are no longer favoured by marketers. They incur high costs, are time consuming, and are not known to yield superior results over STMs. Moreover, a live test market fully exposes the new initiative to competitors. In the worst case scenario, a powerful competitor may be better placed to exploit the benefit of the test market. A case in point is P&G’s launch into test market of Ariel concentrate detergent powder in Vizag, India.

Test Market of Ariel in Vizag

The launch of Ariel was of considerable significance as this was P&G’s initial assault on to the vast Indian detergent market. Moreover, Ariel was the first concentrate powder to be launched in India, and its impact on market dynamics was of great interest to P&G and its competitors.

Hindustan Lever Limited (HLL) responded swiftly to the test market, with a number of competitive manoeuvres. A fighter brand, Rin Concentrate Powder was launched in Vizag. Scientists at HLL’s research centre intensified efforts to develop competing concentrate powders using indigenous ingredients. An in-house consumer panel of over a thousand households was also set up by HLL’s market research team in Vizag, within a few months of the introduction of Ariel. This panel gave HLL considerable advantage over their archrivals, in their understanding of the performance of concentrates in the test market.

P&G also lost its first mover advantage. By the time the company was ready to nationally launch Ariel, HLL’s Surf Ultra concentrate powder was fully developed, and the two brands were introduced into Indian cities at roughly the same time.

Previous Next

Use the Search Bar to find content on MarketingMind.

Contact | Privacy Statement | Disclaimer: Opinions and views expressed on www.ashokcharan.com are the author’s personal views, and do not represent the official views of the National University of Singapore (NUS) or the NUS Business School | © Copyright 2013-2026 www.ashokcharan.com. All Rights Reserved.