A key advertising objective,

particularly for a new product, is to persuade consumers to try the brand.

Research solutions for pre-testing and post-testing advertisements accordingly

incorporate measures for the persuasiveness of advertising.

For online campaigns, which aim to drive ecommerce,

web analytics can provide hard measures such as conversion rates. These figures,

however, tend to be extremely low.

In this context, it is important to remember that

an ad’s impression influences a prospect in many different ways, and at different

times. Conventional research metrics based on pre/post disposition to purchase

the advertised brand often provide a better assessment of the persuasiveness

of an ad.

Market research companies like Ipsos ASI, use

controlled tests to gauge the persuasiveness of advertising.

Prior to watching the test ad, respondents are asked what brand they are likely to purchase

on their next purchase occasion. Post exposure, respondents are asked what

brand they would prefer to win. Asking for the respondent’s preference in a

different context helps to mask the purpose of the question. This lessens the

possible bias that could arise if respondents knew the intent of the question.

An alternative approach is to use two groups — a

test group exposed to the ad and a control group not exposed to the ad. This

approach which eliminates bias, requires two well-matched sample groups, and is

therefore more expensive.

The persuasion score is

the shift between the purchase intent and purchase frequency after seeing the

test ad and before being exposed to it, or the difference between the test and

the control groups. Ipsos ASI computes a benchmark expected persuasion score

called Predicted Average Result (PAR) Shift based on market, brand

strength, category loyalty and market fragmentation. A persuasion index

is computed based on persuasion score divided by the PAR shift.

In copy testing, for advertisement effectiveness,

Ipsos ASI computes the copy effect index (CEI) as a combination of reach

and persuasion.

$$ CEI = Reach × Persuasion\; Index $$

In a post-testing scenario, in addition to pre/post

disposition to purchase, measures of sales response may also be used to gauge

the impact of the advertisement in generating short term sales. This is not

straightforward because the impact of advertising on sales is usually drowned

by causal influences such as in-store promotions. Market response modelling,

which is covered in chapter Marketing mix Modelling can help decompose

the impact of each of the individual elements, and is particularly useful in

assessing short term influences of advertising.

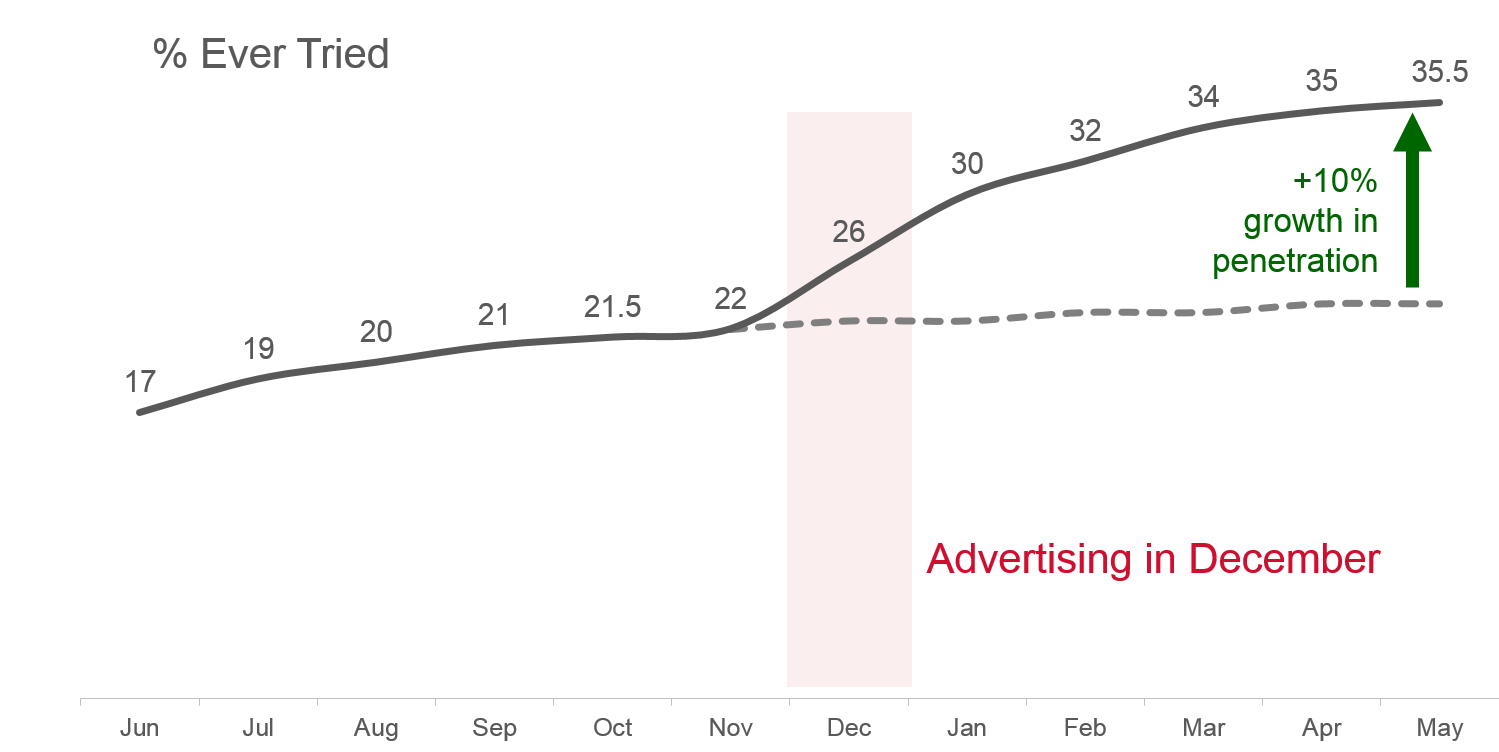

Exhibit 13.8 Consumer panel data reveals a large improvement

in trial as this brand attracts new and lapsed buyers. This improvement in

the brand’s penetration is due to the advertising campaign during December,

as well as other marketing efforts.

Disaggregate level consumer panel data is quite revealing, in

that it can separate trial from repeat purchase. The chart in Exhibit 13.8 reveals a 10% point lift in trial of a

brand due to the impact of an ad campaign in December, as well as other

marketing activities. This is a good measure for the persuasiveness of the

overall marketing effort in attracting new consumers. However, unless we

decompose the impact of each of the marketing elements, we cannot deduce how

much of this impact is due to advertising alone.