-

Promotion

Promotion

In-Store Promotion and Media

Types of Promotions

Trade Promotions

Consumer Promotions

Need to Rationalize Promotions

Promotion-Commotion-Demotion

Promotion Evaluation — Metrics

Basic Assessment of Sales Promotion

Market Modelling

Promotions Response Model

Model Validity — How Good is the Fit?

Watchouts and Guidelines

Store Level Modelling

Interpretation and Analysis

Discount Elasticity

Cannibalization

Displays and Cooperative Advertisement

Sales Decomposition and Due-To Analysis

What-If Analysis

- Price

- Promotion

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

-

MarketingMind

Promotion

Promotion

In-Store Promotion and Media

Types of Promotions

Trade Promotions

Consumer Promotions

Need to Rationalize Promotions

Promotion-Commotion-Demotion

Promotion Evaluation — Metrics

Basic Assessment of Sales Promotion

Market Modelling

Promotions Response Model

Model Validity — How Good is the Fit?

Watchouts and Guidelines

Store Level Modelling

Interpretation and Analysis

Discount Elasticity

Cannibalization

Displays and Cooperative Advertisement

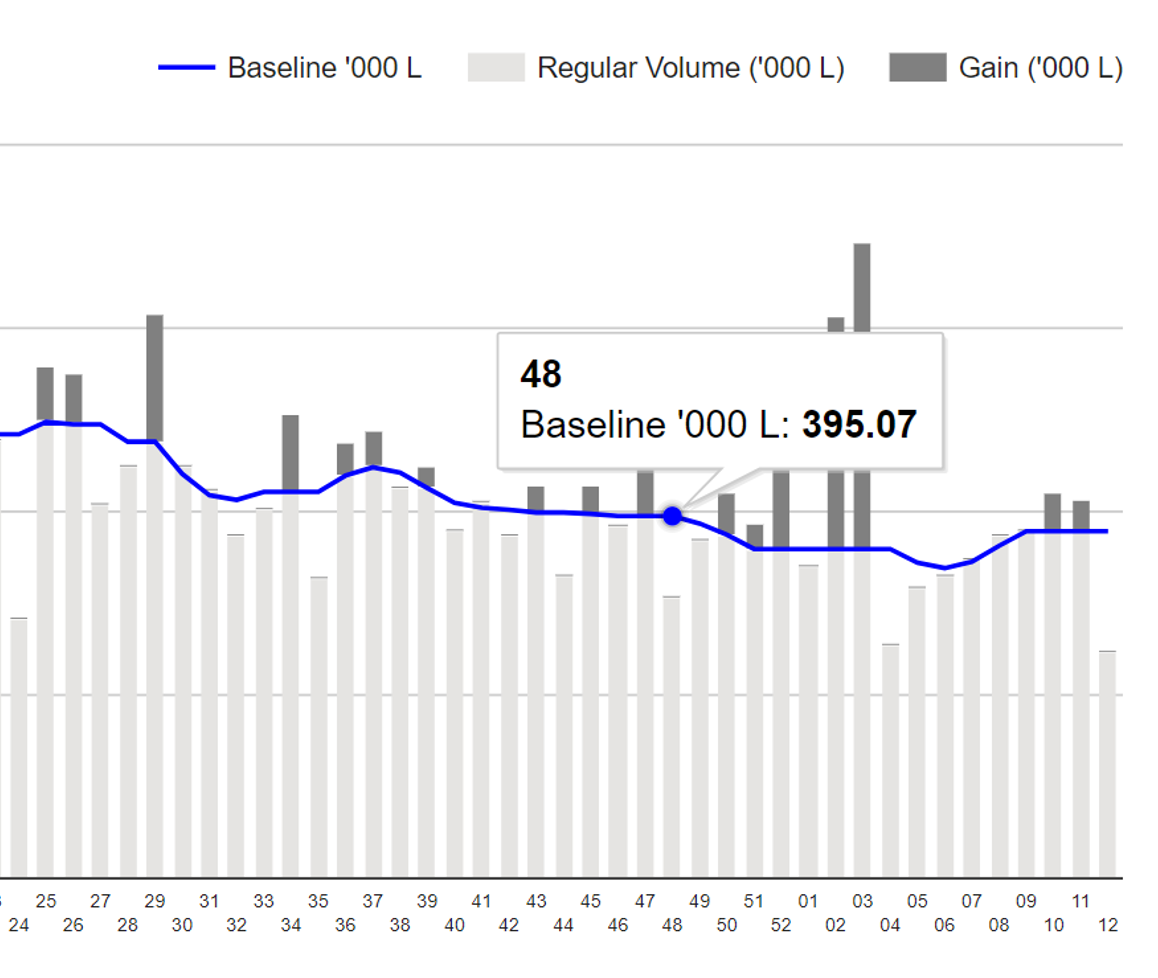

Sales Decomposition and Due-To Analysis

What-If Analysis

- Price

- Promotion

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

Watchouts and Guidelines — Market Response Models

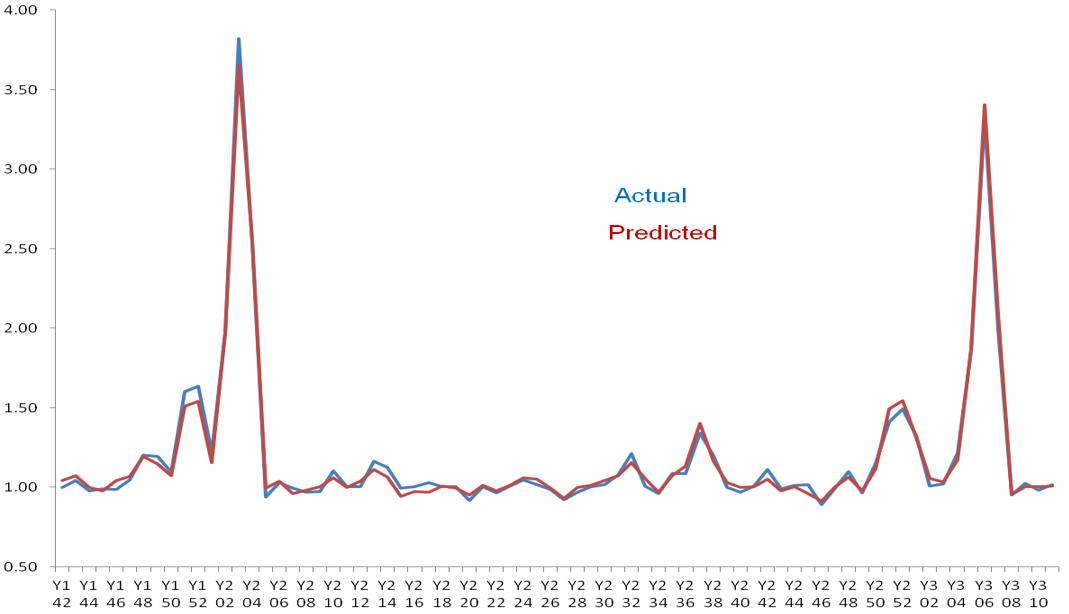

It is important to be cautious when evaluating the quality of market models, as it is easy to construct models that visually appear to have a good fit with the data (e.g., Exhibit 17.9), but are weak, incorrect or nonsensical upon closer analysis. For example, a model may have a high R2 value and appear to closely match predicted and actual data, but fail to accurately capture the underlying relationships between variables or incorporate important variables that affect market behaviour.

Experienced market modelers are aware of these potential issues and are skilled in identifying them. However, if you are not experienced, it can be difficult to assess the quality of a market model. To avoid being deceived by deceptively good-looking models, it is important to be aware of potential issues and pitfalls.

Inclusion of All Sales Drivers

First and foremost, when it comes to developing market models, the knowledge of the market is as important as the knowledge of econometrics. The decision maker who uses the model and the econometrician, who builds it, need to work closely to create a practical solution based on market realities. It is very important that the market dynamics are clearly understood by the developer, that all of the variables that drive performance are included.

All too often in an era of commoditization of market modelling, data is shipped from the marketer to the market modeller, without the necessary information about the characteristics or nuances of the market. For instance, a modeller based overseas may have no knowledge of the Hungry Ghost festival (which is celebrated in countries with significant Chinese populations), the exclusion of which may result in spuriously high elasticities for the brands that are promoted during the festival.

While the exclusion from a model of any factor that significantly influences performance is likely to compromise the validity of the model, measures like R2 will still look good despite the omission. This is because marketing initiatives often occur concurrently, so the impact of the missing variables is attributed to other variables, exaggerating their importance.

In conclusion, it is essential to note that all factors that significantly influence the dependent variable (sales), including external exogenous factors, should be included, regardless of whether or not they are directly related to the research objective.

Potential Difficulties in Estimating Parameters

Modelling works by correlating fluctuations in sales to those in the explanatory factors. If there is no variation in the movement of a particular factor within the data, its potential effect cannot be calculated. For example, if a product has never been offered on discount, it is not possible to calculate its discount elasticity of demand.

Furthermore, when two or more factors consistently occur simultaneously and in similar proportions, it becomes difficult to isolate their individual influences on sales. In such cases, it may be challenging to untangle their effects and determine their respective contributions to sales fluctuations.

Previous Next

Use the Search Bar to find content on MarketingMind.

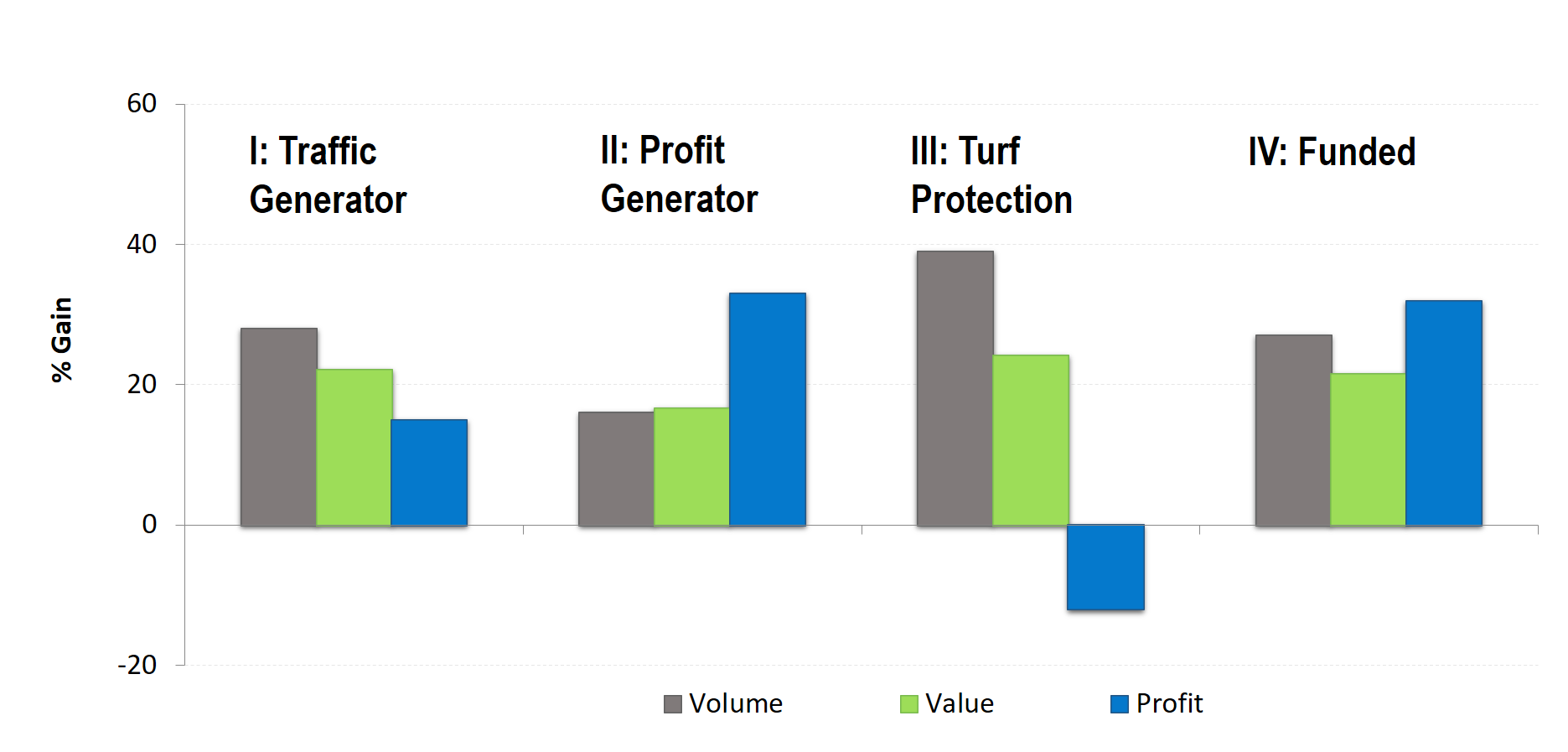

Promotions Evaluation

Automated online solution for analysis of promotions.

Online Apps for training on Promotions

The Plannogrammer is an experiential learning facility for category managers, trade marketers, and retailers in consumer markets. Ideally suited for hybrid learning programmes, Plannogrammer imparts hands-on training in the planning and evaluation of promotions and merchandising.

It supports a collection of simulation and analysis platforms such as Promotions and Space Planner for optimizing space and promotions, Plannogram for populating shelves and merchandising, a Due To Analysis dashboard that decomposes brand sales into the factors driving sales, and a Promotion Evaluator to evaluate the volume, value and profit impact of promotion plans.

Contact | Privacy Statement | Disclaimer: Opinions and views expressed on www.ashokcharan.com are the author’s personal views, and do not represent the official views of the National University of Singapore (NUS) or the NUS Business School | © Copyright 2013-2026 www.ashokcharan.com. All Rights Reserved.