-

Category Management

Category Management

Partnership between Retailers and Manufacturers

Category Managers and Trade Marketers

Trade Marketing

Origins of Category Management

Trade Formats

Categories

Category Roles

Category Strategies

Review

Retail Mix

Price

Promotions and In-Store Media

Space Management

Execution

Benefits of Category Management

Developments in Retailing

- Retail Tracking

- Sales and Distribution

- Retail Analytics

- Category Management

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

-

MarketingMind

Category Management

Category Management

Partnership between Retailers and Manufacturers

Category Managers and Trade Marketers

Trade Marketing

Origins of Category Management

Trade Formats

Categories

Category Roles

Category Strategies

Review

Retail Mix

Price

Promotions and In-Store Media

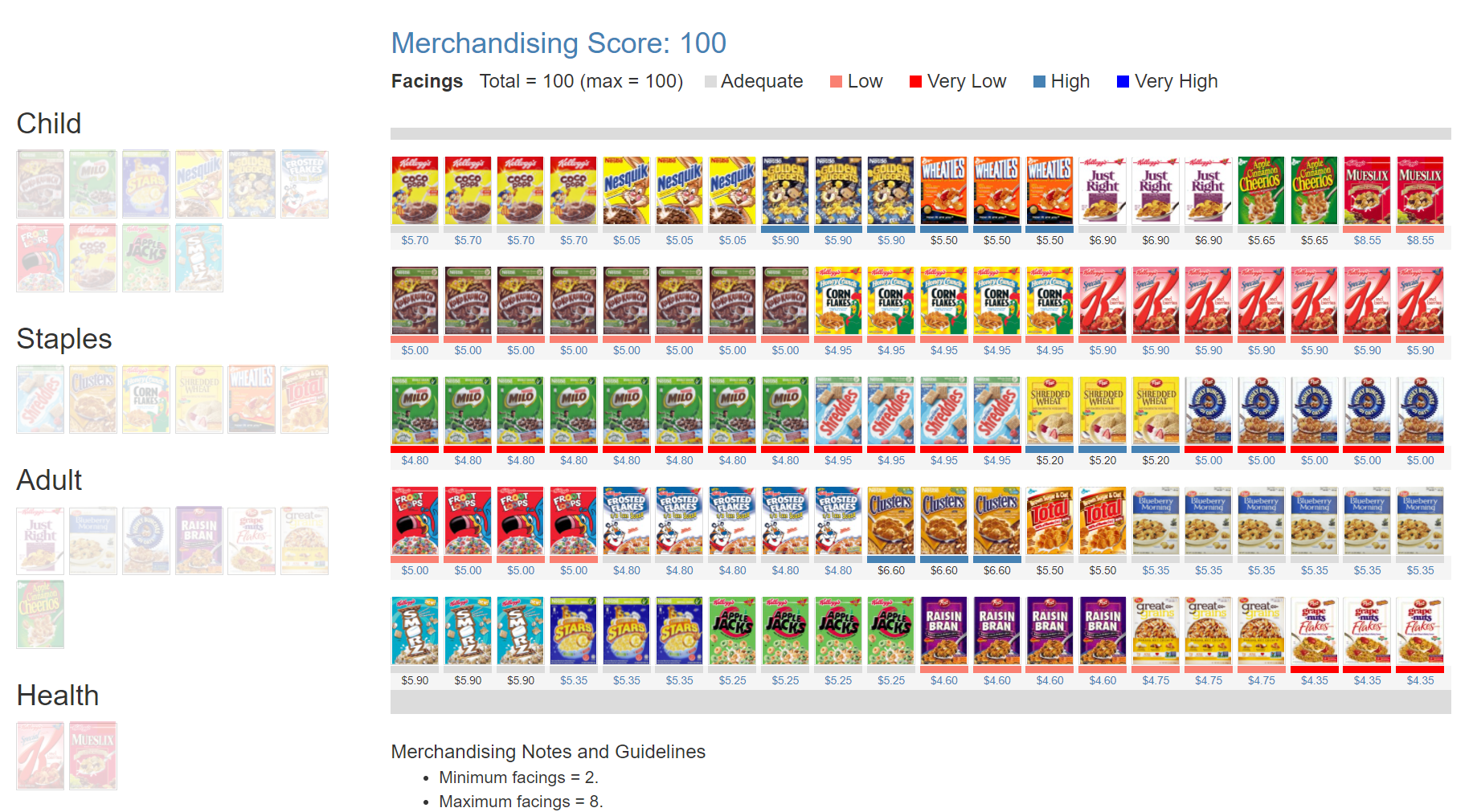

Space Management

Execution

Benefits of Category Management

Developments in Retailing

- Retail Tracking

- Sales and Distribution

- Retail Analytics

- Category Management

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

Origins of Category Management

Developments Leading to Category Management

The first Walmart opened on 2nd July 1962. It was a time when retail was fragmented comprising of numerous small stores with no leverage over dominant manufacturers. The manufacturers largely controlled all elements of the marketing mix.

Today, Walmart has about 5,342 stores in the United States and over 11,000 worldwide, and, taking P&G as an example, it contributes to about 15% of the manufacturer’s worldwide revenue.

As they grew, major retailers like Walmart amassed enormous influence within the marketplace. They acquired greater control on pricing, distribution, promotions, and with the emergence and growth of house brands, their influence on product development also grew. Increasingly brand choices were being made at point-of-purchase in their stores, and they influenced those decisions through their retailing mix.

This shift in the balance of power from manufacturers to retailers inevitably led to adjustments. Manufacturers became vulnerable as the big retailers used their leverage to wring concessions, such as low prices. There was the need to move away from an increasingly distributive relationship to a more constructive, integrative relationship.

Meanwhile, mass markets had splintered into numerous consumer fragments, each with their own tastes, needs and values. This led to an explosion of products catering to the plethora of consumer needs.

Retailers found it challenging to comprehend the needs of shoppers in this increasingly complex marketplace, and they struggled to cope with the continually expanding glut of products. They needed a scientific, fact-driven approach to optimize their retail mix.

With the need for manufacturers to engage with retailers to influence in-store purchasing decisions, and the need for retailers to rely on manufacturers’ understanding of consumers, the time was ripe for the advent of category management.

Advent of Category Management

The term “category management” was coined by Brian F. Harris, a former professor at the University of Southern California and the founder of The Partnering Group (TPG).

In the early 1990s, TPG developed a comprehensive eight-step category management process that became accepted as the industry standard. The eight cyclical steps are as follows:

- Define the category;

- Define the role of the category within the retailer;

- Assess current performance;

- Set objectives and targets;

- Devise strategies;

- Devise tactics;

- Implement plan;

- Review.

According to many industry reports, organizations that successfully adopted the disciplines of category management experienced significant gains in sales and profits. A study by Accenture (2000) for instance, claimed that retailers that adopted category management experienced up to 10% uplift in sales, 3% increase in profit margin and up to 15% reduction in inventory.

Experienced practitioners however, also pointed out that compliance has been an issue. A majority of the recommended actions specified in approved category business plans did not get implemented (TPG and Armature and Interactive Edge, 2001). So, while there have been many successful implementations, the perceived promise of category management has yet to be fulfilled.

Practitioners of category management also feel that the process is complex and time-consuming; that it not only demands specialized data expertise and analytical skills, but also a high degree of coordination and cooperation between departments, and across organizations.

In part the problem probably lies with the interpretation of the TPG process. Category management should not be viewed as a major re-engineering exercise, but rather an ongoing process of improvement. Category management teams need to focus on identifying business issues, and addressing them by tweaking strategies, tactics and refining the retail mix.

Previous Next

Use the Search Bar to find content on MarketingMind.

Online Apps to train Category Managers

The Plannogrammer is an experiential learning facility for category managers, trade marketers, and retailers in consumer markets. Ideally suited for hybrid learning programmes, Plannogrammer imparts hands-on training in the planning and evaluation of promotions and merchandising.

It supports a collection of simulation and analysis platforms such as Promotions and Space Planner for optimizing space and promotions, Plannogram for populating shelves and merchandising, a Due To Analysis dashboard that decomposes brand sales into the factors driving sales, and a Promotion Evaluator to evaluate the volume, value and profit impact of promotion plans.

Contact | Privacy Statement | Disclaimer: Opinions and views expressed on www.ashokcharan.com are the author’s personal views, and do not represent the official views of the National University of Singapore (NUS) or the NUS Business School | © Copyright 2013-2026 www.ashokcharan.com. All Rights Reserved.