-

Advertising Analytics

Advertising Analytics

Audience Measurement

OTT Services

Internet Protocol TV

Return Path Data

Viewer Analytics

Gross Rating Points

Digital Audience Measurement

Total Audience Measurement

Copy Testing

Testing Advertising Online

Advertising Tracking

Continuous vs. Dipstick

Tracking Questionnaire

Advertising Engagement

Behavioural Engagement

YouTube Analytics

Attitudinal Engagement

Branded Memorability

Persuasion

Uniqueness

Likeability

Image and Symbolism

Involvement

Communication

Emotion

Case — Molly LFHC

Awareness Index Model

- How Advertising Works

- Advertising Analytics

- Packaging

- Biometrics

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

-

MarketingMind

Advertising Analytics

Advertising Analytics

Audience Measurement

OTT Services

Internet Protocol TV

Return Path Data

Viewer Analytics

Gross Rating Points

Digital Audience Measurement

Total Audience Measurement

Copy Testing

Testing Advertising Online

Advertising Tracking

Continuous vs. Dipstick

Tracking Questionnaire

Advertising Engagement

Behavioural Engagement

YouTube Analytics

Attitudinal Engagement

Branded Memorability

Persuasion

Uniqueness

Likeability

Image and Symbolism

Involvement

Communication

Emotion

Case — Molly LFHC

Awareness Index Model

- How Advertising Works

- Advertising Analytics

- Packaging

- Biometrics

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

Advertising Tracking (Post-Testing)

To monitor the effectiveness of on-air advertising, many companies rely on advertising tracking research. For major brands in fast-moving consumer goods (FMCG) categories with significant advertising budgets, continuous tracking via interviews conducted throughout the year is recommended. However, for smaller brands with limited research budgets, dipsticks may be a more appropriate option.

In the past these studies were conducted mainly via telephone or face-to-face interviews. Nowadays, online data collection is the most widely used method.

Leading research firms in this area include Millward Brown, whose current in-market tracking service is AdNow (formerly known as ATP or Advanced Tracking Program), and Ipsos ASI, whose service is called BrandGraph (formerly known as Ad*Graph). Ipsos ASI also recently established Ipsos ASI|digital, a global practice dedicated to online advertising research.

Continuous Interviewing versus Dipsticks

Advertising tracking studies may be conducted continuously, with a few interviews every day, or as a series of surveys, referred to as dipsticks (or pulsed interviews) that ‘dip’ into the market over time (e.g., pre- and post-advertising).

Continuous interviewing offers several advantages over dipsticks. It provides an uninterrupted record of measurements, capturing all trends and changes in the market with no gaps or missing time periods in the data. Unlike dipsticks, which are often biased toward the media schedule of a company’s own brands, continuous tracking is better suited for monitoring competitive activity and analysing multimedia campaigns.

Continuous tracking data can also be easily integrated with other continuous data streams such as gross rating points (GRPs) or advertising expenditure, as well as sales data, to develop market response models. Metrics derived from such models, like Millward Brown’s awareness index, can provide an accurate assessment of advertising effectiveness.

To manage costs, continuous tracking is usually reported on a 4-weekly or 8-weekly rolling data basis. For example, if a sample size of 300 is required for reporting, then 75 interviews must be conducted each week for reporting on a 4-weekly moving average basis.

On the other hand, dipsticks are like snapshots in time, providing more accurate pre- and post-measurements for a specific advertising campaign in a shorter time interval. Their primary advantage is their lower cost compared to continuous tracking.

A typical tracking study covers the following aspects of brands and their advertising:

- Brand awareness

- Purchase behaviour

- Brand image

- Advertising awareness

- Advertising diagnostics

The sequence in which these topics are covered minimizes order effects and biases. Unaided brand awareness is measured first, followed by questions related to purchase behaviour and brand image before exposing respondents to any advertising content. This approach ensures that preceding questions do not create unintended awareness of brands or advertising that would bias the answers to questions on awareness.

Brand and advertising awareness measure the extent to which advertising registers in people’s minds. Purchase behaviour is measured in terms of trial, consideration, and current usage.

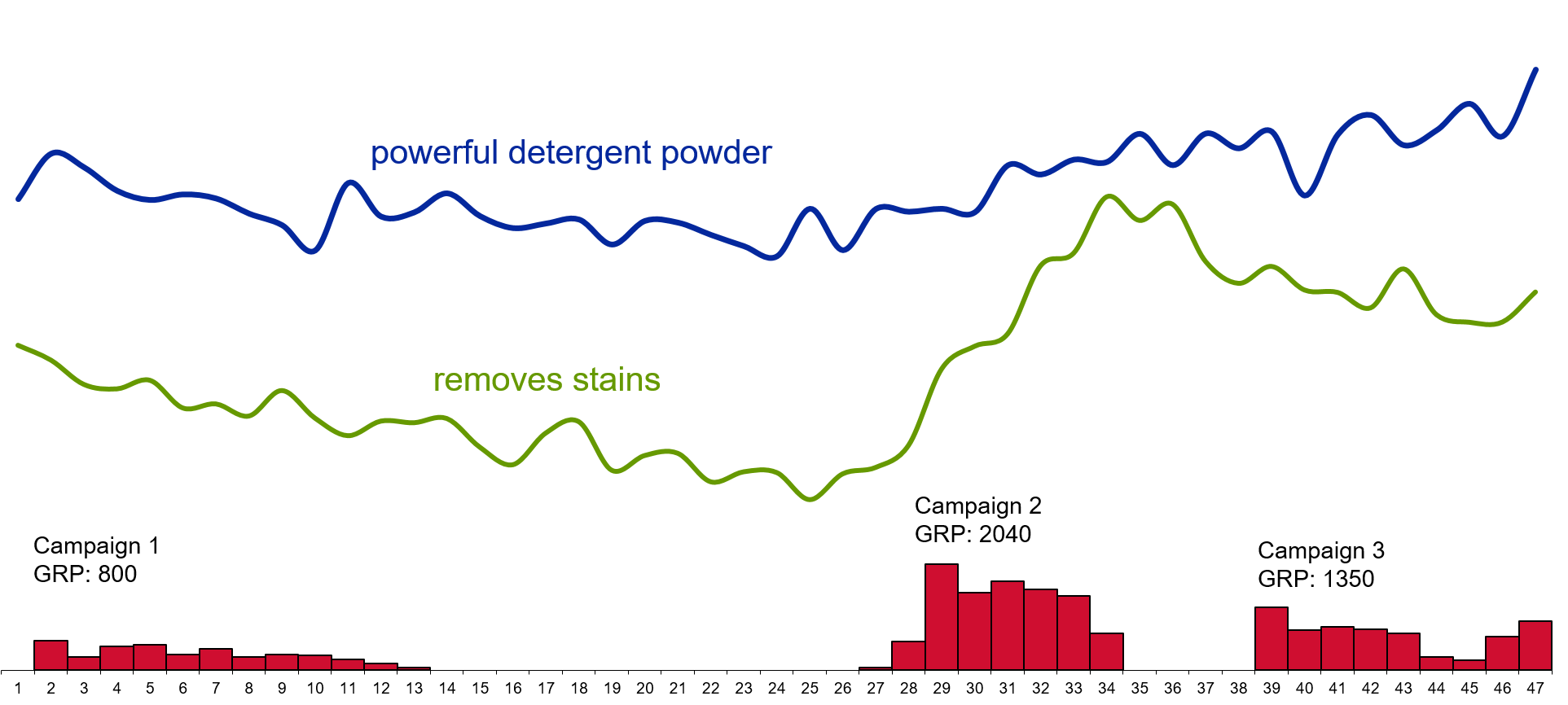

As depicted in Exhibit 13.5, tracking studies typically plot image attribute ratings against campaigns to highlight the impact of individual campaigns on respondents’ perceptions. In the example, it can be clearly seen that Campaign 2 has a marked impact on the image of the detergent brand, particularly on the attribute removes stains.

Further details about how awareness is measured can be found in the section Branded Memorability. The tracking and analysis of brand image are discussed in detail in Volume I, Chapter Brand Sensing.

Previous Next

Use the Search Bar to find content on MarketingMind.

Contact | Privacy Statement | Disclaimer: Opinions and views expressed on www.ashokcharan.com are the author’s personal views, and do not represent the official views of the National University of Singapore (NUS) or the NUS Business School | © Copyright 2013-2026 www.ashokcharan.com. All Rights Reserved.