-

Product Validation

Product Validation

Moments of Truth

Launch Validation Methods

Simulated Test Markets

BASES

Controlled Store Test

Product Launch Evaluation

Parfitt-Collins Model

TRB Model

Bass Diffusion Model

- New Product Development

- Product Design

- Product Validation

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

-

MarketingMind

Product Validation

Product Validation

Moments of Truth

Launch Validation Methods

Simulated Test Markets

BASES

Controlled Store Test

Product Launch Evaluation

Parfitt-Collins Model

TRB Model

Bass Diffusion Model

- New Product Development

- Product Design

- Product Validation

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

BASES

BASES (Booz-Allen Sales Estimating System) is a STM which integrates consumer response data with manufacturers’ marketing plans to assess the volumetric potential of concepts and products prior to introduction.

The system was developed in 1977 by Lynn Y.S. Lin who at the time was with Burke Marketing Research. Lin was inspired by work on marketing simulators at Pillsbury where he was working prior to joining Burke. BASES was acquired by Nielsen in 1998.

BASES Premise

Consumers do not usually do what they claim to do; and often the difference between claims and behaviours is very significant. This inconvenient truth, which complicates market research in general, must not be overlooked in product validation.

As with other STMs, BASES rides on the premise that there exists a strong correlation between consumers’ claimed purchase behaviour and what subsequently transpires in the marketplace. While consumers overstate their intended purchase behaviour, they tend to do so with consistency.

It has been observed that the level of overstatement varies by country, by culture, and by measure. With a database of about 300,000+ concept tests and 500,000+ forecast (as of 2021), BASES is able to accurately estimate the adjustment factors required to deflate the respondents’ claims such that they closely reflect their behaviour.

Model Structure

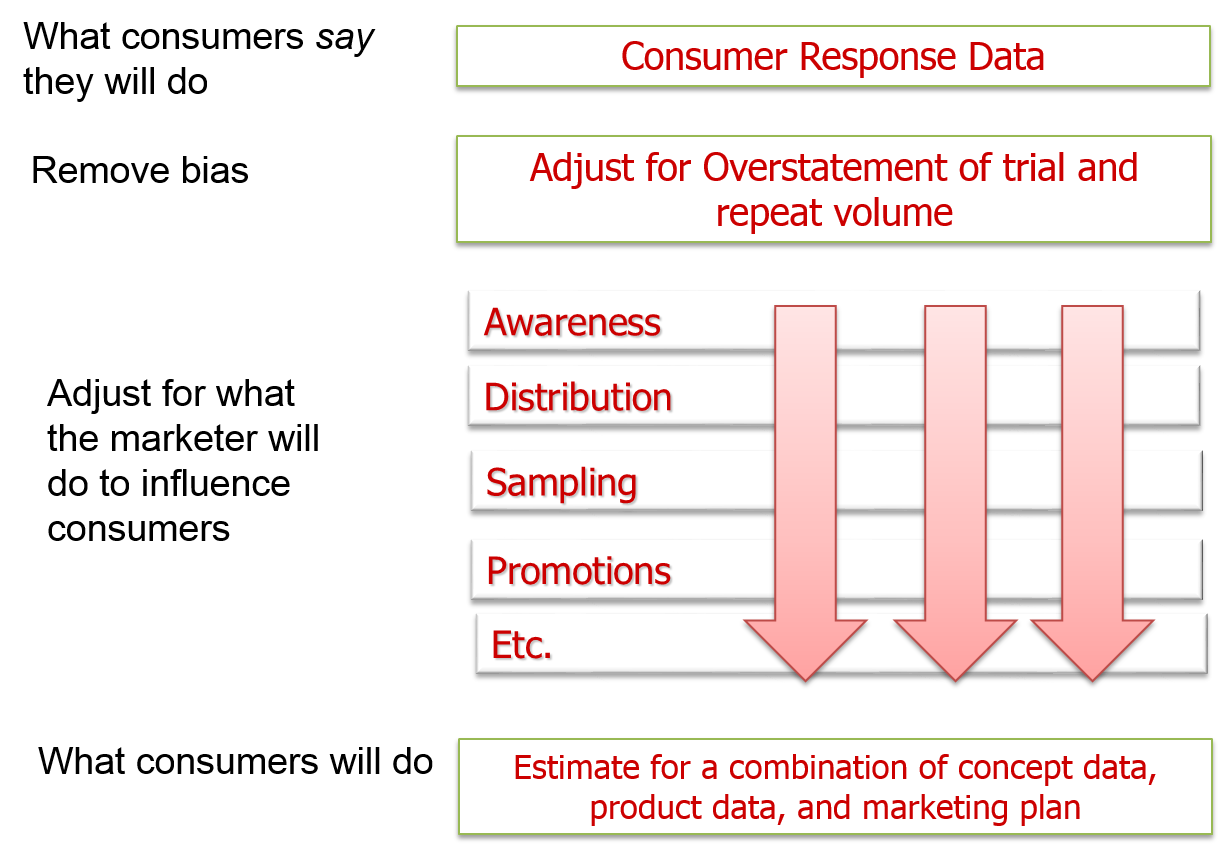

An overview of the model is provided in Exhibit 11.6. BASES essentially takes consumer response data (what people say they will do), deflates it to adjust for overstatement, and adjusts for the impact of marketing activities to yield behavioural data (a forecast of what people will actually do).

Data Collection

Online is the preferred and primary mode of data collection as it yields considerable savings in time and cost of study. BASES has e-Panels in several markets in North America, Europe and Asia; the largest amongst these is the U.S. e-Panel, comprising 125,000.

Where studies require face-to-face interaction (e.g., sniff or taste tests), mall intercept, controlled location tests and door to door methods are used for interviewing respondents.

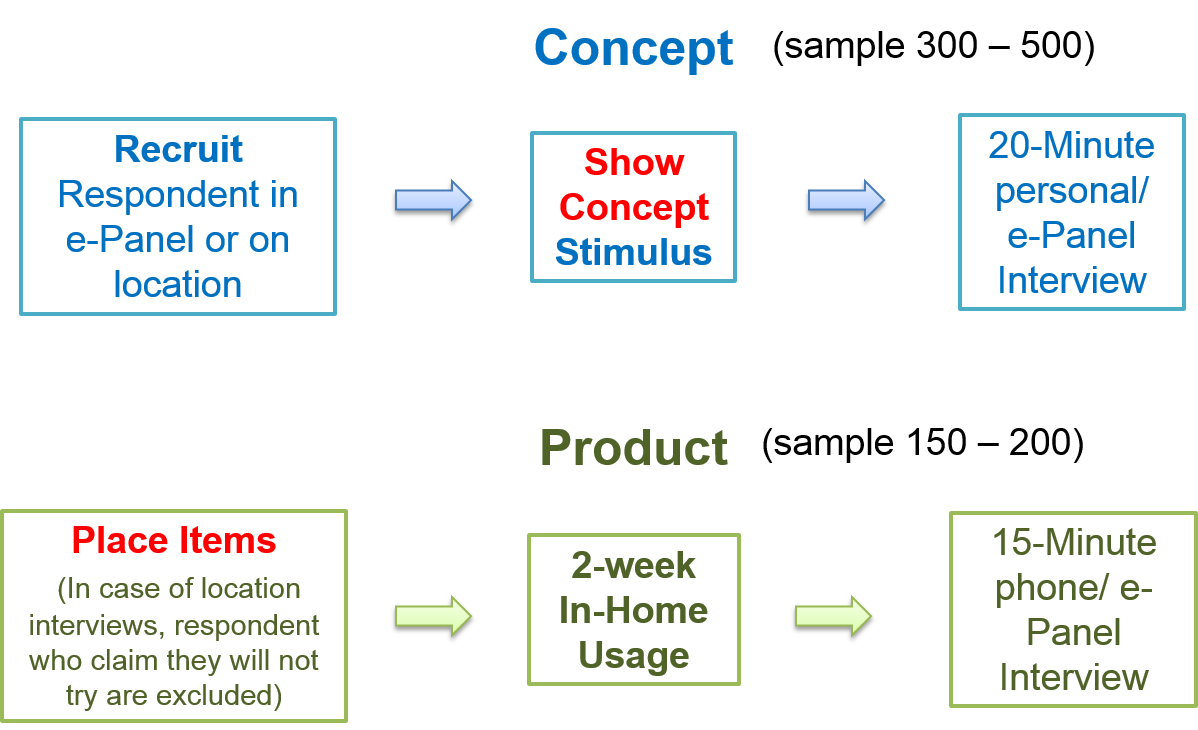

The two-stage interviewing process is depicted in Exhibit 11.7. The concept stage, where respondents respond to questions on the product concept, yields information on product trial.

In case of face-to-face interviews, those respondents who indicate they will not try the product (“definitely would not try”, “probably would not try”) are dropped from the product placement stage. For e-Panel surveys however, all respondents are moved to the product placement stage, and receive samples. After allowing respondents time to use the product samples, a post-usage interview is conducted to obtain information on respondents’ likelihood to repurchase the product.

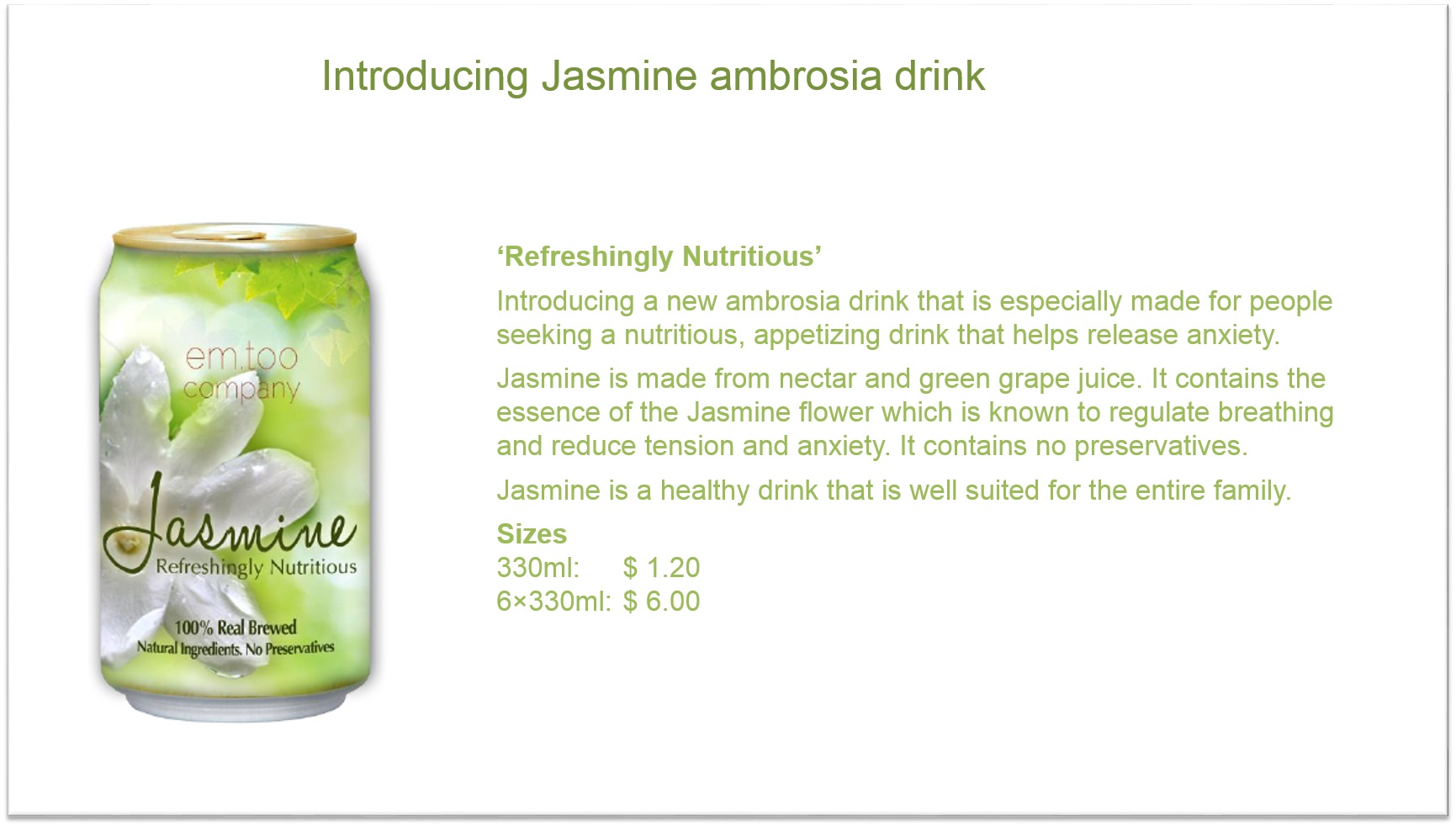

Exhibit 11.8 Example of a concept board (sourced from a student project, where ambrosia is a fictional beverage category).

During the concept stage, either a concept board (like the one shown in Exhibit 11.8), or a commercial is used for conveying the product concept and the brand’s positioning. The board contains the information that will be communicated by advertising as well as details on prices, sizes and varieties. Other than that, no additional information about the brand or competitor’s products is provided.

Analysis and Forecasting

The concept and after-use surveys obtain information for the purpose of volume forecasting. This includes purchase intent, purchase quantity (i.e., the quantity respondents’ claim they will buy should they try the product), and the frequency of purchasing should they continue to buy. The new product is rated on the factors that typically evoke consumers’ desire to purchase, for instance, novelty, likeability, credibility and affordability. Information is also obtained on product usage, its perception on key image and performance attributes, suggested improvement, drivers and inhibiters, and the source of volume.

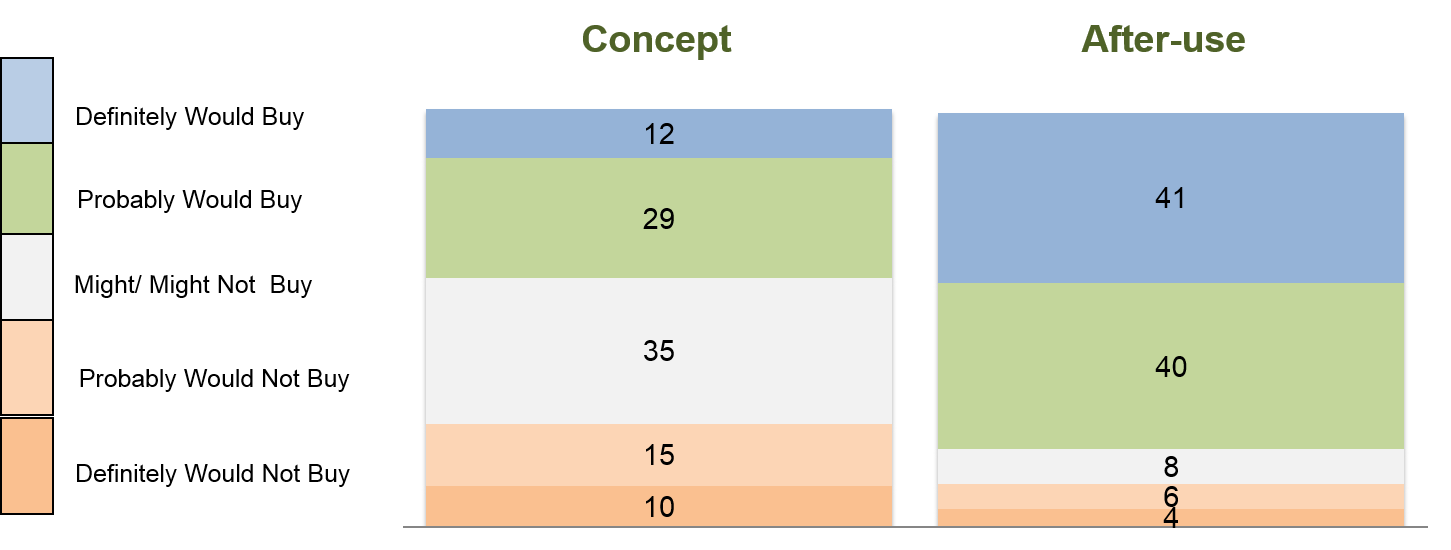

Purchase intent is measured on a 5-point rating scale similar to the one shown in the example in Exhibit 11.9. Considering that it pertains to respondents’ claimed intent to purchase, we need benchmarks to interpret this information. Whether the top 2 box scores of 41% and 81% for concept and after-use purchase intent are good or bad depends on how they compare with the BASES benchmarks.

BASES large database of test results is the primary device used for interpretation. It serves as the source for benchmarks for all key measures, both at the concept and after-use phase. It is noted that while after-use purchase intent strongly correlates with in-market success, purchase intent at the concept phase is not as good a reflection of in-market success. Hence success targets are primarily derived from the after-use scores obtained for products that were tested by BASES and that subsequently achieved in-market success. If a new product achieves a score above the BASES targets, it is more likely to be successful.

To generate a forecast BASES requires the following inputs on the marketing plan for the new product:

- Introduction dates

- Budget

- Distribution and out-of-stock across retail channels

- Advertising schedule

- Consumer promotion schedule

- Trade promotion schedule

- Retail sales for category and company’s internal sales data

- Seasonality

To the extent that execution is not in sync with plan, actual sales volume would differ from the BASES estimates. It is however possible to revise volume estimates based on revisions to the marketing plan.

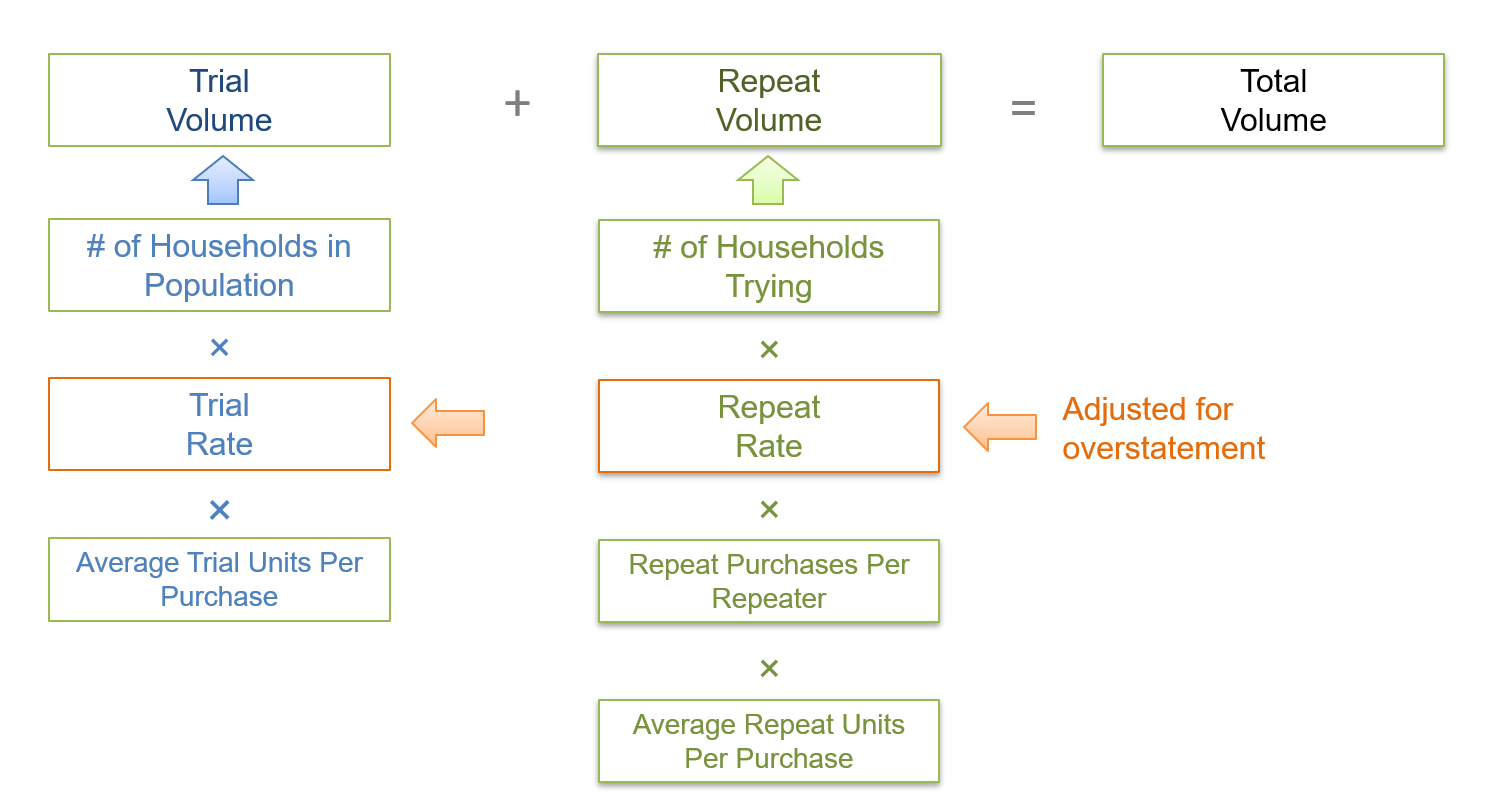

The volume is forecasted by decomposing total sales into trial and repeat volume, as depicted in Exhibit 11.10. The forecast which pertains to a time frame of roughly two years after launch, yields trial volume, repeat volume, and consumption in terms of average frequency of purchase and the average quantity per occasion.

In terms of key deliverables, BASES provides an estimate of a new product’s volume potential. It also estimates the product’s source of growth — how much the new product will cannibalize the company’s brands, and how much it will gain from competitors. In addition, research diagnostics reveal the strengths and weaknesses of the new product initiative, and insights on how to improve the product, its mix and the execution plan.

Previous Next

Use the Search Bar to find content on MarketingMind.

Contact | Privacy Statement | Disclaimer: Opinions and views expressed on www.ashokcharan.com are the author’s personal views, and do not represent the official views of the National University of Singapore (NUS) or the NUS Business School | © Copyright 2013-2026 www.ashokcharan.com. All Rights Reserved.