-

Product Design

IBM 360

Product Design

Sensory Research

Concept/Product Testing

Biometrics

Kano and Conjoint

Conjoint Analysis

House of Quality

- New Product Development

- Product Design

- Product Validation

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

-

MarketingMind

Product Design

IBM 360

Product Design

Sensory Research

Concept/Product Testing

Biometrics

Kano and Conjoint

Conjoint Analysis

House of Quality

- New Product Development

- Product Design

- Product Validation

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

Conjoint Analysis

Food technologists seek to alter their recipes to achieve what they refer to as the “bliss point”, the point at which the composition of ingredients creates the maximum amount of crave. Aeronautical engineers seek to design airplanes that cater to the preferences of the major airlines. Credit card managers seek the combination of features that would incentivize their card holders to spend more on their credit cards. They all are in search of the optimum combination of product features to gratify their target customers.

Conjoint analysis is a method that provides these marketers with an understanding of what it is about their product that drives a customer’s brand choice. It is a predictive technique used to determine customers’ preferences for the different features that make up a product or service.

Conjoint analysis is based on the notion that consumers evaluate products by assessing the value of its separate yet conjoined parts. Products are made up of a wide range of features or attributes such as brand, ingredients, price etc. each with a range of possibilities or levels. Understanding of attribute importance and their perceived value helps marketers segment markets, refine their marketing mix and develop products with the optimum combination of features to gratify their target customers.

Central to the theory of conjoint analysis is the concept of product utility. Utility is a latent variable that reflects how desirable or valuable an object is in the mind of the respondent. The utility of a product is assessed from the value of its parts (part-worth). Conjoint analysis examines consumers’ responses to product ratings, rankings or choices, to estimate the part-worth of the various levels of each attribute of a product. Utility is not an absolute unit of measure, only relative values or differences in utilities matter.

The conceptual framework on conjoint analysis originated in mathematical psychology and was applied in marketing in the early 1970s by Professor Paul Green at the Wharton School of the University of Pennsylvania. Over the years new approaches have emerged that make use of computer-aided online research to considerably expand the scope of the technique.

The following sections describe the conjoint methodology in general, and the strengths, weaknesses and the application areas for the different approaches.

Research Design

The design of a conjoint study is tailored to the study objectives. If the objective is to determine the “bliss point”, the study’s focus will lie on product ingredients. If the objective is to refine the mix to defend against a competitive threat, the focus should be on the key points of differences between products. If the objective is to set price, the emphasis should shift to brand and price.

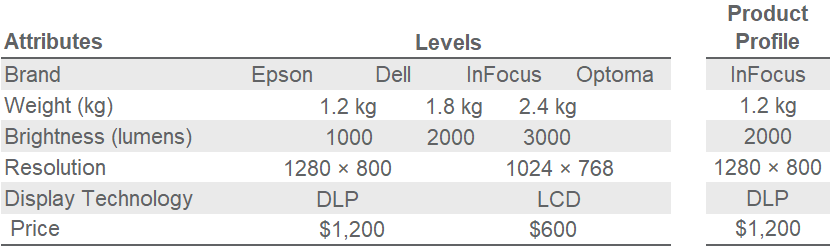

The selection of the product attributes for the research, and their realistic range of values (levels) is based on the objectives. Realism in choice of levels ensures that the derived importance of the attribute is not artificially inflated or deflated. For instance, if smaller brands are excluded as is often the case, the importance of the attribute “brand” is underestimated. Or for instance, if the price range is stretched beyond the range prevailing for most products in the market, its importance will be inflated. Both the highest and the lowest prevalent levels ought to be included, and to avoid bias researchers maintain roughly the same number of levels for each attribute. Exhibit 10.3 depicts the attributes and their levels selected for a study on portable projectors.

Given the above set of attributes and levels, there are as many as 4 × 3 × 3 × 2 × 2 × 2 product permutations. For instance, the InFocus, 1.2 kg, 2000 lumens, 1280 × 800 WXGA, DLP priced at $1,200. These possibilities are referred to as product bundles or product profiles.

The next step in the design of the research is selection of the analysis methodology. If the number of attributes in the research is less than 10, traditional full-profile conjoint analysis will suffice. Otherwise, the use of Adaptive conjoint, which accommodates up to 30 attributes, is recommended.

One assumption inherent in both adaptive and tradition conjoint is pair-wise independence of attributes. The general notion in conjoint analysis is that consumers evaluate the overall desirability of a product based on the value of its separate (yet conjoined) parts. Pair-wise independence assumes that the overall utility or desirability of the product profile is additive, i.e., equal to the sum of its parts. In other words, if the part-worth of the brand InFocus is 3.5, the part-worth for weight 1.2 kg is 2.5, brightness 2000 lumens is 2, resolution 1280 × 800 is 1 and price $1,200 is –2, then the utility of the product bundle shown in Exhibit 10.3 is 3.5 + 2.5 + 2 + 1 – 2 = 7.

While the pair-wise independence assumption generally holds true, there are instances when this might not be the case. For example, if the brand Epson is associated strongly with Liquid Crystal Display (LCD) display technology, respondents may desire the brand more when it is bundled with LCD technology. Its part-worth is higher when combined with LCD technology and lower when it is with Digital Light Processing (DLP). In this case the whole is greater or less than the sum of its parts, and interaction terms must be included in the model.

Interaction effects can be handled by choice-based conjoint analysis where consumers undergo a task similar to what they would actually do in the marketplace — choosing a preferred product from a group of products. This approach, along with adaptive conjoint analysis, is described later in the section on developments in conjoint analysis.

Conjoint analysis works by observing how respondents’ preferences change as one systematically varies the product features. It examines how they trade-off different aspects of the product, weighing options that have a mix of more desirable and less desirable qualities. The observations allow one to statistically deduce (typically via linear regression) the part-worth of all the levels across the product attributes.

One approach to deciphering the customers’ hierarchy of choices would be to ask respondents to rank or rate all the product profiles (288 in the example of portable projectors). This, however, is neither practical nor necessary, provided one assumes pair-wise independence. The assumption allows for a reduction to a much-reduced minimum sample of 11, as obtained from the below equation:

Minimum sample = Total levels across all attributes − Number of attributes + 1

= (4 + 3 + 3 + 2 + 2 + 2) − 6 + 1 = 16 − 6 + 1 = 11.

Normally, however, we include more than the minimum number of profiles, so that all the discrete attribute levels are well represented in a sample of carefully chosen, well-balanced product concepts.

Data Collection

Online panels are an efficient and cost-effective means of collecting the information for conjoint analysis. They also permit the use of computers to customize the questionnaire, as required for adaptive conjoint.

If an online panel is not available for the research, or if the research requires respondents to sniff or taste product samples, one could conduct live interviews at a booth set up at a controlled location. Controlled location tests (CLT) usually are conducted at high traffic sites such as shopping malls. For instance, for our portable projector study, data could be sourced from a booth located at a mall that is popular for computers and peripherals.

Door-to-door interviewing, though expensive, remains an option for full profile conjoint studies, which do not require the use of computers.

Only respondents interested in buying in the near future should be selected for the survey. Depending on the desired accuracy, sample sizes vary from 200 to 500 respondents.

To facilitate data collection, product concepts need to be accurately and vividly depicted. For face-to-face interviews, concept cards are printed out for ease of handling by interviewers and respondents.

The different methodologies essentially require respondents to either rate, rank or select product profiles. Rating scales for conjoint analysis are relatively large varying from 0 to 10 for fewer profiles, and can expand to 0−100 for studies with large number of profiles.

Ranking, which is a more rigorous exercise, requires respondents to sort product samples from most preferred to least preferred. One approach is for respondents to place the profiles into three lots: desirable, neutral and undesirable, and then rank the profiles in each of the three lots. Because it is very time consuming, ranking is infrequently used nowadays.

Data Analysis

Specialized solutions like Sawtooth Software and Bretton-Clark as well as all-purpose statistical packages such as SPSS and SAS, are among the software packages commonly used for conjoint analysis.

Fundamental to conjoint analysis is the derivation of the utility functions. All the study deliverables such as computing attribute importance, running “what-if” simulations, and examining trade-offs are based on product utility.

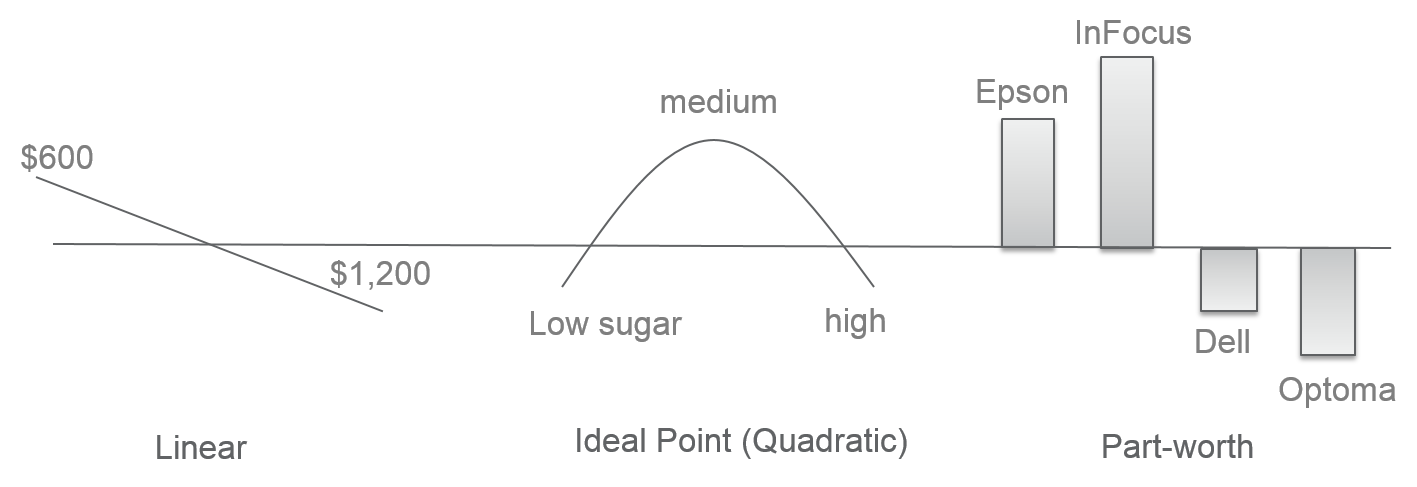

Utility functions, such as those shown in Exhibit 10.4, specify the utility of each level for each attribute, for each individual respondent. Individual-level utilities capture the heterogeneity within the market, allowing for the segmentation of respondents based on their utilities, and permitting a wider variety of approaches to marketing simulations.

A common approach to deriving a respondent’s utility function is the “part-worth” model that estimates the part-worth utility that survey respondents place on each individual level of a particular attribute. This is particularly appropriate for qualitative features like brand or colour that are unordered. With quantitative features such as price, there is usually a simple relationship between level and its part-worth. Linear models assume a straight-line relationship, as might be appropriate for price. Ideal-point or quadratic models (inverted U-shaped curves) are appropriate when consumers have a preference for a specific level (optimum level), as is the case for level of carbonation or sweetness in soft drinks.

The utilities are usually scaled within a given attribute such that they add up to zero. Referred to as effects-coded, the zero point in this approach represents the average. Levels above zero are preferred above average, while those below zero are below average. In an alternative approach called dummy-coded, the least preferred value is set to zero, and all other levels are positive values.

Once the utility functions are known, we can compute the utility for any of the possible product profiles by adding the scores for each of the profile’s attributes. Going back to the portable projector example we can predict the utility of each of the 288 possible product profiles, for each and every respondent.

Standard Deliverables

Attribute Importance

| Attributes | Levels | Part-Worth | Importance | Relative Importance (%) |

|---|---|---|---|---|

| Brand | Epson | 1.5 | 5.15 | 26.4 |

| Dell | -1.35 | |||

| InFocus | 2.5 | |||

| Optoma | -2.65 | |||

| Weight | 1.2 kg | 1.5 | 2.5 | 12.8 |

| 1.8 kg | -0.5 | |||

| 2.4 kg | -1 | |||

| Brightness | 1000 lumens | -2 | 3.48 | 17.8 |

| 2000 lumens | 0.52 | |||

| 3000 lumens | 1.48 | |||

| Resolution | 1280 x 800 | 1.89 | 3.78 | 19.4 |

| 1024 x 768 | -1.89 | |||

| Technology | DLP | 0.78 | 1.56 | 8 |

| LCD | -0.78 | |||

| Price | 1200 | -1.53 | 3.06 | 15.7 |

| 600 | 1.53 | |||

| Total | 19.53 | 100 |

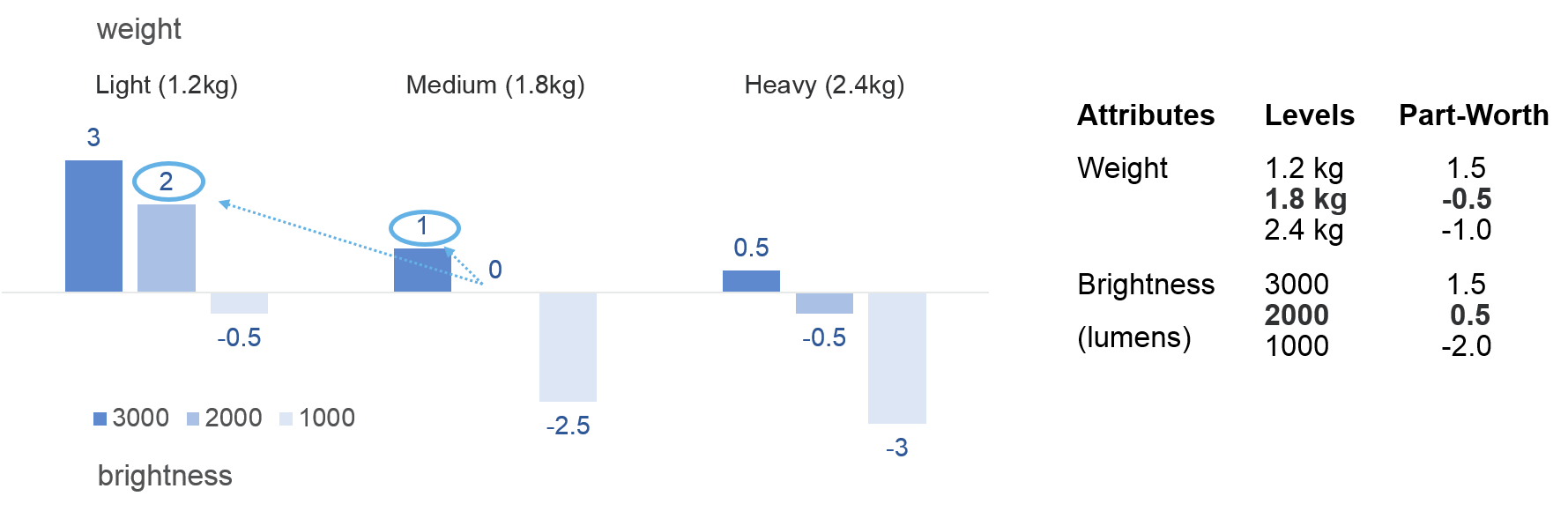

The average part-worth score across all respondents, as shown in Exhibit 10.5, serves as the analysis summary. It is used to derive the importance and the relative importance of an attribute. Attribute importance is the difference between the highest and lowest utility level of the attribute. Relative importance of an attribute is essentially its share of importance.

If the distance between the utility levels of an attribute is large, then that attribute will have a larger bearing on the respondents’ choice of product than another attribute where the distance is not as large. The distance therefore reflects the importance of the attribute in determining consumer preferences.

It becomes apparent here how the choice of levels has a critical bearing on attribute importance, and why both the highest and the lowest prevalent levels should preferably be included in the design to get unbiased estimates of the importance of attributes. If the levels within an attribute do not cover its entire range its importance is deflated. On the other hand, if the range is stretched beyond the prevailing levels in the market, its importance will be inflated.

Since it may not always be desirable or feasible to cover the realistic range of levels within attributes, the correct interpretation of data in Exhibit 10.5 is that for the average consumer, given the attribute properties tested, brand has the highest influence on brand choice, followed by resolution, brightness, price, weight and technology.

Knowledge of the relative importance of various attributes can assist in marketing and advertising decisions. Other factors being equal, one would devote greater attention and resource to improving a product, on attributes that are of greatest importance to target consumers.

Trade-off Analysis

Product developers are constantly faced with trade-offs. For instance, reducing the weight of a portable projector would result in an increase in price as lighter components cost more. Whether this could result in an increase in demand could be gauged by examining the trade-offs that consumers are willing to make.

Exhibit 10.6 provides an illustration of trade-off analysis. In this case the developer of a projector that currently has brightness of 2000 lumens and weighs 1.8 kg, is considering whether to increase the product’s brightness to 3000 lumens or reduce the weight to 1.2 kg. Since utility improves by + 2 (from − 0.5 to + 1.5) if we reduce weight to 1.2 kg, compared to + 1 (from 0.5 to 1.5) if we improve brightness to 3000, the developer can deduce that the average consumer will prefer the reduction in weight over the improvement in brightness.

Marketing Simulation

For product developers, perhaps the greatest value of conjoint analysis comes from what-if market simulators that are able to predict the changes in consumer preferences across brands should a proposed new product enter the market, or if an existing product is withdrawn.

One approach to marketing simulation referred to as the first-choice model, assumes that a consumer chooses the product that commands the highest utility. As mentioned earlier the utility of each product profile is the sum of the part-worth of its features. Computed for each respondent across all products that exist in the market, the simulation results are aggregated and weighted to yield the consumers’ share of preferences within the market.

The first-choice model, where the winner-takes-all is appropriate for markets where consumers tend to buy only one brand or item in the short term, as is the case for consumer durables. It may also apply to categories where brand loyalty is known to be very high.

| Product | Utility | eU | First Choice | Share of Utility | Multinomial Logit |

|---|---|---|---|---|---|

| A | 1 | 2.7 | 0 | 10 | 3.2 |

| B | 2 | 7.4 | 0 | 20 | 8.7 |

| C | 3 | 20.1 | 0 | 30 | 23.7 |

| D | 4 | 54.6 | 100 | 40 | 64.4 |

| 10 | 84.8 | 100 | 100 | 100 |

However, for the majority of FMCG products, consumers tend to maintain a repertoire of brands. The multinomial logit and the share of utility methods are better suited for such products. Exhibit 10.7 provides a comparison of all three methods.

The share of utility method allocates volume in proportion to the products’ utility. It recognizes that for some categories a consumer may want variety, and while she may prefer a chicken burger more than other menu options at a fast-food restaurant, from time to time she will try some of the other options. In the share of utility method, the utility reflects the proportion of time that the respondent will prefer that option within the specified competitive context. For example if the utility of products A, B, C and D is respectively 1, 2, 3 and 4, then the share of preferences for A is 10% (1/[1 + 2 + 3 + 4]), and share for B, C, and D is 20%, 30% and 40% respectively.

The multinomial logit model takes the following mathematical form:

$$ Share_p=\frac{e^{U_p}}{\sum^n_{i=1} e^{U_p}}$$where:

Sharep is the estimated share of preference for product p.

Up is the estimated utility for product p.

Ui is the estimated utility for product i.

n is the number of products in the competitive set.

Share of Preference and Market Share

Conjoint analysis is a highly versatile technique that yields valuable insights for the development of products and their marketing mix. When interpreting the results, however, we need to remain aware that the technique provides estimates of the share of preference, which ought not to be confused with share of market.

Besides their preferences for product features, consumers’ buying behaviour is dependent on a number of other market factors, including brand and advertising awareness, product knowledge, product perceptions, promotions and distribution.

It takes time for the awareness of a new brand to grow, and for its advertising associations and claims to penetrate minds. Consumers are not fully aware of product details, even for established brands. Their perceptions about a product may be inaccurate, and their choice of brand is usually limited to what is available at the outlets they frequent.

Moreover, market share is not static, it varies over time. Dissemination of information takes time. Trends take time to reach equilibrium. And there is a lag between intent to purchase and date of purchase.

Because many factors that influence market share are not replicated in the conjoint study, the study results are unlikely to accurately reflect buying behaviour. They do however provide an accurate gauge of consumers’ preferences for different product features, and this information has many practical applications.

Applications

New Product Development

Knowledge of what drives customer preferences, in terms of the part-worth, and the importance of product features and attributes, is of immense value to product developers. It helps them refine existing product, configure the elements of a new product or service, and launch new variants or line-extensions.

These new/refined product concepts can be simulated to provide an assessment of their market potential, as also an understanding of their source of growth in terms of the amount of business they are likely to gain from other brands (cannibalization).

Market Segmentation

Crafting segments on the basis of the product features that are valued by consumers is an apt approach to segmentation from the standpoint of product development. It aligns well with consumers’ needs and preferences, albeit primarily in terms of product related attributes and price.

The segments are identified based on similarities reflected in respondents’ utility functions. Cluster analysis is one of a number of methods that can be used for this purpose.

By way of example consider the case of portable projectors. It might be observed that some customers highly value price and display technology, while others value brand, brightness and weight. On examining the profile of the customers, we might find that one segment comprises mainly business customers whereas the other consists primarily of home users. Information of this nature is helpful in product development and targeting customers. Marketers can also identify profitable niches and create products tailored to those specific markets.

Advertising and Communication

Knowledge of segments and the relative importance of various attributes within each segment helps marketers prioritize their messages in advertising and other forms of brand communication.

Price

Where price evaluation is the prime objective of the research, we use two attributes: brand name and price (for the most popular pack size). The brand name, in essence, captures the features associated with the brand.

Traditional conjoint, however, is not the recommended approach for determining brand price elasticity because the pair-wise independence assumption does not hold true for brand and price.

Some brands are more sensitive to changes in price than others. The importance of price, therefore, depends on the brand with which it is associated, and the traditional conjoint model which fails to capture this interaction, would essentially get the price sensitivity wrong.

Refer the section Interaction Effects in Chapter Price, for more information on interaction effects. Discrete Choice Modelling (or choice-based conjoint), which is also covered in the same chapter, is the recommended approach for most ad hoc pricing research applications.

Traditional conjoint analysis is appropriate for answering questions such as what to charge for a product feature.

For instance, if a manufacturer of a 1.8 kg projector considers introducing a 1.2 kg model, what price premium can the lighter model command?

Based on Exhibit 10.5, the increase in part-worth is equal to 2.0 points (increase from -0.5 to +1.5). This is approximately two-third of the increase in the part-worth (3.06 points) from price 1,200 to 600 (-1.53 to +1.53). Assuming a linear price utility curve, the equivalent value of 2.0 utility points is two-thirds of the difference in price, or $400. We may therefore deduce that the 1.2 kg model can command a premium of $400.

For more examples refer the section How to Price a Product Feature in Chapter Price.

Developments in Conjoint Analysis

With the shift from mass marketing in the 1970s to personalized marketing in our digital age, products and services have become highly specialized, providing consumers with an array of options. The constraints on the number of attributes and their levels in full profile conjoint analysis have made this traditional approach impractical for modern marketing needs.

At the same time, the trend towards online computer aided research facilitated the development and use of adaptive and hybrid conjoint methods, and relatively sophisticated techniques such as adaptive self-explication, which allowed for much larger number of attributes to be accommodated.

Adaptive Conjoint Analysis

Introduced in 1985 by Richard Johnson at Sawtooth Software, adaptive conjoint analysis (ACA) customizes the interview for each respondent, seeking trade-offs only on those attributes and levels, which are of relevance to the respondent.

A good illustration of the ACA process can be found at Sawtooth’s website (www.sawtoothsoftware.com) where a sample survey is provided.

It encompasses a four-stage interactive computer aided survey, where the responses at each stage serve to customize the questions in subsequent stages.

- Stage 1 — Preference rating: Respondent is asked to rate attribute levels from most to least preferred. Sawtooth for example employs a 7-point rating scale from extremely undesirable to extremely desirable.

- Stage 2 — Importance rating: Respondent is

asked to specify the importance of the difference in levels on a 7-point scale

varying from “Extremely important” to “Not at all important”.

Example: If the two projectors were the same in all other ways, how important would this difference be to you? InFocus vs. Epson. - Stage 3 — Paired comparisons: Depending on

the responses to the self-explicated questions (Stages 1 and 2), the survey

adapts to present the respondent a set of paired comparisons which are best

suited to elicit the respondent’s underlying preferences.

Example: If everything else about these two projectors were the same, which would you prefer?

Option 1: InFocus, 2000 lumens

Option 2: Epson, 3000 lumens

- Stage 4 — Profile rating:

Depending on the responses to the self-explicated questions in Stages 1

and 2, and the trade-offs in Stage 3, the respondent is finally asked to rate a

limited set of product profiles on a 0 to 100 scale.

Example: Now we are going to show you four projectors. For each projector, please tell us how likely you are to buy it. Answer using a 100-point scale, where 0 means not likely at all and 100 means definitely would buy it.

Customization based on the response to self-explicated questions, improves the efficiency of the survey. If for instance a respondent has indicated that the InFocus brand is preferable to Epson, and DLP display technology is preferable to LCD, a paired comparison between InFocus-DLP and Epson-LCD becomes redundant. By ensuring that only relevant paired comparisons and profile ratings are shown, ACA substantially trims the task that each respondent is required to perform. The improvement in efficiency allows for the expansion in scale allowing ACA to accommodate designs with as many as 30 attributes.

Choice-based Conjoint Analysis

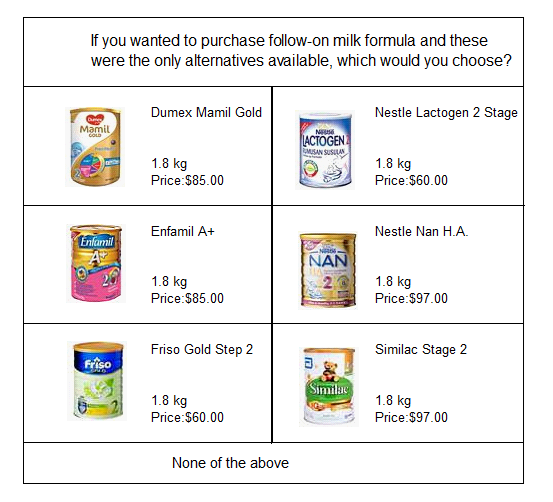

Choice-based conjoint analysis, an application of discrete choice modelling, gained popularity during the 1990s driven by the advantage that it reflects the real world more closely than any of the other approaches to conjoint analysis. Consumers undergo a task similar to what they actually do in the marketplace — choosing a preferred product from a group of products.

Unlike the other approaches, choice-based conjoint analysis can also estimate higher-order interactions, although we do not need to include these effects for most marketing problems.

Respondents are asked to select a brand from choice sets similar to the one shown in Exhibit 10.8. The choices usually include a “none” choice that can be selected if none of the products appeal to the respondent. The number of choice sets varies from 8 for a small study to 24 for a study with relatively large number of attributes.

Because realism is of utmost importance in pricing research, choice-based conjoint analysis is the preferred method for pricing research studies.

Previous Next

Use the Search Bar to find content on MarketingMind.

Contact | Privacy Statement | Disclaimer: Opinions and views expressed on www.ashokcharan.com are the author’s personal views, and do not represent the official views of the National University of Singapore (NUS) or the NUS Business School | © Copyright 2013-2026 www.ashokcharan.com. All Rights Reserved.