-

Category Management

Category Management

Partnership between Retailers and Manufacturers

Category Managers and Trade Marketers

Trade Marketing

Origins of Category Management

Trade Formats

Categories

Category Roles

Category Strategies

Review

Retail Mix

Price

Promotions and In-Store Media

Space Management

Execution

Benefits of Category Management

Developments in Retailing

- Retail Tracking

- Sales and Distribution

- Retail Analytics

- Category Management

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

-

MarketingMind

Category Management

Category Management

Partnership between Retailers and Manufacturers

Category Managers and Trade Marketers

Trade Marketing

Origins of Category Management

Trade Formats

Categories

Category Roles

Category Strategies

Review

Retail Mix

Price

Promotions and In-Store Media

Space Management

Execution

Benefits of Category Management

Developments in Retailing

- Retail Tracking

- Sales and Distribution

- Retail Analytics

- Category Management

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

Developments in Retailing — eCommerce

Disruptions brought about by the Covid pandemic accelerated the pace of transformation in retailing.

According to NielsenIQ, attitudes and barriers towards eCommerce changed when health safety and mobility issues brought about by the pandemic, compelled shoppers to embrace online shopping. It pushed manufacturers, retailers, and financial and logistics companies to quickly innovate in response to these changes in shopping behaviour.

Even prior to the pandemic, eCommerce was well entrenched in sectors such as luxury products, travel, books, music, computers, event tickets and consumer electronics. Other sectors including FMCG grew rapidly during the pandemic of 2019-22.

According to NielsenIQ, at the start of 2022, eCommerce accounted for nearly 20% of FMCG sales in Asia Pacific where it is the second biggest retail channel. In markets such as South Korea and China, where online formats have historically been important, more than 30% of FMCG sales are coming through eCommerce.

In Europe and North America, eCommerce has a share of about 13% to 14%, and in Africa, Middle East and Latin America the share is below 10%.

Shopper trends reveal that omnichannel, which include brick-and-mortar stores, app-based options, and online platforms, has become the way most people shop for their weekly groceries.

The incidence of online shopping will continue to grow even after the pandemic. Besides the convenience of having groceries delivered at your doorstep, online offers the benefit of a wider assortment of products. Whereas supermarkets list roughly 15,000 to 25,000 items and hypermarkets list 50,000 to 100,000, eCommerce super apps offer between 1M to 1.5M items, 24/7.

Online levels the playing field in manufacturing; scale is no longer as big an advantage as it used to be. In cyberspace there is no battle for shelf space. Smaller brands that are unable to secure listing in supermarkets are available online. Importantly too, in cyberspace all items have equal facings, so, the big brands do not benefit from greater visibility.

As for retailing, the shift towards eCommerce is a game changer. It circumvents the brick-and-mortar infrastructure, thereby lowering the barriers of entry into retail, even making it viable for manufacturers to sell directly to their consumers.

eCommerce vitiates the conventional retail chain’s greatest strength — its brick-and-mortar stores, located at prime locations. Such a network of strategically located outlets takes considerable time and resource to build and its possession has historically given the major retailers a formidable competitive advantage.

As shopping habits shift from offline to online, the dominance of big brick-and-mortar retailers is likely to diminish. Over several years in the future, the balance of power, which in the past had been shifting towards the big brick-and-mortar retailers, will slowly and steadily spread across a wider spectrum of organizations. In terms of global retailing revenues, Amazon is already in second place after Walmart.

Previous

Use the Search Bar to find content on MarketingMind.

Online Apps to train Category Managers

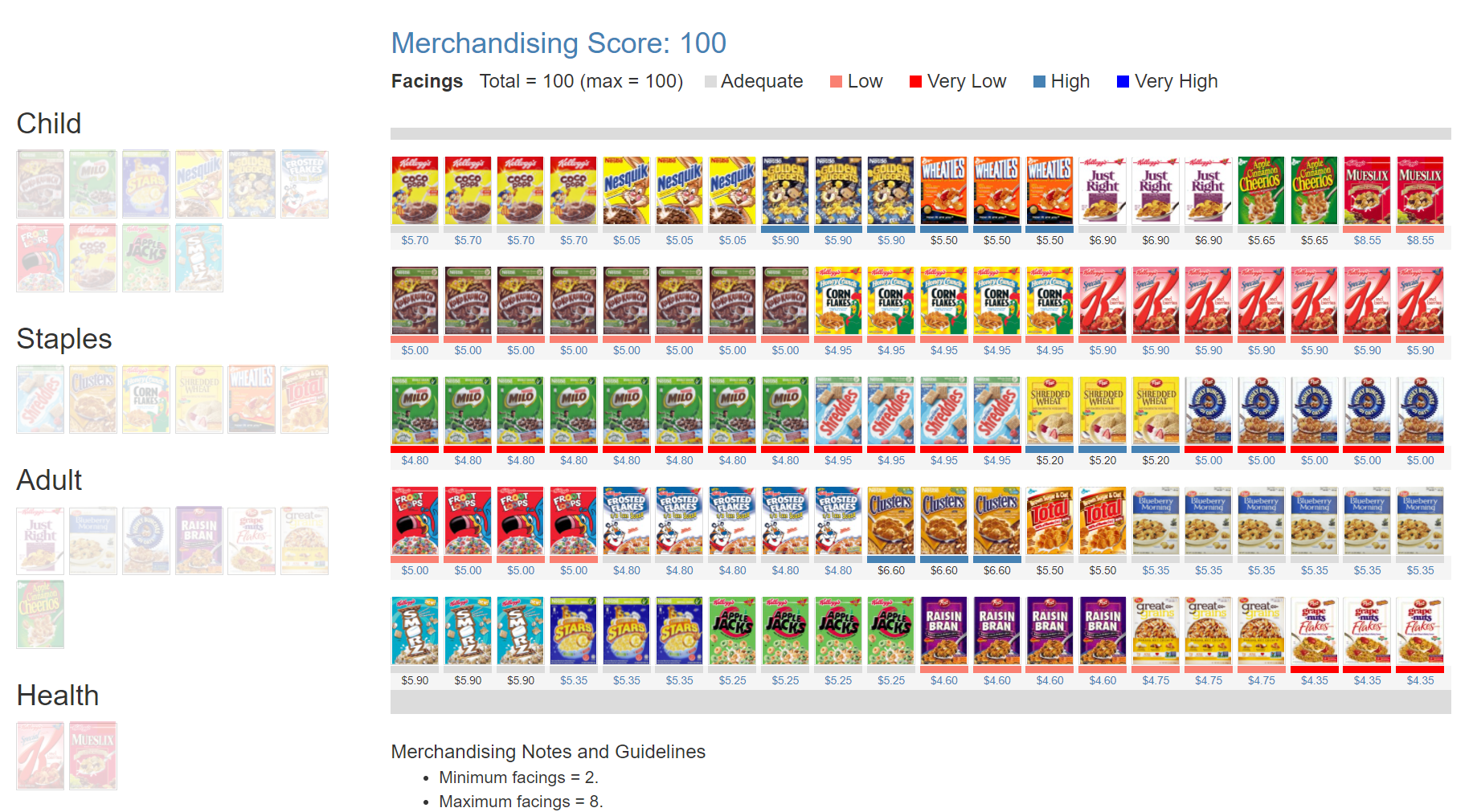

The Plannogrammer is an experiential learning facility for category managers, trade marketers, and retailers in consumer markets. Ideally suited for hybrid learning programmes, Plannogrammer imparts hands-on training in the planning and evaluation of promotions and merchandising.

It supports a collection of simulation and analysis platforms such as Promotions and Space Planner for optimizing space and promotions, Plannogram for populating shelves and merchandising, a Due To Analysis dashboard that decomposes brand sales into the factors driving sales, and a Promotion Evaluator to evaluate the volume, value and profit impact of promotion plans.

Contact | Privacy Statement | Disclaimer: Opinions and views expressed on www.ashokcharan.com are the author’s personal views, and do not represent the official views of the National University of Singapore (NUS) or the NUS Business School | © Copyright 2013-2026 www.ashokcharan.com. All Rights Reserved.