-

Category Management

Category Management

Partnership between Retailers and Manufacturers

Category Managers and Trade Marketers

Trade Marketing

Origins of Category Management

Trade Formats

Categories

Category Roles

Category Strategies

Review

Retail Mix

Price

Promotions and In-Store Media

Space Management

Execution

Benefits of Category Management

Developments in Retailing

- Retail Tracking

- Sales and Distribution

- Retail Analytics

- Category Management

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

-

MarketingMind

Category Management

Category Management

Partnership between Retailers and Manufacturers

Category Managers and Trade Marketers

Trade Marketing

Origins of Category Management

Trade Formats

Categories

Category Roles

Category Strategies

Review

Retail Mix

Price

Promotions and In-Store Media

Space Management

Execution

Benefits of Category Management

Developments in Retailing

- Retail Tracking

- Sales and Distribution

- Retail Analytics

- Category Management

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

Partnership between Retailers and Manufacturers

“Every great business is built on friendship.” — JC Penny.

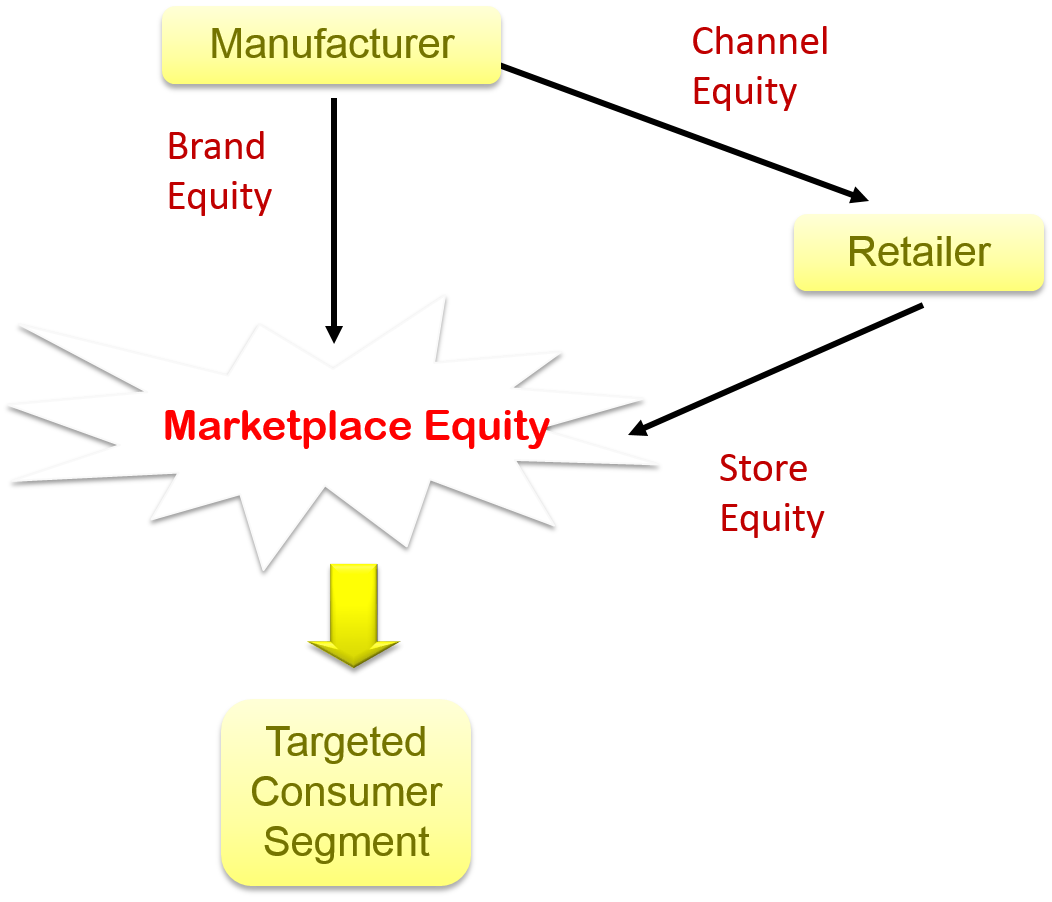

Exhibit 33.3 Manufacturers and retailers jointly contribute to marketplace equity. Adapted from Anderson et al., Business Market Management. (2009).

Category management is essentially the management of a collection of brands in stores. It works best as a collaboration between retailers and manufacturers to enhance marketplace equity.

Marketplace equity (Exhibit 33.3) represents the incremental value a consumer derives from acquiring her repertoire of brands at a particular store. It is the outcome of brand equity and store equity and the extent to which they reinforce one other, and it serves the mutual interests of both the retailer and the manufacturer.

Manufacturers realize that increasingly brand choices are made in stores. What is stocked, where, at what price and with what incentives has great influence on the consumers’ buying behaviour and ultimately their choice of brand. They recognize the need to work with retailers to market their brands in the retailers’ stores.

Retailers recognize the need to rely on manufacturers’ resources and knowledge of products and consumers, for the development and execution of category strategies.

The foundation of category management stems from retailers’ and manufacturers’ need to collaborate to pursue their mutual interests. It is the retailer/supplier process of managing categories to achieve superior business results by enhancing marketplace equity.

It has become an industry practice for major retailers to appoint manufacturers as category captains for important categories, and count on their expertise and support to manage categories. While the category captaincy usually goes to one of the larger manufacturers, others participate as category advisors.

Manufacturers eagerly embrace category management as it affords the opportunity to collaborate with retailers to strengthen their categories and enhance the health of their brands. Being appointed as a category captain is also seen as a source of competitive advantage, allowing manufacturers to strengthen their relationships with retailers. Additionally, the close proximity to retail partners allows for quick access to useful trade information and resources. This facilitates faster more efficient decision-making and implementation of trade strategies.

Category Managers and Trade Marketers

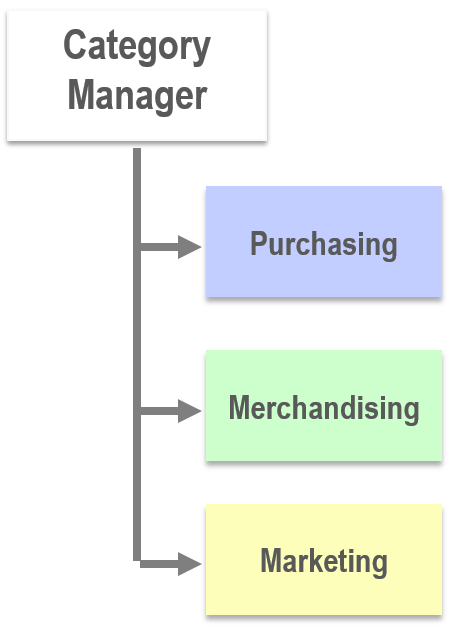

Exhibit 33.4 Category manager’s role encompasses marketing and merchandising in addition to purchasing.

Structure follows strategy. As the practise of category management permeated retail organizations, “buyers” transformed into “category managers”. Their roles, Exhibit 33.4, expanded to encompass operational and financial accountability for their categories. Besides purchasing, their responsibilities now encompass merchandising (assortment, and space allocation) and marketing (pricing, promotions, in-store marketing). This provides for a better co-ordinated approach to category management with category responsibility and authority placed under one team.

Meanwhile suppliers embraced the practice of trade marketing, a form of business-to-business marketing intended to strengthen trade relationships and improve business performance.

One of the outcomes of this transformation, though limited to more progressive retailers, was change in purchasing orientation or the philosophy that guides purchasing-related decisions. Whereas traditionally buyers focussed on obtaining the lowest prices and maximizing power over manufacturers, progressive category managers now seek growth in sales and profitability through a more collaborative approach.

Previous Next

Use the Search Bar to find content on MarketingMind.

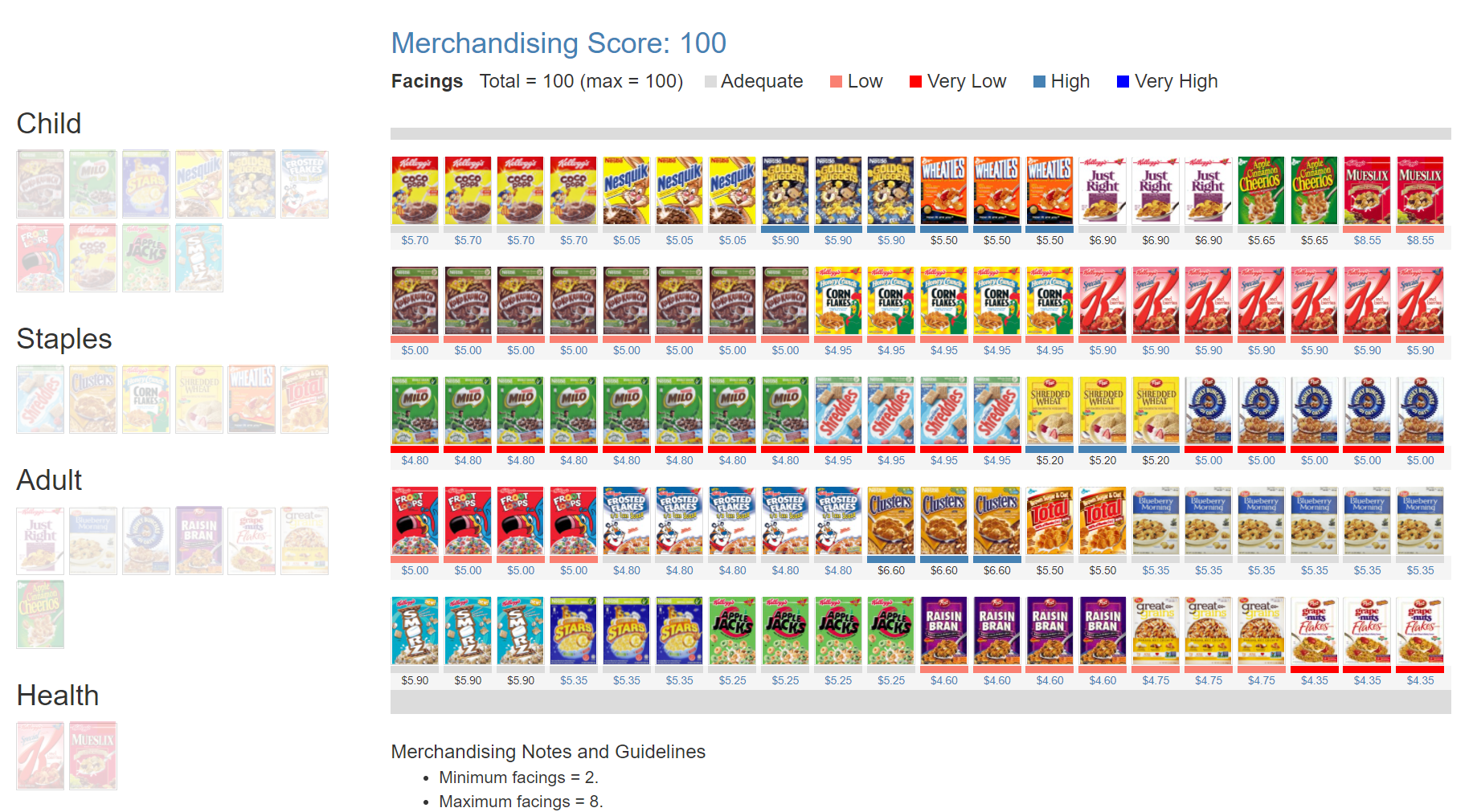

Online Apps to train Category Managers

The Plannogrammer is an experiential learning facility for category managers, trade marketers, and retailers in consumer markets. Ideally suited for hybrid learning programmes, Plannogrammer imparts hands-on training in the planning and evaluation of promotions and merchandising.

It supports a collection of simulation and analysis platforms such as Promotions and Space Planner for optimizing space and promotions, Plannogram for populating shelves and merchandising, a Due To Analysis dashboard that decomposes brand sales into the factors driving sales, and a Promotion Evaluator to evaluate the volume, value and profit impact of promotion plans.

Contact | Privacy Statement | Disclaimer: Opinions and views expressed on www.ashokcharan.com are the author’s personal views, and do not represent the official views of the National University of Singapore (NUS) or the NUS Business School | © Copyright 2013-2026 www.ashokcharan.com. All Rights Reserved.