-

Retail Tracking

Retail Tracking

The Nielsen Code

Applications of Retail Tracking

Where to Measure Sales?

Retail Measurement Services

Retail Universe

Retail Census

Sample Design — Retail Tracking

Data Collection — Retail Tracking

Data Processing — Retail Tracking

Data Projection — Retail Tracking

Analysis and Interpretation — Retail Tracking

Numeric and Weighted Distribution

In-Stock and Out-of-Stock Distribution

Coverage Analysis — Retail Tracking

Pipeline Effect

- Retail Tracking

- Sales and Distribution

- Retail Analytics

- Category Management

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

-

MarketingMind

Retail Tracking

Retail Tracking

The Nielsen Code

Applications of Retail Tracking

Where to Measure Sales?

Retail Measurement Services

Retail Universe

Retail Census

Sample Design — Retail Tracking

Data Collection — Retail Tracking

Data Processing — Retail Tracking

Data Projection — Retail Tracking

Analysis and Interpretation — Retail Tracking

Numeric and Weighted Distribution

In-Stock and Out-of-Stock Distribution

Coverage Analysis — Retail Tracking

Pipeline Effect

- Retail Tracking

- Sales and Distribution

- Retail Analytics

- Category Management

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

Where to Measure Sales?

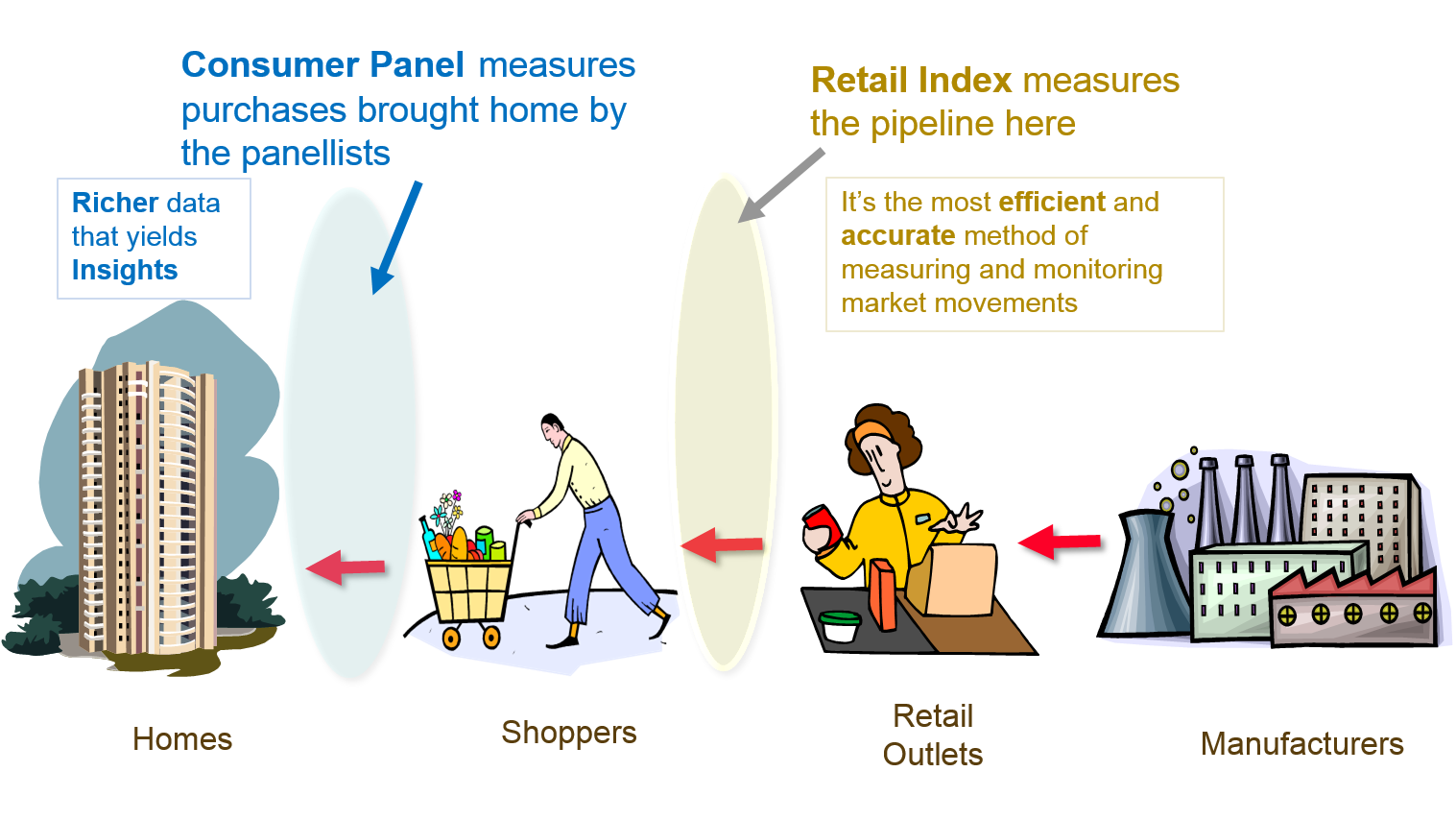

As goods flow from manufacturers to retailers and from retailers to consumers, there are multiple points in their path where it becomes feasible to measure sales.

The sales pipeline commences with primary sale, the sale from manufacturer to distributor. Primary sale also encompasses direct sales to the big retail chains.

Sale from the distributor to the retailer is referred to as secondary sale. And at the end of the pipeline, the sale from the retail outlet to consumer is called retail sale, consumer purchases or consumer offtake.

Sales may be estimated by measuring the flow of goods at a number of points in the pipeline as depicted in Exhibit Exhibit 30.4. The common methods to track and measure sales include the retail index, consumer panel and data pooling. Each of these methods, outlined in the following paragraphs, offers different levels of information richness and accuracy. Furthermore, the data collection processes associated with these methods vary, with some being more efficient and cost-effective, while others have the potential to yield more insightful and diagnostic information.

Retail Index (Retail Tracking)

Retail sales or the sale of goods from retailers to shoppers may be tracked through syndicated retail panels and projected to reflect total sales for the market. Commonly referred to as the retail index, this approach offers the most accurate and efficient measurement of sales and distribution, at relatively affordable costs, for markets where goods primarily flow through retail channels.

Consumer Panel

Sales may also be tracked at the point when goods are brought home by consumers. Estimates of consumers’ purchases are obtained from a representative sample of homes called a consumer panel.

It should be noted, however, that syndicated household consumer panels are neither as efficient nor as accurate as the retail indices, for tracking sales. They also miss out on goods that are consumed out of home. Hence consumer panels are not the preferred choice for tracking sales, in markets where retail indices exist.

Despite these limitations, consumer panels are highly valued because they provide richer disaggregated data at the household level. This level of granularity allows for more in-depth analysis and better diagnosis of market issues.

For a comprehensive exploration of consumer panels and consumer analytics, please refer to Volume I, Chapter 7, Consumer Panels and Consumer Analytics.

Data Pooling

Data pooling involves the exchange of sales data among manufacturers. Typically facilitated by an intermediary agency, this process entails the collection, compilation, and redistribution of processed data to the participating manufacturers. Data pooling is particularly feasible when a small number of manufacturers dominate a significant portion of the market. Its primary advantage lies in its low cost.

However, the pipeline between primary sales and consumer offtake can be long and permeable, leading to potential discrepancies. Primary sales are also prone to volatility caused by trade promotions and other sales efforts, resulting in stock accumulation within the pipeline. Consequently, data pooling is not as reliable a reflection of consumer demand compared to the retail index.

It is important to note that data pooling relies on data sourced from competitors who can be notoriously unreliable. Instances where the arrangement breaks down due to incorrect or missing data are not uncommon.

Previous Next

Use the Search Bar to find content on MarketingMind.

Business Intelligence - Market and Trade

Suite of interactive, online dashboards that seamlessly integrate retail and consumer data sources in a manner that makes it easier to glean insights.

Scan Track

Suite of dashboards to visualize/analyse retail scan data.

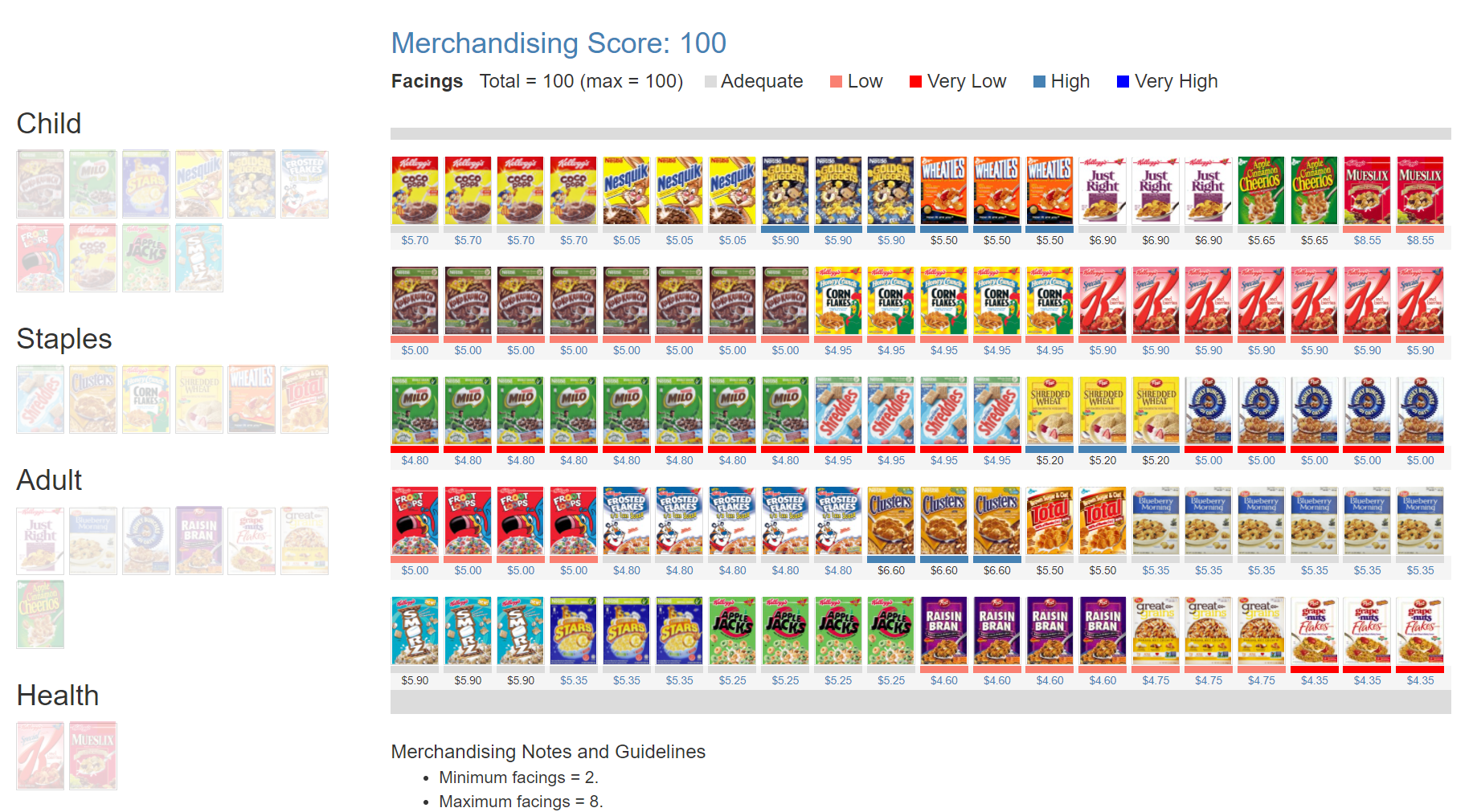

Online Apps to train Category Managers

The Plannogrammer is an experiential learning facility for category managers, trade marketers, and retailers in consumer markets. Ideally suited for hybrid learning programmes, Plannogrammer imparts hands-on training in the planning and evaluation of promotions and merchandising.

It supports a collection of simulation and analysis platforms such as Promotions and Space Planner for optimizing space and promotions, Plannogram for populating shelves and merchandising, a Due To Analysis dashboard that decomposes brand sales into the factors driving sales, and a Promotion Evaluator to evaluate the volume, value and profit impact of promotion plans.

Contact | Privacy Statement | Disclaimer: Opinions and views expressed on www.ashokcharan.com are the author’s personal views, and do not represent the official views of the National University of Singapore (NUS) or the NUS Business School | © Copyright 2013-2026 www.ashokcharan.com. All Rights Reserved.