The net promoter index is a useful, uncomplicated indicator of brand equity. One may argue that because

brand equity is multi-faceted, a series of questions are more appropriate than

the single “willingness to recommend” statement used for deriving the net

promoter index. In practice, however, it is unlikely to make a substantive

difference because the statements used to generate the index are highly

correlated.

That said, most brand equity models tend to use a

series of three or four statements that reflect the outcomes of brand equity — brand

loyalty, willingness to pay a price premium, and the willingness to endure some

inconvenience (e.g., travel a distance) to secure the brand. The following

statements are used to create NielsenIQ’s Winning Brands’ Brand Equity Index:

- If you have to recommend a brand of [category] to somebody which

brand would it be?

- Which brand of [category] would you say is your favourite brand?

It may or may not be the brand you use/buy most often.

- Can you please indicate which of these statements best describe

how much you would be willing to pay for [brand name]?

- Whatever it costs

- Even if it costs more than any

other brand

- I would buy even if it costs a lot

more than the cheapest brand

- Even if it costs a bit more than the

cheapest brand

- Only if it costs same as the

cheapest brand

- I would not buy it at all

- Do not know

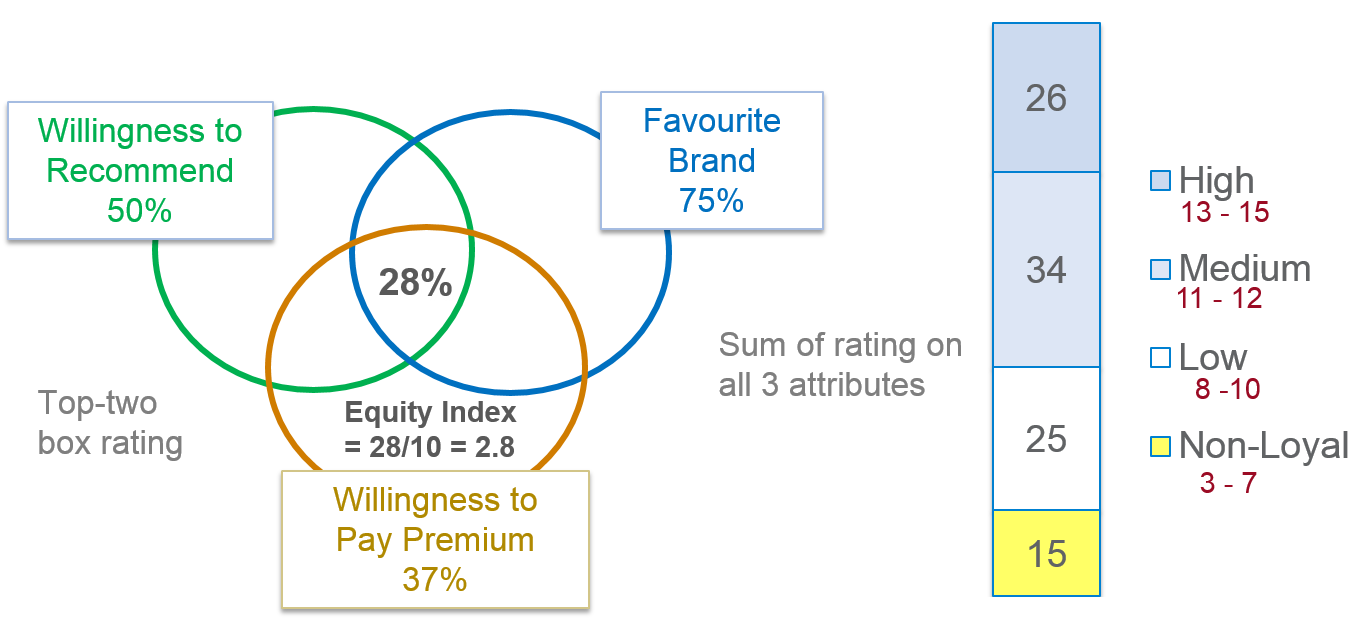

Exhibit 2.9 Equity index based on extent of intersection of the

composite measures. Consumer segments derived from Likert scale.

There are a variety of approaches that may be used

to craft an index; for instance, as depicted in Exhibit 2.9, the equity index

may be based on the size of the intersection of the composite measures. In this

example, the intersection — i.e., the percent of respondents who rate the brand

within top 2 boxes for all the three statements — is 28%. This intersection

value is a reflection of the brand’s equity, and on a 10-point scale, the

brand’s equity index (2.8) is computed by dividing this value by 10.

An alternative approach is to take a weighted

average of the ratings on the statements used to determine brand equity, where the

weights are obtained through factor analysis.

A Likert scale (i.e., the sum of responses to the statements)

may be used to segment consumers based on their affinity to the brand. If a 5-point

rating scale is used, the Likert scale for the three statements ranges from 3

(1+1+1) to 15 (5+5+5). In the example, the 26% of the respondents with a

composite score of 13 to 15 are classified as loyal, 34% (score 11 or 12) are

classified as satisfied, 25% (score 8 to 10) are classified as neutral, and the

remaining 15% (score 7 or less) are classified as dissatisfied. While there are

no hard rules for the cut-offs, it is preferable that the levels are chosen

such that respondents are well distributed across each of the groups. The size

of the segments, though, tends to be larger in the middle and smaller at the

extremes.

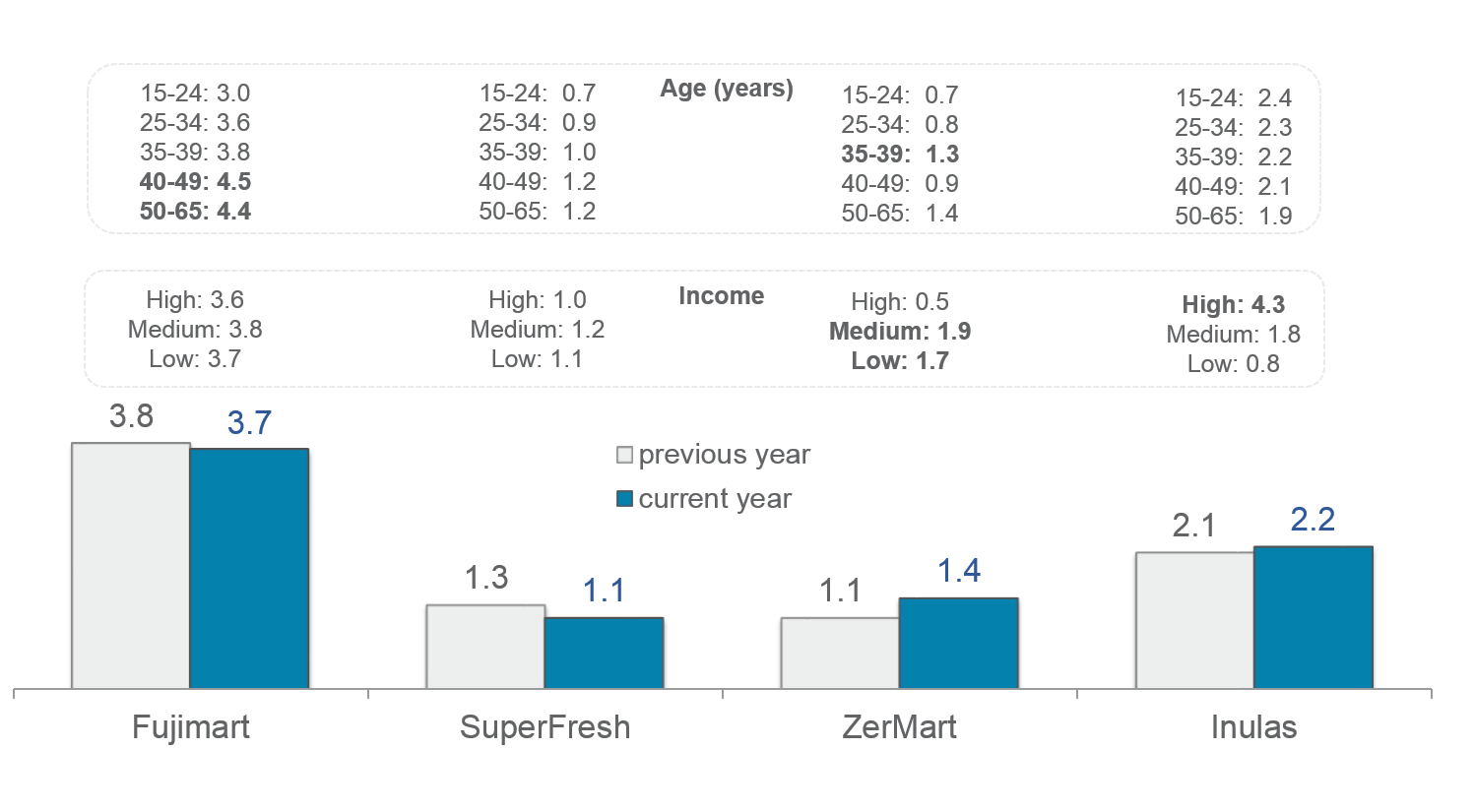

Exhibit 2.10

Store equity indices for some supermarkets.

Of prime interest when analysing

brand equity data is the assessment of the impact of marketing initiatives on

your brand’s equity. To determine what course of action to take to improve your

brand’s performance, you will need answers to the following questions:

- What is my brand’s equity and how does it compare with competing

brands?

- What are my brand’s (and my competitor’s) strengths and

weaknesses?

- Is my brand’s equity improving or deteriorating? Which segments

are contributing to the improvement/decline?

- What are the factors contributing to the improvement or the

decline in equity?

Exhibit 2.10 depicts the store equity indices of

some stores based on the NielsenIQ equity index. The indices, as you will notice,

are low for most stores; only Fujimart crosses 3 on this 10-point scale. This

reflects the reality in the marketplace. Only a few brands have an equity index

that exceeds 3, most brands hover below 1. A ten on this scale would mean that

everybody in the market is a loyal customer of the brand and would willingly

pay a significant price premium, whereas a zero means that there are no loyal

customers, and nobody would pay any more than the cheapest price for that brand.

The variations in equity

across the demographic groups shown in Exhibit 2.10, reveal the strengths and

weaknesses of the brands. Referring back to Exhibit 2.3, observe also how the

trends in store equity are reflected in the movements in the loyalty pyramid.