-

Brand Equity

Brand Equity

Zen versus i-Pod

Benefits

Loyalty Pyramid

NPI, NAI

Brand Equity Models

Brand Equity Index

Brand Equity Drivers

Analysis and Interpretation

Overview

- Brand Sensing

- Brand Equity

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

-

MarketingMind

Brand Equity

Brand Equity

Zen versus i-Pod

Benefits

Loyalty Pyramid

NPI, NAI

Brand Equity Models

Brand Equity Index

Brand Equity Drivers

Analysis and Interpretation

Overview

- Brand Sensing

- Brand Equity

- Marketing Education

- Is Marketing Education Fluffy and Weak?

- How to Choose the Right Marketing Simulator

- Self-Learners: Experiential Learning to Adapt to the New Age of Marketing

- Negotiation Skills Training for Retailers, Marketers, Trade Marketers and Category Managers

- Simulators becoming essential Training Platforms

- What they SHOULD TEACH at Business Schools

- Experiential Learning through Marketing Simulators

Brand Equity Models

Leading market research agencies have developed proprietary brand equity models that measure brand equity and tell us what is driving it. Though their terminology differs — “affinity”, “bonding”, “resonance” or plain “brand loyalty” — the well-known brand equity models are essentially based on measuring surrogates for brand loyalty.

Research firm Millward Brown’s (Kantar) equity index, called Voltage, is derived from a brand pyramid that is similar to the loyalty pyramid. Voltage is referred to as a brand’s “stored energy”, or “usable brand equity”. It is a reflection of the brand’s potential — a high voltage brand has greater potential to gain from its own marketing initiatives and greater capacity to endure the actions of competitors.

A brand signature is crafted based on the strengths and weaknesses of the brand at each of the levels of the brand pyramid, and Voltage is computed from the brand signature.

BrandDynamics and Meaningfully Different Framework

Research firm Millward Brown’s BrandDynamics has been a leading platform for measuring brand equity, for close to 25 years. Voltage, the metric originally used in BrandDynamics to quantify equity, was derived from the brand loyalty pyramid. It represented the brand’s “stored energy”, or “usable brand equity” — a high voltage brand had greater potential to gain from its own marketing initiatives and greater capacity to endure the actions of competitors.

One of the most significant enhancements to BrandDynamics came about in 2013 when the company introduced the Meaningfully Different Framework.

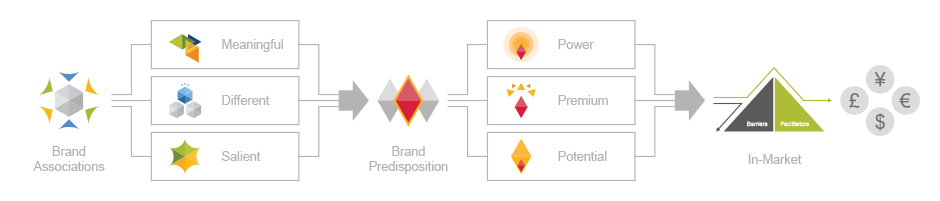

This framework, depicted in Exhibit 2.8, employs simple scores that summarize a brand’s equity and relate directly to the revenue the brand is likely to generate for the present as also in the future:

- Power: a prediction of the brand’s volume share.

- Premium: a brand’s ability to command a price premium relative to the category average.

- Potential: the probability that a brand will grow value share.

According to Millward Brown, analysis of the BrandDynamics database revealed that the most successful brands tend to share five core qualities:

- Consumers feel an affinity for them.

- Consumers think they perform well to meet their needs.

- They are seen as unique.

- They are dynamic – set category trends.

- They are top of mind to consumers.

Factor analysis reveals that the variations in the above (5) qualities can be explained by these three dimensions:

- Meaningful: Dominated by affinity and meets needs, meaningful indicates the extent that brands build an emotional connection and are perceived to meet functional needs.

- Different: This dimension mainly represents uniqueness and dynamism (setting trends). It captures the extent to which brands differ, by offering something unique – intangible or tangible – and by leading the way.

- Salient: Top of mind/spontaneous awareness. It represents how quickly and easily the brands come to mind.

These three qualities, in varying combinations, are present in brands that sell the most, command the highest price premium and generate the most value share growth the following year.

For more information about the Meaningfully Different Framework refer this article by Jorge Alagon and Josh Samuel.

Other Models

Research International’s model, the Equity Engine was developed in 1997 in consultation with David Aaker who is renowned for his theories on brand equity. An equity index is constructed from the perceptions of the brand on a combination of affinity and performance elements. The Equity Engine also computes brand value which is the interaction between brand equity and perceived price relative to other brands in the market (The research firm Research International is now merged with TNS).

Ipsos’ model called the Equity Builder, places emphasis on brand health which is dependent on brand equity, brand involvement and value. Brand involvement relates to the substitutability of brands; substitutability vitiates the benefits of brand equity. Value, on the other hand, relates to the price differential. Increases in price-gap erode behavioural loyalty.

Brand equity, according to the Ipsos model, is a function of the five factors — differentiation, relevance, popularity, familiarity and quality — described below:

- Differentiation: “Unique or different features, or a distinct image other brands do not have”.

- Relevance: “Appropriate, fits my lifestyle and needs”.

- Popularity: “A popular brand”.

- Familiarity: “Familiar with and understand what this brand is about”.

- Quality: “Has consistently high quality”.

The Equity Builder model calculates scores for brand equity, brand involvement and value, which are then combined to create an overall brand health score.

Nielsen’s Winning Brands model was based on Kevin Keller’s (1998) consumer-based brand equity framework. This model is described in some detail in the sections that follow.

Previous Next

Use the Search Bar to find content on MarketingMind.

Contact | Privacy Statement | Disclaimer: Opinions and views expressed on www.ashokcharan.com are the author’s personal views, and do not represent the official views of the National University of Singapore (NUS) or the NUS Business School | © Copyright 2013-2026 www.ashokcharan.com. All Rights Reserved.